WTI futures surge to a 5-month high

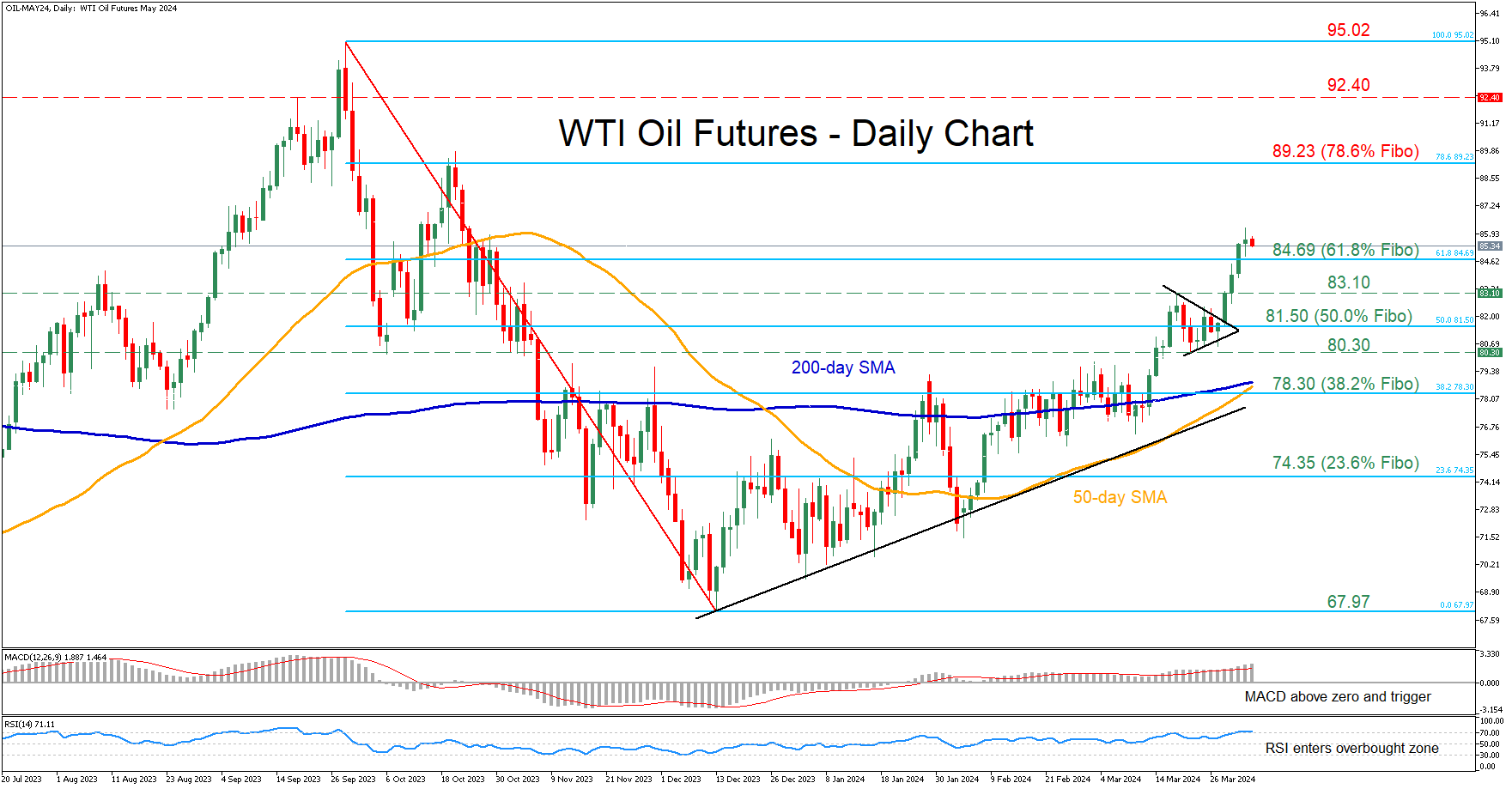

WTI oil futures (May delivery) have been in a slow but constant recovery from their December bottom of 67.97, posting a fresh five-month peak of 86.20 on Wednesday. Meanwhile, the 50-day simple moving average (SMA) is positively closing the gap with the 200-day SMA, where an upside violation could ignite more gains.

Should the advance resume, there is no prominent resistance until 89.23, which is the 78.6% Fibonacci retracement of the 95.02-67.97 downleg and a region that acted as resistance in October 2023. Jumping above that zone, the price may challenge the October 2023 resistance of 92.40. Even higher, the 2023 peak of 95.02 might prevent further advances.

Alternatively, bearish actions could send the price lower to test the 61.8% Fibo of 84.69. A violation of that region could pave the way for the March resistance of 83.10 ahead of the 50.0% Fibo of 81.50. Further retreats could then come to a halt at the March support of 80.30.

In brief, WTI futures’ rebound accelerated following the breakout move from the pennant structure in late March, resulting in consecutive fresh five-month peaks. However, the risk of a pullback is growing given that technical indicators are warning of an overstretched advance.