While the dollar is confused, the S&P 500 faces NVIDIA’s rebalancing threat

While the dollar is confused, the S&P 500 faces NVIDIA’s rebalancing threat

US dollar

The US dollar has been consolidating for more than two weeks. Pressure on the USD index is being exerted by the increased likelihood of a Fed rate cut in September, from 69% to 85%, following Jerome Powell’s dovish rhetoric in Jackson Hole and the White House’s intention to pursue fiscal dominance. Instead of reducing the budget deficit by cutting government spending and raising taxes, a different approach is being taken.

Donald Trump and his team are pushing the Fed to cut rates. For the first time in the central bank’s 111-year history, the president has dismissed a member of the FOMC. The US administration is exploring the possibility of replacing the heads of the Federal Reserve Banks. The main task is to change the composition of the Committee and ensure aggressive monetary policy easing. When other central banks maintain rates, this should lead to a severe weakening of the US dollar.

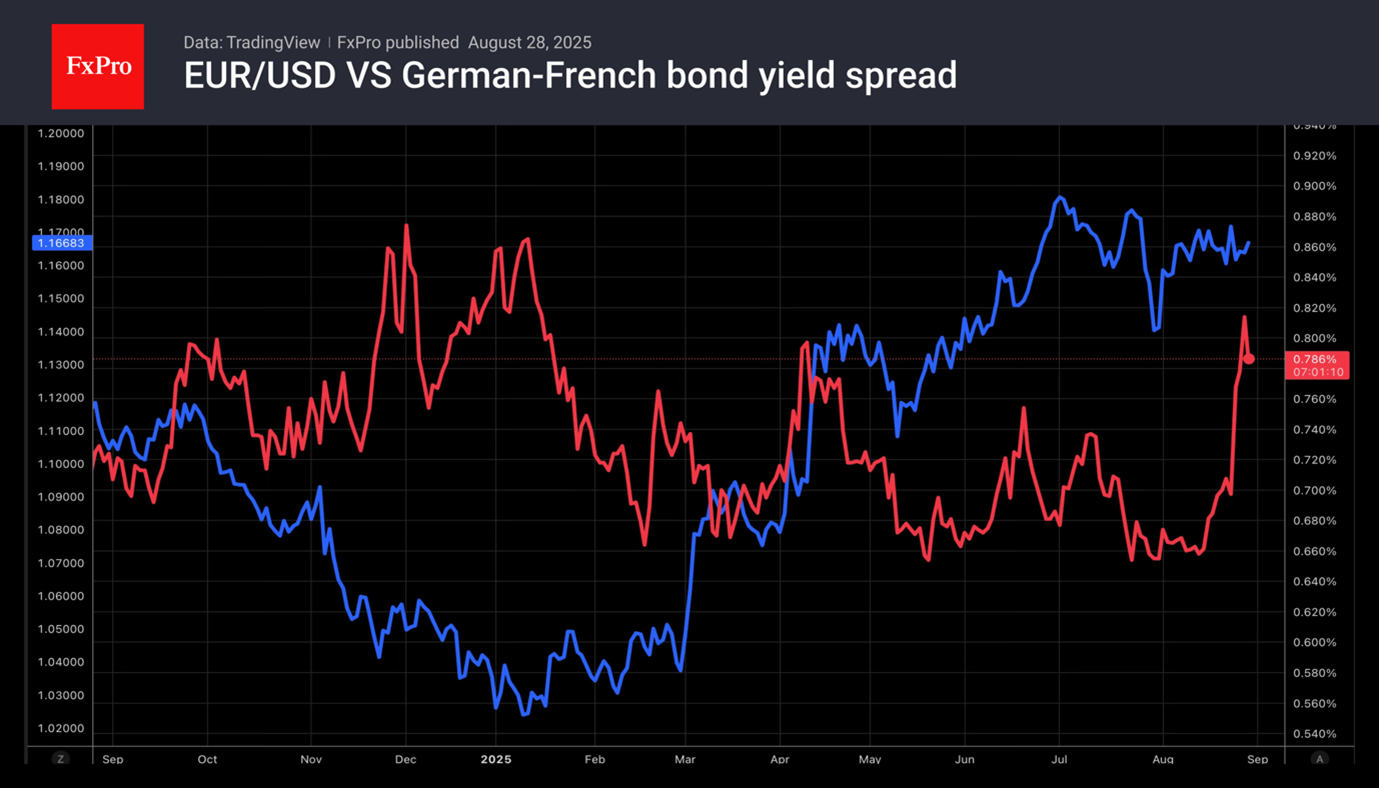

The problems of its competitors hamper the fall of the USD index. The Dutch government survived a vote of no confidence, but the French government is unlikely to do so in September. The increase in political risks threatens to widen the yield spread between French and German bonds to its highest level since 2012, a formidable headwind for EURUSD.

Stock indices

The S&P 500 set another record high in anticipation of strong corporate reporting from NVIDIA. Earnings and expected revenue pleased investors, but sales in the important data processing segment were disappointing. So was the news that the H20 AI chip was not being sold to customers in China. As a result, quarterly revenue fell by $4 billion. Excessively high expectations were not met, and we are seeing another example of ‘buy the rumour, sell the fact’.

NVIDIA’s reporting is extremely important for investors, not only as the flagship of the AI revolution (until OpenAI is traded on the stock exchange), but also as the most expensive company and one of the best in terms of dynamics in recent years. It is also important because of its 8% weight in the S&P 500 index, a historic record in more than 40 years of index calculation. There is an opinion that, for the most part, the first three factors are reflected in the quotes, and the drive to rebalance portfolios is gaining momentum.

Rebalancing should not be confused with correction. Investors are not going to leave the market. They are diversifying their portfolios in favour of other S&P 500 sectors. The strong US economy and the Fed’s readiness to cut rates are creating a tailwind for equities. This is especially true for small-cap companies: over the week, the Russell 2000 gained 6.4%, almost three times more than the S&P 500.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)