Cryptocurrencies have cleared overbought

Market Picture

The total capitalisation of the crypto market fell 8.6% last week to $1.16 trillion, according to CoinMarketCap, returning to consolidation levels in early April.

Bitcoin has fallen 8.2% in the last seven days to $27.4K but is consolidating near levels from the second half of March. The market has erased its previous growth momentum and is now testing the strength of the medium-term uptrend in the form of the 50-day moving average (now at $27K). A break below this would call into question the bull market's strength, while a consolidation below $26.6K could be the prologue to a more profound decline.

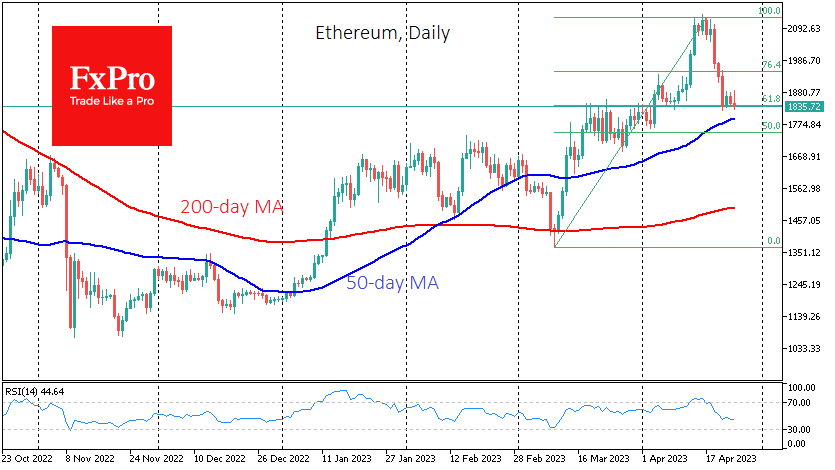

Ethereum lost 11.7% to $1850, also approaching a test of its 50-day at $1800, while other leading altcoins in the top 10 fell between 5.7% (BNB) and 16.2% (Solana).

Technically, the pullback in cryptocurrencies has cleared the accumulated overbought conditions, which is good for potential buyers. However, short-term traders would be wise to keep an eye on the near term as the risk of a sharp decline has increased.

News background

The US Congress is aiming for a bipartisan cryptocurrency bill. According to The Block, a bill could be drafted by the end of May.

According to ultrasound.money, the Ethereum market supply has dropped by more than 100,000 ETH since The Merge update. The deflation on the network after the move to PoS was 0.15% on a year-over-year basis.

Metropolitan Commercial Bank, one of the top 10 most efficient banks in the US in 2022, has notified the SEC of its withdrawal from cryptocurrency-related business due to the recent collapse of Silvergate Bank, Silicon Valley Bank and Signature Bank and regulatory pressure.

The Canadian Teachers' Pension Fund of Ontario (OTPP) withdrew from cryptocurrency investments after investing $95 million in the bankrupt FTX crypto exchange.

Wallet developers have added the ability to buy Bitcoin via the Telegram messenger's web interface. Previously, the feature was only available through a text bot in the messenger.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)