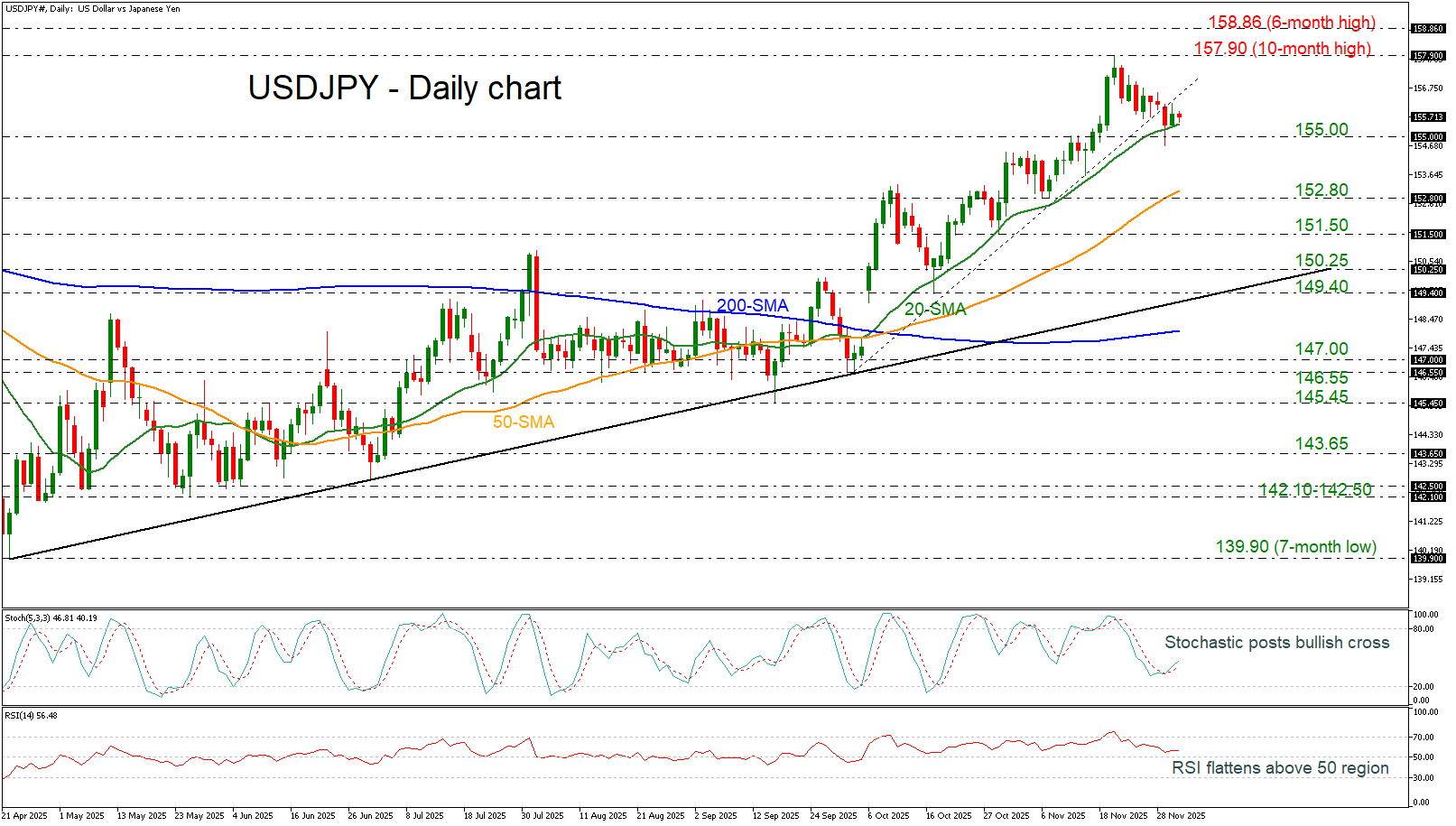

USDJPY struggles within 155.00-156.00

USDJPY has extended its recent bearish momentum, breaking below the sharp upward trendline and hovering near the 155.00–156.00 range.

The US dollar weakened as markets priced in expectations of deeper Federal Reserve rate cuts. Meanwhile, investors remain focused on the possibility of a Bank of Japan rate hike this month, following hawkish signals from policymakers, despite the perception that Prime Minister Sanae Takaichi’s administration prefers accommodative monetary policies.

If the pair holds above the critical 155.00 level, the short-term bullish outlook could stay intact, paving the way for a retest of the ten-month high at 157.90 and the next resistance at 158.86.Alternatively, further downside corrections may push the pair toward the 50-day simple moving average (SMA) near 152.80, before challenging the next support levels at 151.50–150.25. A rebound from these zones would help preserve the broader positive trend.

Technical indicators currently lean neutral-to-bullish. The stochastic oscillator is ticking higher after a bullish crossover between its %K and %D lines, while the RSI remains steady above the neutral 50 mark.

USDJPY is at a critical juncture, with price action near key support levels and mixed signals from technical indicators. While holding above 155.00 could sustain bullish momentum toward multi-month highs, a break lower may trigger deeper corrections.