Yen Weakens on BoJ Uncertainty as Kiwi and Aussie Hold Firm | 4th September 2025

Yen Weakens, Kiwi Steady

Thursday’s FX markets were shaped by diverging trends, with the Japanese Yen under notable pressure as ambiguity from the Bank of Japan and ongoing political uncertainty eroded confidence in the currency. Despite its weakness, other majors such as the Australian and New Zealand Dollars found support, with the Kiwi in particular gaining momentum after softer US labor market data weighed on the Dollar. The Aussie, meanwhile, steadied following solid trade balance results, reflecting underlying resilience even as risk sentiment remained cautious. The Euro also stayed subdued near 1.1650 ahead of Eurozone retail sales, while the Dollar Index edged higher toward 98.50 on safe-haven demand. Overall, the session highlighted how shifting policy expectations and data releases continue to drive volatility, leaving traders focused on the balance between US economic signals and central bank guidance.

Australian Dollar Forecast (AUD/USD)

Current Price and Context

The Australian Dollar (AUD/USD) held steady in the mid-0.6500s after stronger-than-expected trade balance data. July’s trade surplus widened to A$7.31 bn, outpacing the forecasted A$4.92 bn, backed by a 3.3% rise in exports and a 1.3% dip in imports. Despite this, the pair moved little as investors paused ahead of upcoming US labor market data, including ADP employment and ISM Services PMI.

Key Drivers

Geopolitical Risks: Limited current impact; market focus remains on macro data.

US Economic Data: Softer US labor stats would weaken the dollar, potentially boosting AUD.

FOMC Outcome: Fed rate-cut expectations offer support to AUD against USD.

Trade Policy: Strong trade data underpin AUD but global demand concerns remain.

Monetary Policy: Australia’s resilient growth outlook tempers RBA easing expectations, supporting the currency.

Technical Outlook

Trend: Neutral—consolidating in 0.6400–0.6600 range.

Resistance: 0.6568 (weekly high), then 0.6625 (2025 high).

Support: 0.6520, followed by 0.6470.

Forecast: Rangebound—holding above 0.6520 could open a push toward resistance; breach below could slide toward support.

Sentiment and Catalysts

Market Sentiment: Cautiously optimistic, guided by trade data and macro signals.

Catalysts: US labor data, ADP employment, ISM PMIs, and RBA commentary.

Japanese Yen Forecast (USD/JPY)

Current Price and Context

The Japanese Yen continues to struggle amid ongoing ambiguity from the Bank of Japan and heightened political uncertainty. The currency lacks directional conviction as markets await clearer policy signals, particularly on interest rates. These developments are weighing on the yen, reinforcing demand for USD/JPY.

Key Drivers

Geopolitical Risks: Political instability in Japan is clouding investor sentiment and undermining confidence in the yen.

US Economic Data: Stronger-than-expected U.S. data could bolster the dollar further, reinforcing the yen’s weakness.

Risk Sentiment & Safe-Haven Flows: Although USD/JPY should benefit from uncertainty, safe-haven demand for the yen remains muted, limiting any corrective strength.

Monetary Policy Divergence (BoJ vs. Fed): Mixed messaging from the Bank of Japan on rate hikes contrasts sharply with the U.S. Fed’s more decisive path, widening the policy differential and pressuring the yen.

Technical Outlook

Trend: Weak—but consolidating as traders await clarity.

Resistance: 147.50 → 148.20.

Support: 146.70 → 146.20.

Forecast: USD/JPY may consolidate within 146.20–147.50, with upside favored unless BoJ signals clear policy change.

Sentiment and Catalysts

Market Sentiment: Cautiously USD-positive, taking cues from BoJ uncertainty.

Catalysts: BoJ commentary, Japan political updates, and U.S. employment or inflation data.

AUD/JPY Forecast (Australian Dollar / Japanese Yen)

Current Price and Context

AUD/JPY is holding ground near 97.00, supported by stronger-than-expected trade balance data from Australia. The country’s goods surplus widened to A$7.31 billion in July—its highest since early 2024—boosted by rising exports of iron ore, LNG, meat products, and gold, while imports declined 1.3%.

Key Drivers

Geopolitical Risks: Ongoing political instability and rate ambiguity in Japan keep the yen under pressure, indirectly supporting the AUD/JPY cross.

US Economic Data: Any surprise US weakness might weaken the yen further and buoy AUD/JPY.

Risk Sentiment: While global uncertainty usually favors the yen, it’s currently subdued amid policy ambiguity.

Trade Policy: Australia’s robust trade performance continues to underpin the AUD.

Monetary Policy Divergence: Australia’s resilient macro backdrop contrasts with the BoJ’s cautious tone, widening yield differentials.

Technical Outlook

Trend: Bullish bias—holding above the 100-day EMA and trend support

Resistance: 97.00–97.10, followed by 97.29 and 97.43, the summer highs

Support: 96.80 (recent lows), then the 100-day EMA near 96.50

Forecast: Sustained strength above 97.00 could propel price toward the multi-month highs; a break below 96.80 risks deeper correction.

