Sharply deteriorating business sentiment in Germany

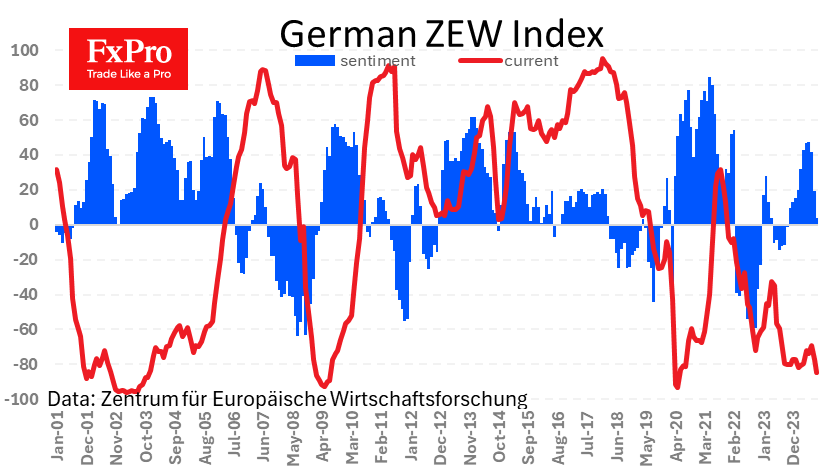

German business sentiment deteriorated sharply in September, according to ZEW data. The relevant index fell to 3.6, the lowest level since October 2023. The situation was even worse for the component assessing current conditions, which fell to -84.5, the lowest since 2020 and near the historic low.

The three-month downtrend in the sentiment index has erased eight months of smooth recovery, which began after the current conditions assessment reversed from improvement to deterioration in June. The short-term negative impact on the euro is amplified by the significant divergence from expectations, as a decline to only 17.1 was expected instead of the actual 3.6.

The extent of the deterioration in sentiment raises the question of whether the ECB will accelerate monetary easing after last Thursday's rate cut. Interestingly, with objectively stronger macroeconomic data and higher inflation in the US, there is a 67% probability that the Fed will immediately cut the Fed Funds rate by 50 basis points on Wednesday.

Thus, a more decisive monetary easing is expected from the US, which is giving a positive boost to the EUR/USD, which climbed to 1.1145 on Tuesday before the release of the ZEW figures. If the Fed confirms market expectations, the single currency's appreciation could continue despite objectively weaker macroeconomic data from Europe.

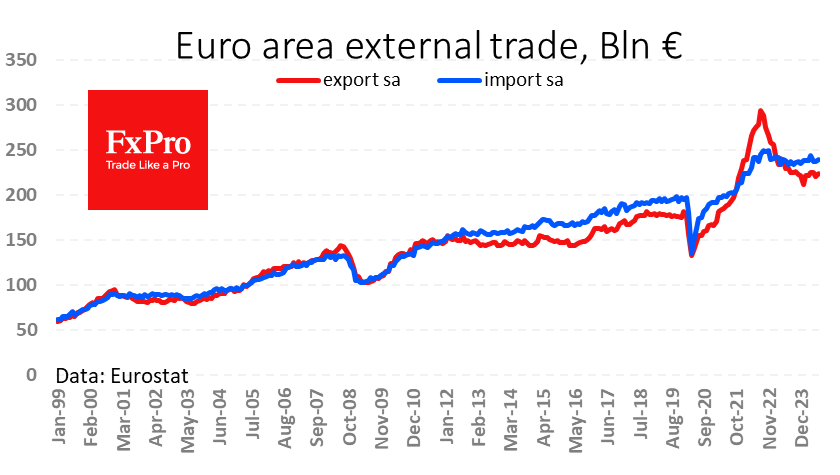

The trade balance figures paint a more insidious picture. The surplus exceeded expectations and remains high by historical standards, although it has narrowed somewhat in recent months. This is not compared to the near-historic record deficits in the US and the UK, which works in the euro's favour. However, the significant 24% decline in exports over the past two years and a 4% decline in imports from the peak also reached almost two years ago cannot be overlooked.

The weakness in industrial production in recent months suggests that exports will fall further. The euro's appreciation is becoming an additional factor reducing the competitiveness of the euro area economy. If the ECB manages to overcome the hawks' resistance, it could adopt an even softer monetary policy stance.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)