Yen stabilizes as Japan ramps up intervention warning

Yen on intervention watch

Authorities in Japan issued another round of warnings to defend the sinking yen, which fell towards its lowest levels in three decades last week, even after the Bank of Japan raised interest rates out of negative territory.

Finance minister Suzuki said earlier today that “rapid currency moves are undesirable” and that Tokyo will not rule out any steps to support the devastated yen. He highlighted the speed of FX moves as a source of concern, echoing comments from the nation’s top currency diplomat who described the latest moves as “strange” and “speculative”.

That said, neither official went as far as to describe recent FX moves as “one-sided” or “disorderly”, which are the catchphrases they have used in the past right before intervening. Therefore, Tokyo is not ready to pull the trigger yet. Traders seem to agree as implied volatility in USDJPY options remains low, signaling that big funds are not panic-hedging against FX intervention.

As for the yen, the mere threat of intervention was enough to stop the bleeding, but it is still trading near the three-decade low of 151.90 against the dollar. How the market behaves around this region will be telling. If it holds strong once again, that would leave scope for a yen recovery in the spring, whereas a clean break would signal a resumption of the longer-term downtrend.

Dollar and stocks retreat ahead of US data

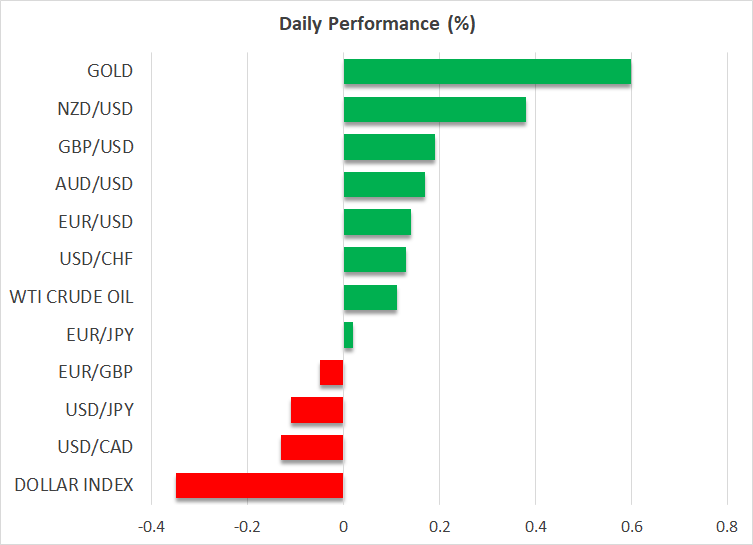

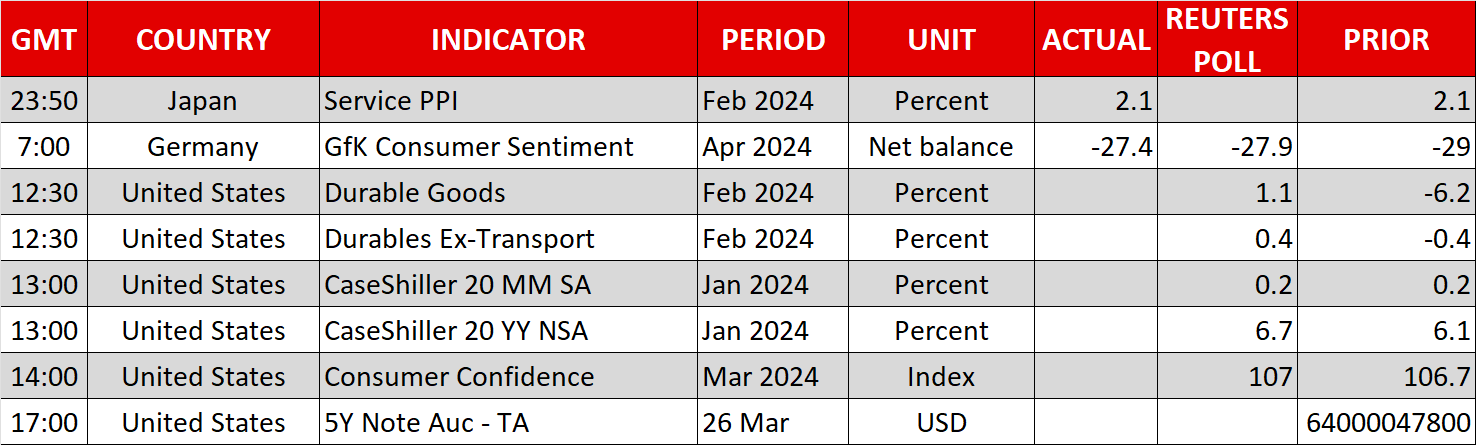

Meanwhile, the US dollar started the new week on the wrong foot, drifting lower against most of its competitors without any clear news catalyst to speak of. Looking ahead, the focus for dollar traders will shift to data releases, starting with durable goods orders and consumer confidence today, ahead of the Fed’s favorite inflation measure on Friday.

In the equity space, shares on Wall Street also took a step back on Monday, although the retreat was minor and probably driven by profit-taking after such a powerful rally. Overall, stock markets are enjoying the best of all worlds, buoyed by a resilient US economy and speculation that Fed rate cuts are just around the corner, helping to justify stretched valuations.

Crossing into crypto, Bitcoin prices surged more than 7% yesterday, bringing the leading coin back above the $70,000 region. The prospect of reduced supply growth ahead of next month’s halving event seems to be fueling the rally in Bitcoin, alongside growing interest from financial institutions as the king of crypto increasingly enters portfolios as an alternative asset.

Mind the liquidity gap

One of the main themes of this week might be a shortage of liquidity. Most markets will be shut on Friday for a public holiday, which means liquidity will be thinner than usual, especially since it will also be the end of the quarter. In addition, there are key US data releases on the schedule for Friday, alongside a speech by the Fed Chairman.

With important events set to take place in an environment of scarce liquidity as traders will be away for a holiday at the end of the quarter, it seems like a perfect recipe for explosive moves on Friday, as the FX market will be open for business.

When liquidity is in short supply, markets can move a lot without any real news behind them. And if there is important news, the market impact can be greater than usual, setting the stage for a volatile end to this week.

impact can be greater than usual, setting the stage for a volatile end to this week.

.jpg)