EBC Markets Briefing | Euro rally against sterling defies macro shift

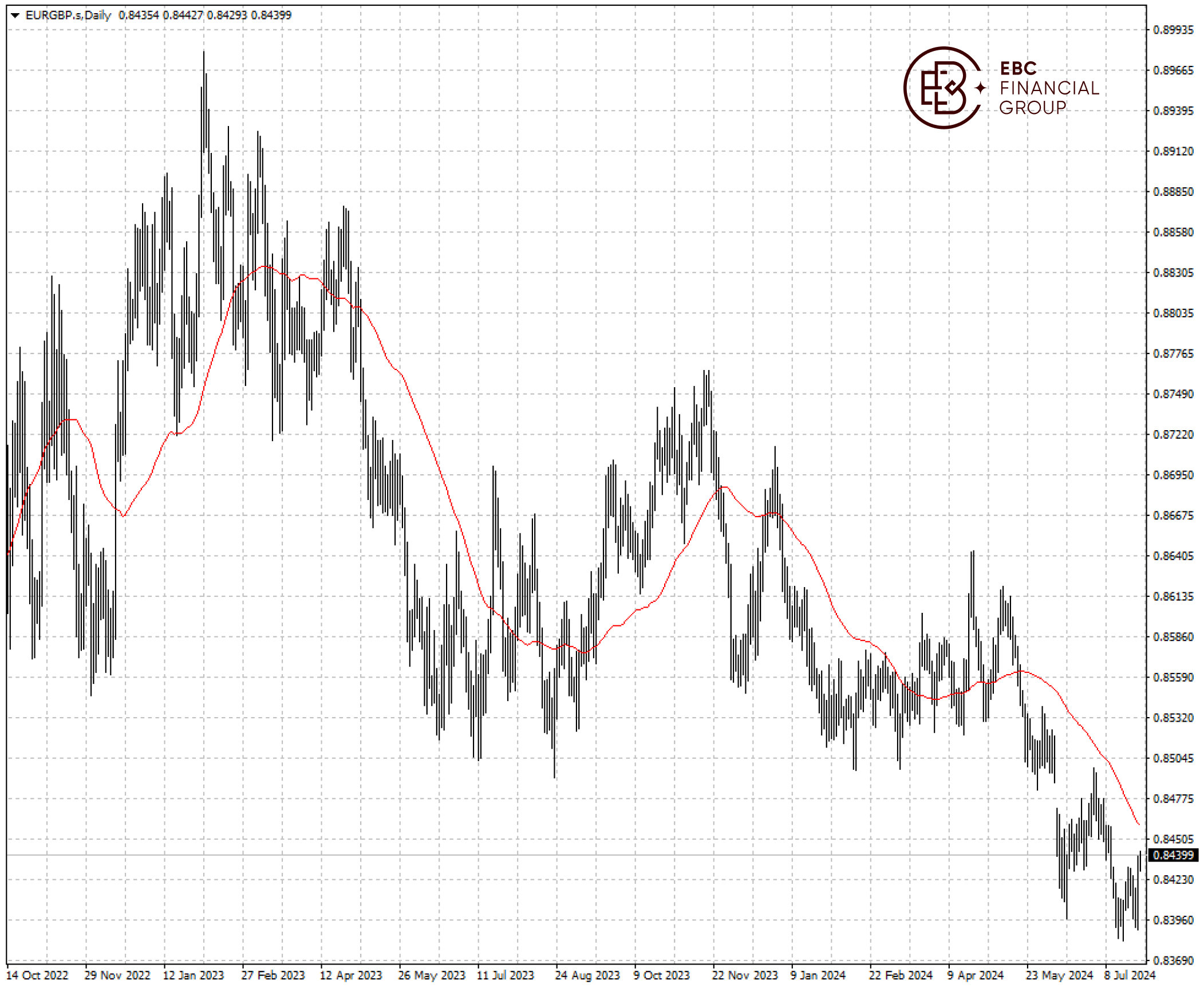

The euro hovered around its highest level in over two weeks against the pound on Friday although the latest data show more signs of the UK’s recovery outpacing that in the single market.

Growth in euro zone business activity stalled this month as a tepid expansion in the services industry failed to offset a deeper downturn among manufacturers, a survey showed on Wednesday.

HCOB's preliminary composite PMI dropped to 50.1 from June's 50.9, defying expectations for an uptick to 51.1. Price pressures on companies picked up at the fastest pace for three months.

But German consumer confidence rose more than forecast this month, a GfK survey showed. The bloc's economy will average 0.7% growth this year and 1.4% next, according to a Reuters poll earlier this month.

Economists said the weaker growth outlook made the ECB more likely to cut interest rates at its next meeting in September. However, sticky service inflation is complicating policy path.

In contrast, British business activity picked up this month, bolstered by the fastest manufacturing growth in two years and the strongest inflow of new orders since Apr 2023. The figures should cheer Starmers’ government.

The pair looks set to challenge the resistance around 50 SMA and, given the macro fundamentals, a likely failed break may lead to the lows below 0.8400.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.