Sentiment and Catalysts

Market Sentiment: Mildly bullish on AUD/JPY, leveraging Australia’s trade data and Japan uncertainty.

Catalysts: July’s trade data follow-up, BoJ policy signals, and global risk appetite shifts.

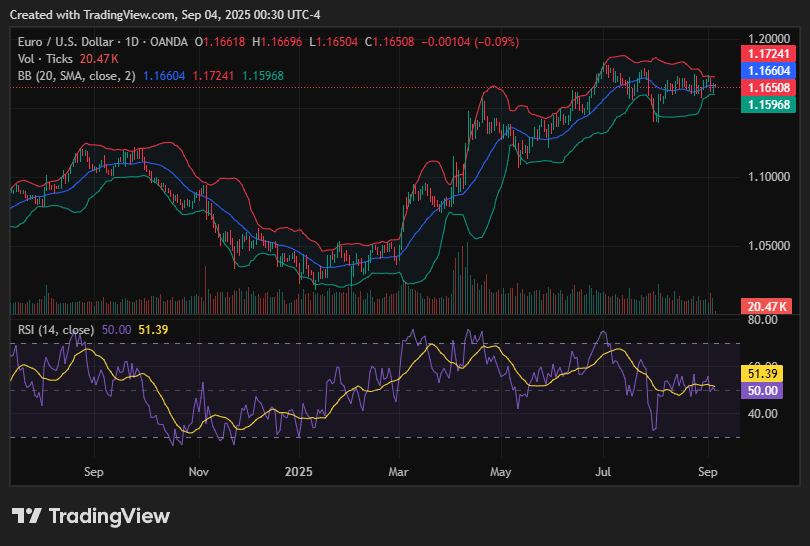

EUR/USD Forecast

Current Price and Context

UR/USD trades near 1.1650, holding losses as anticipation builds for Eurozone Retail Sales data, which is expected to show a sharp year-over-year decline in July (forecast: +2.4% vs. previous +3.1%) and a monthly dip of 0.2% following a 0.3% rise.

Key Drivers

Geopolitical Risks: Elevated global uncertainty continues to favor the U.S. dollar.

US Economic Data: Softer U.S. job openings (JOLTS) have bolstered rate-cut expectations, capping dollar strength.

FOMC Outcome: Markets are increasingly pricing in a September Fed rate cut, which could eventually weigh on the greenback.

Trade Policy: No immediate new developments; broad external demand continues to influence sentiment.

Monetary Policy: ECB’s cautious stance contrasts with the Fed’s evolving policy outlook, providing limited support to the euro.

Technical Outlook

Trend: Bearish, hovering near the 1.1650 mark.

Resistance: 1.1680 → 1.1700.

Support: 1.1620 → 1.1600.

Forecast: A weaker-than-expected retail-sales print may test the downside toward 1.1600, while strength above 1.1680 could open a retracement.

Sentiment and Catalysts

Market Sentiment: Cautiously bearish toward the euro amid subdued macro signals.

Catalysts: Eurozone retail sales, US JOLTS and PMI data, and shifts in Fed rate-cut pricing.

NZD/USD Forecast (New Zealand Dollar / U.S. Dollar)

Current Price and Context

NZD/USD strengthened above 0.5850, buoyed by weaker-than-expected U.S. job openings data—reporting just 7.18 million in July, well below forecasts of 7.4 million—indicating further cooling in the labor market. This weakness in U.S. data has bolstered rate-cut expectations, putting downward pressure on the U.S. dollar and supporting the Kiwi.

Key Drivers

Geopolitical Risks: Limited direct impact, but risk sentiment supports commodity-linked currencies.

US Economic Data: Slower job openings strengthen Fed rate cut bets, weighing on USD.

FOMC Outcome: Markets heavily price a rate cut in September, supporting NZD.

Trade Policy: No major changes; global demand concerns continue to shape NZD sentiment.

Monetary Policy: A dovish RBNZ may cap the Kiwi’s upside, despite supportive external conditions.

Technical Outlook

Trend: Bullish breakout above 0.5850.

Resistance: 0.5880 → 0.5900.

Support: 0.5830 → 0.5800.

Forecast: If NZD/USD holds above 0.5850, a move toward 0.5900 is possible; a break below 0.5830 could see a retreat toward 0.5800.

Sentiment and Catalysts

Market Sentiment: Optimistic for NZD against USD amid Fed easing bets.

Catalysts: Upcoming U.S. employment data, Fed policy signals, and RBNZ commentary.

Wrap-up

Global FX trading closed the session with mixed dynamics, as Yen weakness set the tone while commodity-linked currencies showed resilience. Market participants remained cautious, balancing the risk of prolonged US Dollar strength against signs of softness in the US labor market. The Kiwi emerged as an outperformer, while the Aussie maintained stability and the Euro held losses amid subdued European data expectations. With investors still seeking clarity from both the Federal Reserve and the Bank of Japan, short-term direction will likely hinge on upcoming US employment figures and Eurozone retail sales. These data points could redefine expectations for global monetary policy and influence near-term flows across major pairs.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!