Where Crude oil prices could pop

Oil has accelerated its gains over the past week, adding more than 20% to the lows of 28 June, when the latest rally began. Technical factors coming into play and excitement in the markets from robust macro data are adding fuel to the fire.

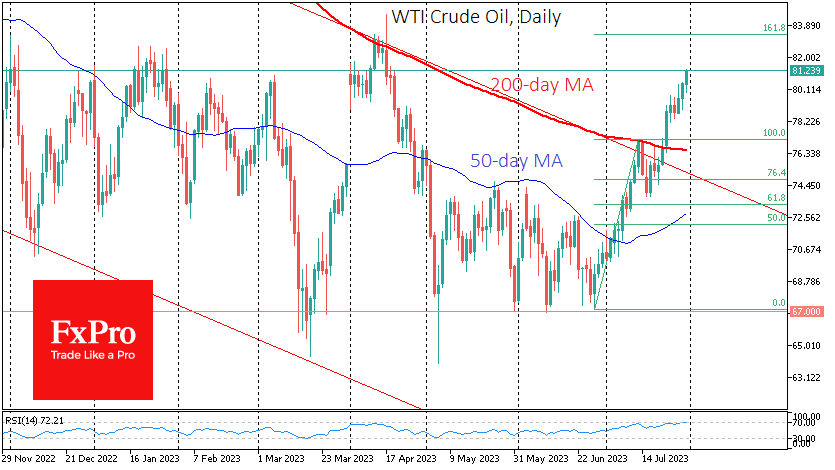

WTI broke above $81 on Monday and is making new multi-month highs after six weeks of strength. Last Monday, the price bounced sharply off its 200-day moving average, confirming the break of a downtrend that has been in place for more than a year.

The medium-term technical picture now points to a rise to the $83.50 area, centring on the May highs and the 161.8% Fibonacci retracement from the rally's start to the first touch of the 200-day MA. However, oil's rally may not stop there and could take it to levels above $90, the double top of October and November last year.

Fundamental factors also support higher prices than we are seeing now. Market investors are cheering lower inflation figures, suggesting that central banks will move more quickly to ease policy, supporting global demand for commodities.

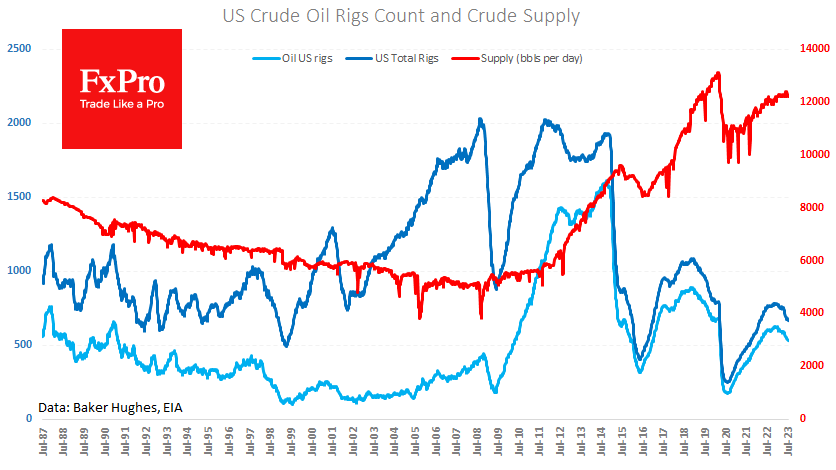

Interestingly, the multi-week price rally has not changed US oil producers' mood. Oil inventories remained at 12.2M BPD last week - just below the average level since the start of the year, signalling a relatively cautious near-term sentiment. The number of active drillers fell to 528 (-2) for the week, the lowest since March last year.

That's a sign of long-term pessimism, which is surprising, given the news that oil consumption has surpassed all-time highs and the supply/demand balance moved into deficit in July. On top of that, the US continues adding jobs, and China is ramping up its stimulus to accelerate economic growth.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)