EBC Markets Briefing | Tech boom is uncertain through the rest of 2024

The unstoppable march of the mega caps, expected central bank pivots, political turmoil and M&A is back - the first half of 2024 has been another whirlwind in world markets.

Forecasts for a global interest-rate-cutting frenzy have not fully materialized, but the Magnificent 7 soared another $3.6 trillion in market value. The tech sector in other stock markets also shined.

For more than a year, Nvidia’s customers have been snatching up all of the AI accelerator chips the company can produce. However, there is still plenty of uncertainty about whether AI can live up to the hype.

Some analysts refer to the costly build-out of telecommunications networks in the 1990s, which helped propel stocks like Cisco Systems to levels it has not surpassed more than two decades later.

Investors have discerned what a reckoning for Nvidia shares might look like when the chipmaker plunged 13% over the span of just three days. Micron Technology’s Q2 earnings disappointed, adding to the jitters.

The White House could also change markets’ tone. A shaky performance from President Biden in his latest TV debate against Trump has just ratcheted November's US election uncertainty up substantially.

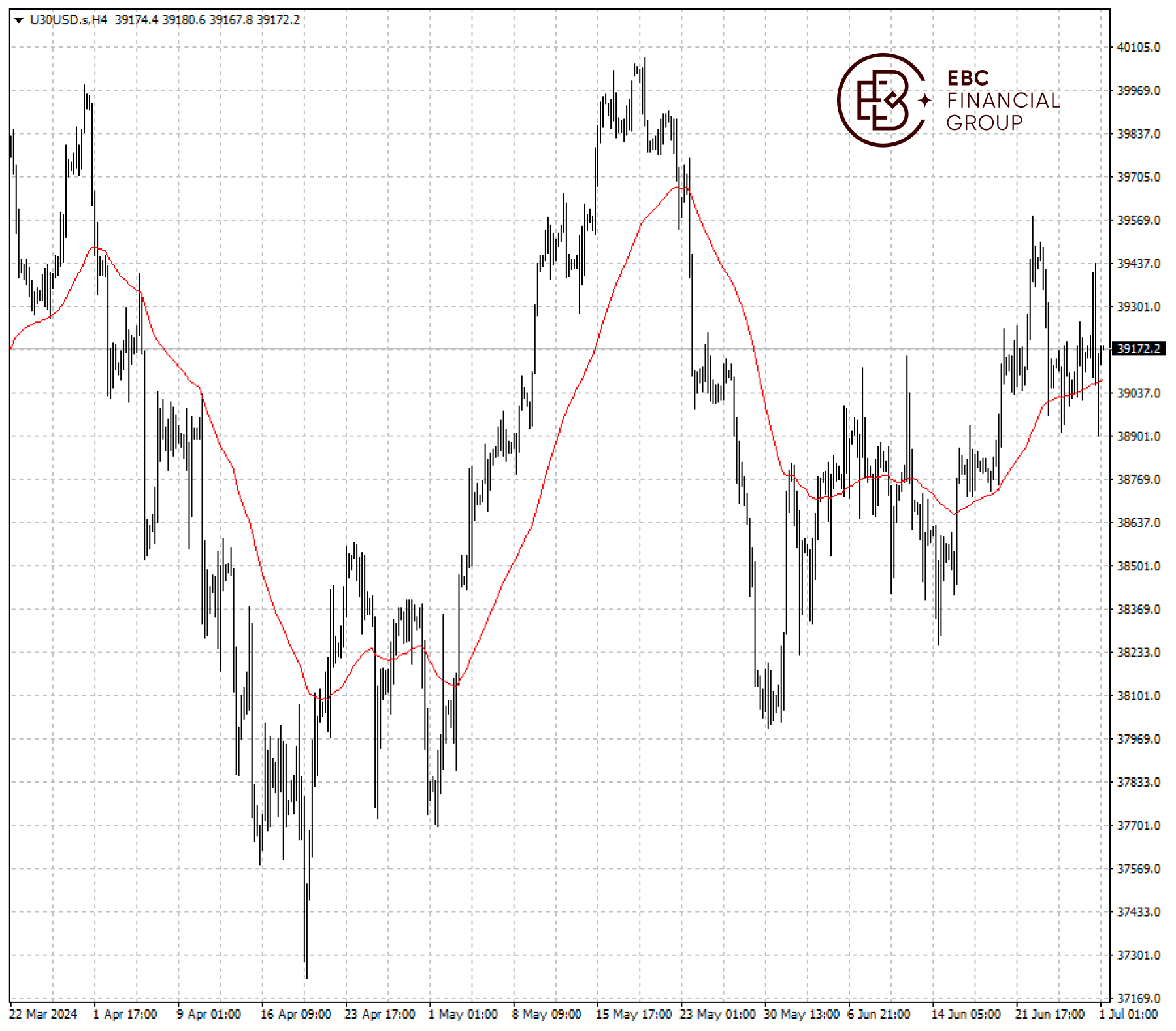

The Dow traded above 50 SMA and it still looks bullish in the medium-term. To stage another rally towards the all-time high around 40,000, the index needs to first overcome the resistance of 39,600.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.