Crypto market shakes off consolidation

Market picture

The release of US inflation data sparked a surge in risk asset purchases, with cryptocurrencies leading the charge. This follows a period of prolonged consolidation, which provided enough pent-up energy to fuel increased volatility.

Over the past 24 hours, the crypto market has added 5.3% to $2.39 trillion - its highest in ten days. But much more importantly, with this move, the market has broken through the resistance of the descending range and is now testing the previous highs. The market's ability to gain weight on Thursday and Friday will be an important confirmation of the market's bullish bias. Potentially, this break opens the way to the highs of March, when capitalisation exceeded $2.75 trillion.

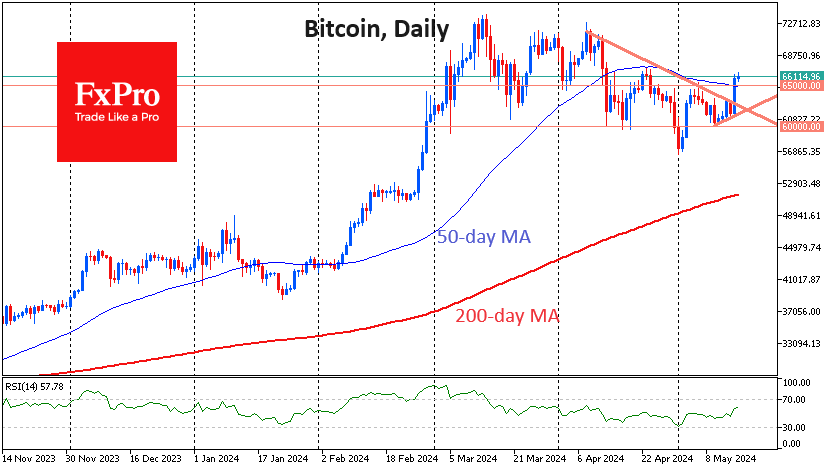

Bitcoin has broken out of its short-term triangle in one fell swoop, consolidating above its 50-day moving average and previous local highs. Yesterday may well have seen the end of the correction and the start of a new round of buying. It is worth being prepared for Bitcoin to meet a few obstacles on its way to $72K, although a renewal of historical highs is unlikely to be quiet.

News background

Cane Island Alternative Advisors see Bitcoin rising to $100,000 in the fourth quarter of 2024 or the first quarter of 2025 if the US speculative-grade high-yield bond rate falls from the current 7.5% to levels below 6% or 7%.

According to attorney Scott Jonsson, the SEC is examining the grounds for rejection of spot Ethereum-ETF applications and may consider designating Ethereum as a security. VanEck and Grayscale's applications are due in May.

El Salvador has mined nearly 474 BTC in three years by harnessing geothermal energy from a volcano. The country's government currently holds 5,748 BTC (~$380 million).

According to Dune, more than 1 million new coins have been created since the beginning of April. Of these, over 370,000 have launched on Ethereum and 640,000 on Solana. 88% of the coins on the Ethereum network are running on Base's L2 solution. This activity is probably due to cheap transactions and the hype around meme tokens.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)