EBC Markets Briefing | Euro may fall further against Swiss franc amid fear

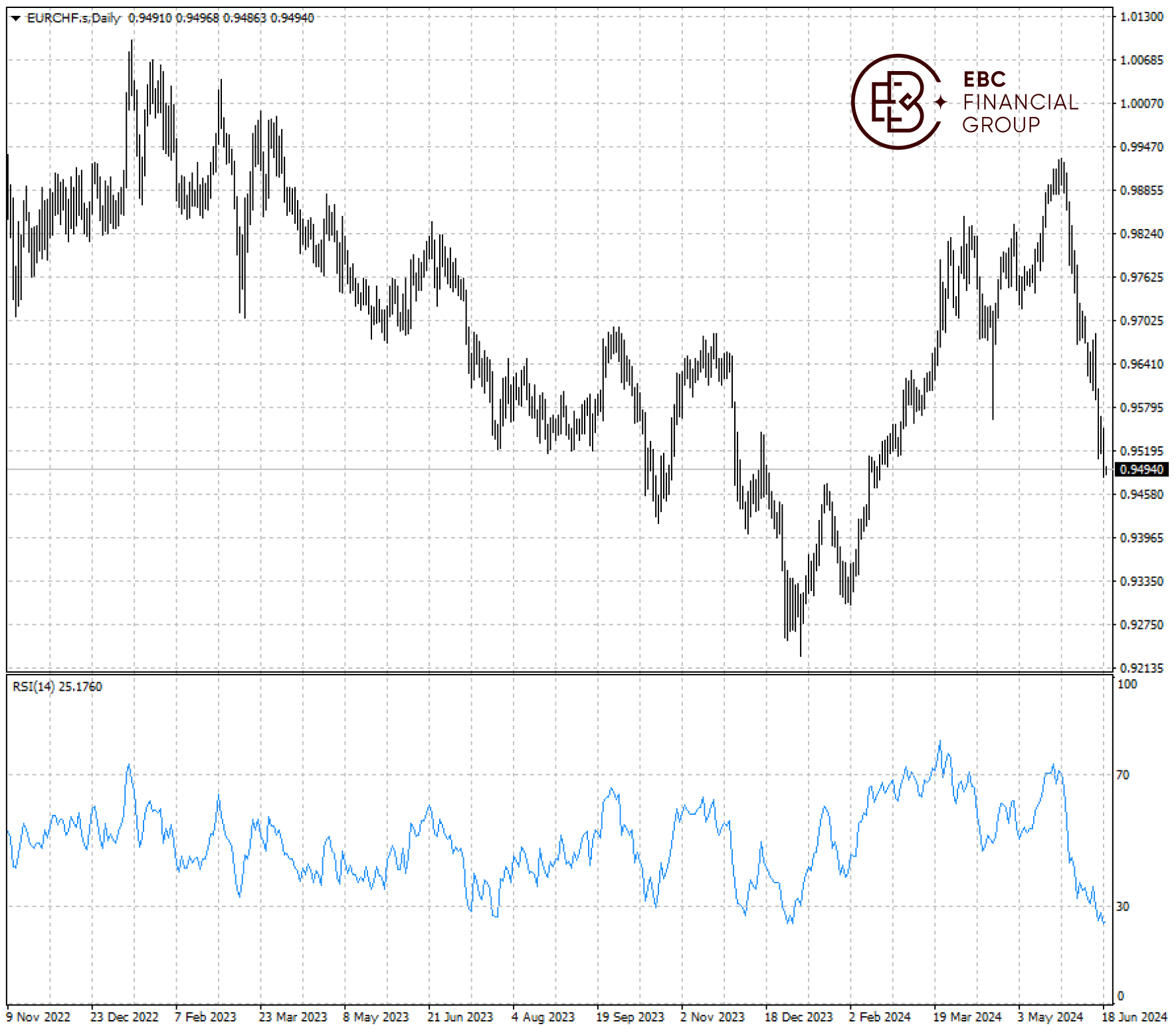

The euro traded around its lowest since mid-February against the Swiss franc on Wednesday as the ongoing political turmoil in the EU nudged traders towards safe-haven currencies.

The ECB will cut its deposit rate twice more this year, in September and December, according to a significant majority of economists polled by Reuters who said the risks were skewed towards fewer rate cuts than expected.

But improving business activity and still-sticky price pressures have added uncertainties. Chief Economist Philip Lane said there was no "acute urgency" to lower interest rates if the economy continues to expand.

Another separate survey showed the SNB will cut its key policy rate by 25 bps later this month for a second straight meeting. The central bank announced a surprise cut back in March – the first among G10 central banks.

Although that was in line with market pricing of a nearly 75% chance of a June rate cut, the policy decision could be a close call given a recent rebound in economic growth and a break in the trend of disinflation.

The recent strengthening in the franc, which has risen around 4% against the euro since late May, could provide additional support for any move to ease policy.

The pair is extending the descending trend with RSI flashing an oversold signal. The head and shoulders pattern points to more pains ahead so the next support could lie at 0.9400.

EBC Economic Research Findings Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.