EURUSD is at an equilibrium; where will it go next?

The single currency is trading near $1.076, waiting for further cues and facing serious resistance in its attempt to consolidate above 1.08 on Friday.

On Friday, EURUSD's growth accelerated against the trend of the previous three weeks on negative US labour market data for the dollar. However, the attempts of the bulls in the pair to consolidate above 1.08 failed.

It is easy to understand the sellers of the single currency, as the balance of risks is shifted towards a softer monetary policy in the eurozone compared to the US. ECB officials are cementing expectations of a June cut and fuelling sentiment that further cuts will follow. Friday's US labour market data narrowed the gap, as after it, the odds of a rate cut before September rose to 67% from 46% a week earlier. And markets are used to playing up changes in US expectations first, only then spreading them to related markets.

Separately, we note that the market finds the euro attractive at current price levels. Throughout 2023, EURUSD was reversing to the upside with each approach of 1.05. But last month's dip to 1.06 appeared attractive to cautious buyers.

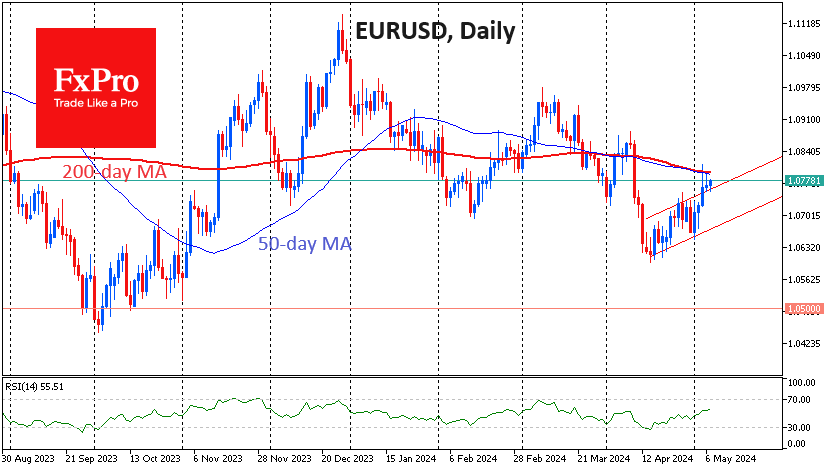

The local technical picture points to a slight bearish bias as EURUSD is trading below its 200- and 50-day moving averages. Moreover, they are both pointing downward. On the other hand, the bulls have not given up trying to break through this resistance, making attempts on Friday and Monday in addition to accelerating the gains seen last month.

The bull and bear positions in EURUSD are very balanced, and this is a good time to watch what the next move will be. A sharp change, by 1% or so, in either direction could signal the start of a relatively long trend.

In terms of levels, EURUSD overcoming the 1.0850 level opens prospects for a rise to the 1.1050 area with the potential for further upside. On the contrary, a failure under 1.0650 could force buyers to regroup in the 1.05 area and possibly trigger a further downward trend.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)