Gold near a peak, but uptrend might stay solid

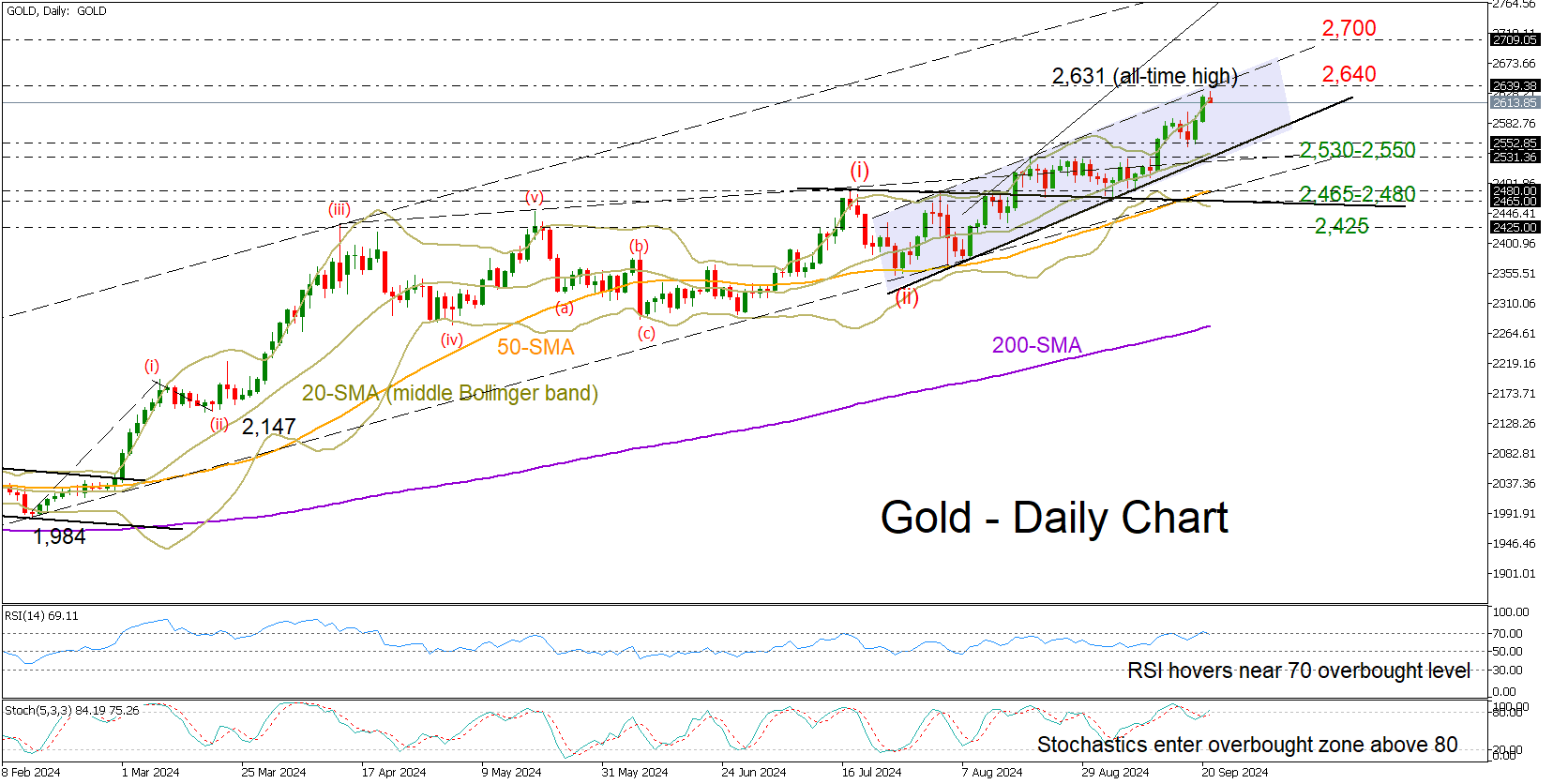

Gold hit a new milestone early on Monday, unlocking a fresh record high of 2,631 following two consecutive impressive weeks in uncharted territory, which boosted the price by 5%.

The precious metal is sailing in overbought waters according to the RSI and the stochastic oscillator, and with the price hanging around the upper Bollinger band and the upper band of an upward-sloping channel, the risk of a downside correction or some stability is increasing.

An interesting observation emerging from counting Elliot waves (i-v) suggests that the market might be approaching the end of wave 3 in the bullish pattern, indicating a potential pause before wave 4 initiates.

If the bulls stay trapped below the channel’s resistance line at 2,640, the spotlight will turn to the bottom of the channel and the 2,530-2,550 support region, which includes the 20-day simple moving average (SMA). A break lower could pause near the 50-day SMA and the almost flat constraining line which triggered September’s upturn at 2,480 and 2,465 respectively. Then, the bears could target the 2,425 region.

On the upside, if the rally continues above 2,640, the next obstacle could pop up near the 2,700 psychological mark. Even higher, the price may retest the tentative ascending line which connects the December 2023 and April 2024 highs at 2,800.

In a nutshell, the recent bullish trend in gold might lose momentum soon, but any drop in price could be temporary if it remains above 2,465.

.jpg)