GBPUSD fights for uptrend resumption

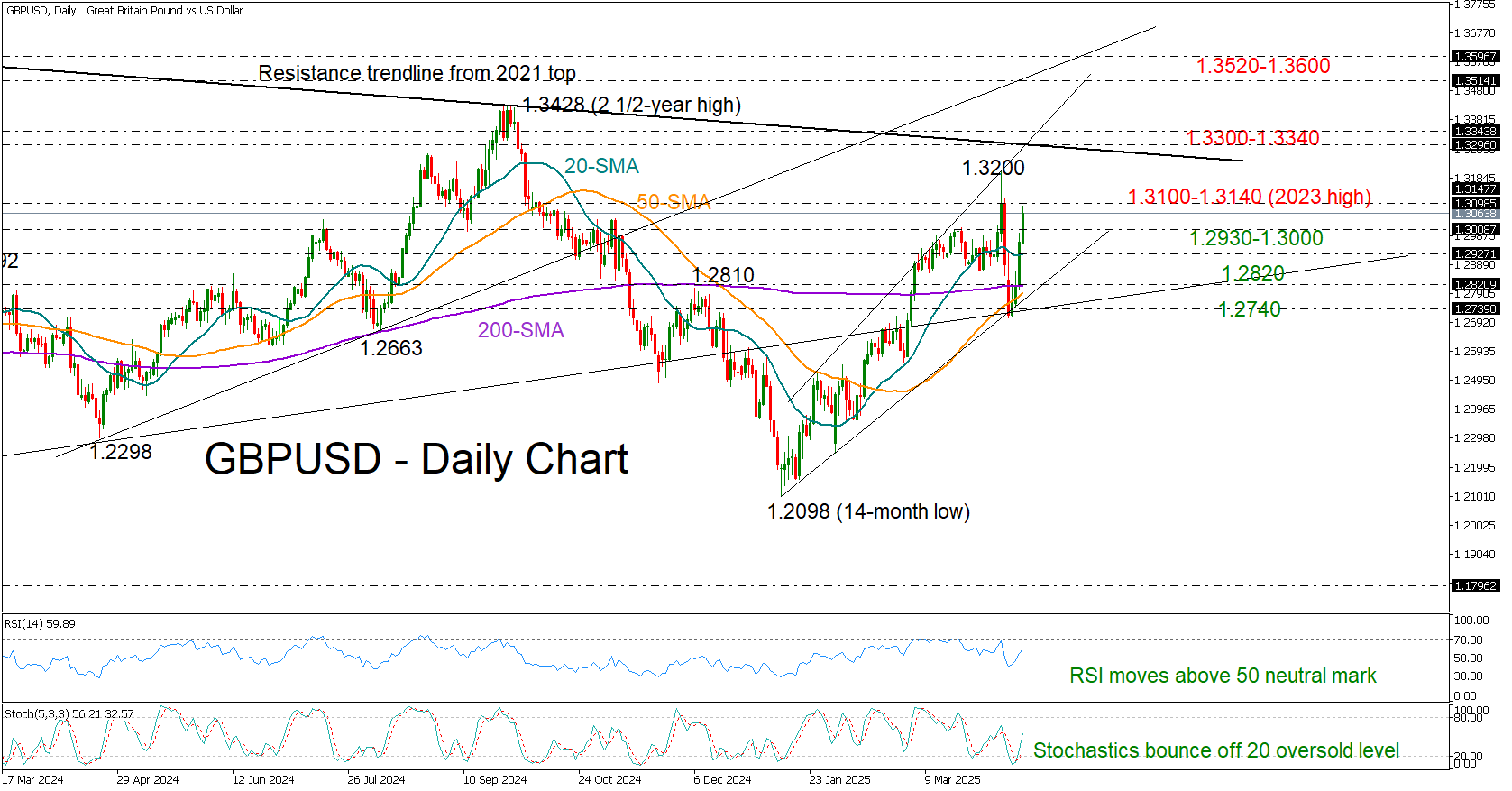

GBPUSD has nearly erased last week’s steep losses, supported by a weakened US dollar. The pair has rebounded above its simple moving averages (SMAs), with potential to revive its 2025 uptrend.

Although the pair lacks the strong momentum seen in EURUSD, technical indicators feed optimism that there might be more bullish episodes in the coming sessions. The RSI is rising comfortably above its neutral 50 mark, and the stochastic oscillator has just bounced from its oversold territory near 20 - both suggesting that positive momentum could persist.

The 1.3100–1.3140 zone, which capped gains last week, will be in focus in the coming sessions. A decisive break above this range - which also includes the 2023 high - could pave the way for a rally toward the long-term resistance trendline drawn from the 2021 peak at 1.3300. Not far above, the 2025 ascending trendline, currently near 1.3350, also comes into play. Further gains could encounter resistance around another trendline region at 1.3520–1.3600.

On the downside, a pullback below 1.3000 may initially find support around the 20-day SMA, currently at 1.2930. Failure to hold this level could open the door to a deeper retracement into the congested 1.2740–1.2820 zone, where a couple of support trendlines and the 50- and 200-day SMAs converge. A break below this area could accelerate the decline toward the 1.2560–1.2600 region.

In summary, the solid rebound in GBPUSD may have more room to run in the short term. Traders will be looking for a confirmed move above 1.3140 to validate the continuation of the 2025 uptrend.

.jpg)