Dip Opportunities are Emerging for GBPUSD

The Ultima Markets team breaks down the GBPUSD setup as it stands on 4 December 2025.

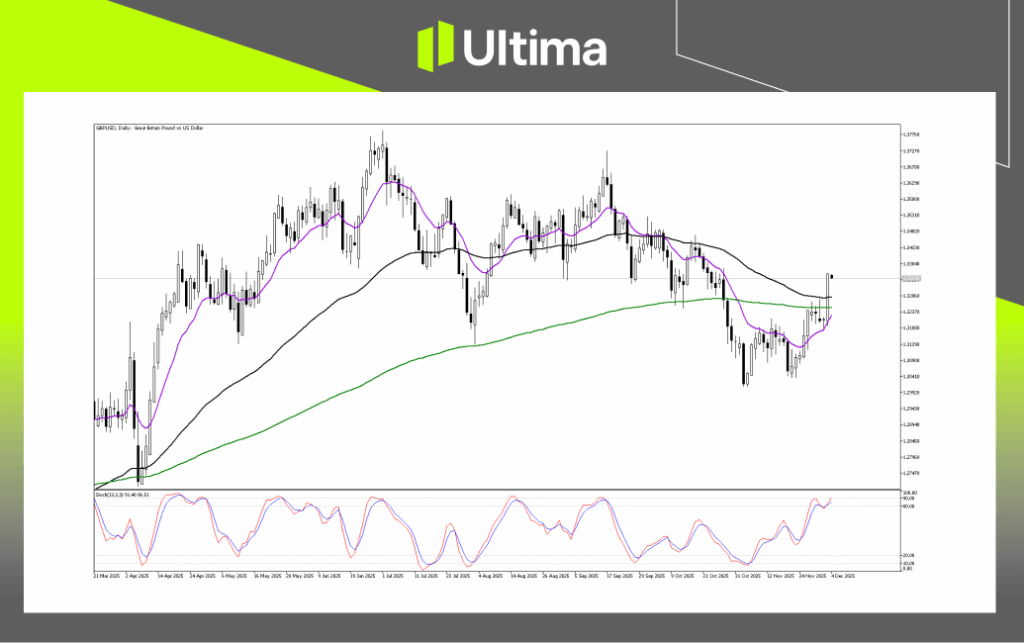

GBPUSD Rally Meets Its First Big Test

The GBPUSD has staged a strong recovery after its multi-month slide from July to October, lifting off the 1.3000 region and climbing toward an important band of moving-average resistance. Momentum remains firm, but the latest push has driven the pair into stretched territory, increasing the likelihood of a pause or short-term dip before buyers attempt another leg higher. The 1.3340–1.3360 area is the first notable barrier, marked by the Black Moving Average and the previous daily peak, making it a crucial zone for bullish continuation.

Key Levels

Price is pressing into the 1.3340–1.3360 ceiling, a level reinforced by both recent highs and the Black Moving Average. A clean breakout opens the room toward 1.3430–1.3450, with scope for further upside toward 1.3620 if momentum holds. Should the pair pull back, support is expected to be around 1.3250–1.3270 near the Green Moving Average, followed by 1.3180 at the Purple Moving Average. A fall through the 1.3000–1.3040 base, however, would undermine the current bullish structure.

Has GBPUSD Rallied Too Fast?

GBPUSD’s latest climb has pushed the pair far above the Purple Moving Average, creating a wide separation that signals an overheated move. In technical terms, price behaving this way often acts like a stretched elastic band, it can only extend so far before easing back or slowing down long enough for the average to close the gap. Adding to the caution, the most recent candles around 1.3350 show small bodies and upper wicks, a classic sign that buyers are starting to tire at these heights.

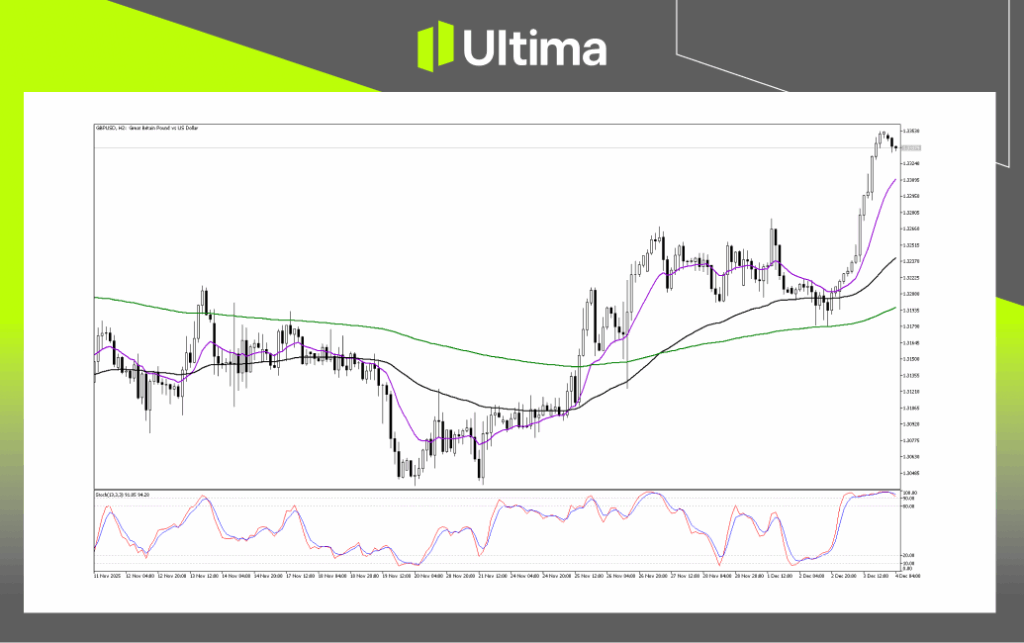

Breakout Scenarios

Given how sharply GBPUSD has climbed, the market now faces two probable paths. One possibility is that price pauses and moves sideways, or dips gently toward 1.3300, forming a classic bull-flag pattern as the Purple Moving Average moves closer. If buyers can defend 1.3300 and later push through the 1.3360 barrier, the next upside objective sits near 1.3400.

The second outcome is a cooling-off move: a Stochastic drop below 80 paired with a candle closing under 1.3320 could trigger a deeper pullback toward the Black Moving Average at 1.3250. Such a retreat would be a normal reset within the broader uptrend and could offer an appealing zone for swing traders looking to join the bullish momentum.

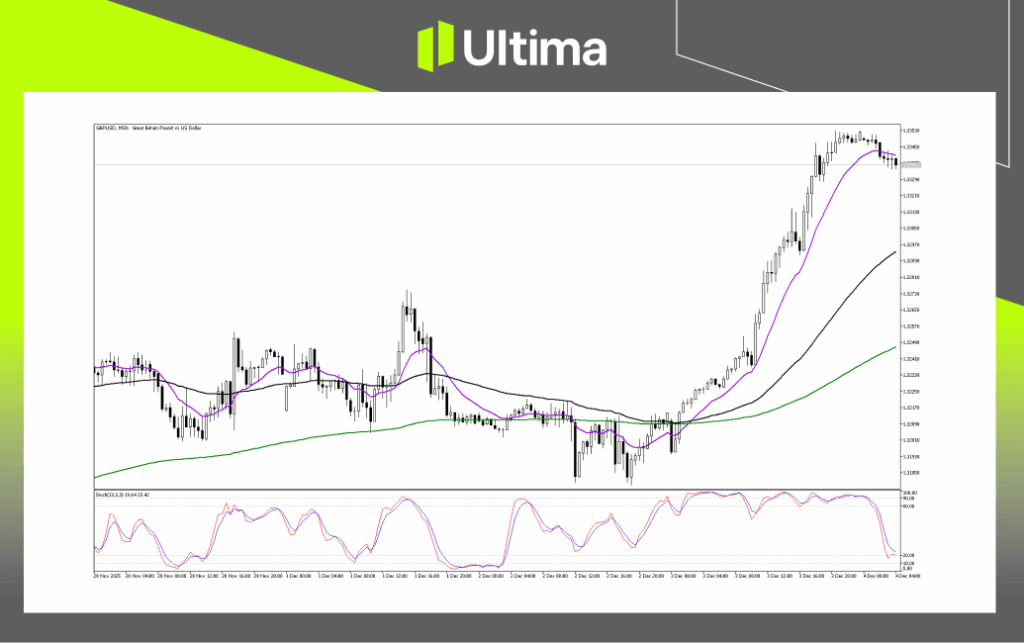

GBPUSD Pullback Looks More Like a Reload

Strong uptrends rarely reverse immediately upon reaching oversold Stochastic readings; instead, price typically stabilises and rebounds as selling pressure exhausts itself. This type of reset creates an ideal opportunity for bulls to establish fresh positions.

The short-term bias remains bullish while waiting for the trigger, as the M30 chart suggests selling pressure is nearing exhaustion. The market has transitioned from overbought to oversold with minimal price decline, demonstrating underlying strength.

Traders should monitor the Stochastic Oscillator for an upward cross above the 20 level, which will likely align with price finding support near 1.3330 or 1.3300. However, shorting at these levels should be avoided, as selling an oversold market within a macro uptrend carries low probability; instead, focusing on identifying long entry opportunities on the bounce.

Navigating the Forex Market with Ultima Markets

Navigating global markets, whether you trade forex, commodities, indices, or shares, is far easier when you have clear guidance and reliable education. Ultima Markets supports traders at every stage with expert analysis and learning resources, including the UM Academy, where you can develop practical skills and deepen your market knowledge.

If you’re looking for a trading environment built around support, insights, and advanced tools, Ultima Markets offers a full ecosystem designed to help you trade with confidence. Connect with us for tailored assistance, and keep an eye out for more market updates and educational content from our team.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.