- ホーム

- コミュニティ

- 経験豊富なトレーダー

- USD/JPY

Advertisement

Edit Your Comment

USD/JPY

Oct 02, 2014からメンバー

905 投稿

Mar 28, 2016からメンバー

94 投稿

May 27, 2016 at 20:25

Mar 28, 2016からメンバー

94 投稿

The USDJPY was indecisive yesterday. The bias is neutral in nearest term and we need a clear break from the range area as you can see on my H1 chart below to see clearer direction. Buy around 109.10 or sell around 110.65 with a tight stop loss seems to be the most reasonable trading plan for now. A clear break and daily/weekly close below 109.10 could trigger further bearish pressure next week testing 108.00 or lower. On the other hand, a clear break and daily/weekly close above 110.65 could trigger further bullish pressure testing 111.90 region.

Mar 28, 2016からメンバー

94 投稿

May 31, 2016 at 07:18

Mar 28, 2016からメンバー

94 投稿

The USDJPY continued its bullish momentum yesterday topped at 111.44. The bias remains bullish in nearest term testing 111.90 as a part of the bullish phase after the break above the range area as you can see on my H1 chart below. Immediate support is seen around 110.65. A clear break below that area could lead price to neutral zone in nearest term as direction would become unclear.

Mar 28, 2016からメンバー

94 投稿

Jun 01, 2016 at 08:13

Mar 28, 2016からメンバー

94 投稿

The USDJPY failed to continue its bullish momentum yesterday and slipped below 110.65 key support as you can see on my H1 chart below. The bias is neutral in nearest term but as long as stay above the EMA 200 I still prefer a bullish scenario at this phase targeting 111.90 region. Immediate support is seen around 110.20. A clear break and daily close below that area could trigger further bearish pressure testing 109.00 region.

Oct 02, 2014からメンバー

905 投稿

Mar 28, 2016からメンバー

94 投稿

Jun 06, 2016 at 07:09

Mar 28, 2016からメンバー

94 投稿

The USDJPY had a strong bearish momentum last week bottomed at 106.51. The bias is bearish in nearest term testing 106.00 – 105.50 which is a good place to buy with a tight stop loss. Immediate resistance is seen around 107.70. A clear break above that area could lead price to neutral zone in nearest term as direction would become unclear.

Oct 11, 2013からメンバー

769 投稿

Mar 28, 2016からメンバー

94 投稿

Jun 13, 2016 at 06:37

Mar 28, 2016からメンバー

94 投稿

The USDJPY attempted to push higher last week topped at 107.90 but whipsawed to the downside, closed lower at 106.90 and hit 106.06 earlier today. The bias is bearish in nearest term testing 106.00 – 105.50 area which is a good place to buy with a tight stop loss. Immediate resistance is seen around 106.85. A clear break above that area could lead price to neutral zone in nearest term testing 107.25 or higher.

Jul 03, 2016 at 16:25

Nov 16, 2015からメンバー

708 投稿

Jul 03, 2016 at 17:13

Apr 09, 2016からメンバー

419 投稿

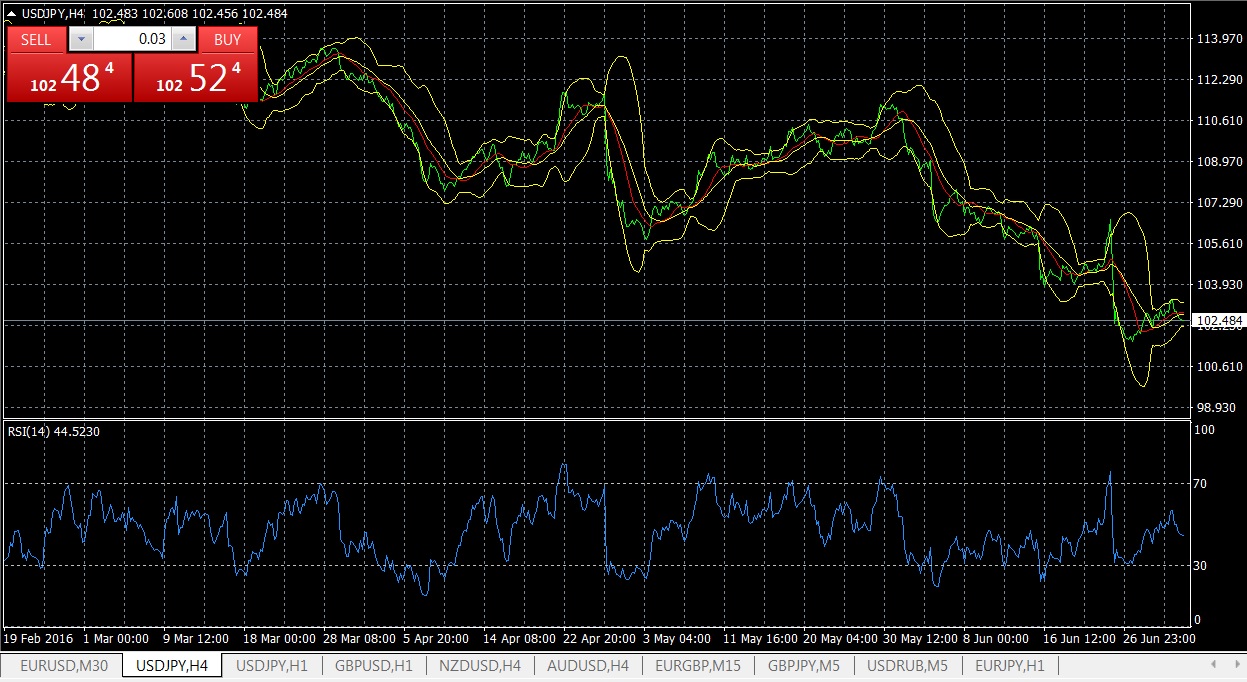

The most probable movement of the USD/JPY is falling to the 100.00-101.00 zone, and as a major resistance level will perform the 103.50 zone. An alternative view - the possible growth of the pair to the level of 106.30. At the same time, we must remember that the USD/JPY is now at Pivot Point level of the first half of 2014 year, and perhaps for some time it will follow along this line.

Oct 11, 2013からメンバー

769 投稿

Jul 05, 2016 at 08:28

Nov 16, 2015からメンバー

708 投稿

The US dollar remarked modest decrease against the Japanese Yen on Monday. The pair remained almost unchanged and lost only 7 pips. The graphics continue to develop under moving averages, while the index of relative strength remain on neutral territory. The outlook remains neutral in the short term, levels at 101.20 and 103.70 retain their key role.

Sep 28, 2015からメンバー

34 投稿

Jul 06, 2016 at 05:27

Sep 28, 2015からメンバー

34 投稿

What do you at these levels of USD/JPY ??? Is intervention sure not a verbal that has counter productive so far. At the time of writing it is at 100.90 and next support observe at 100.50 ahead of 98.78. Resistance is unchanged at 103.50 /60. Kuroda will speak tomorrow.

Jul 06, 2016 at 08:02

Nov 14, 2015からメンバー

315 投稿

Way2Riches posted:

What do you at these levels of USD/JPY ??? Is intervention sure not a verbal that has counter productive so far. At the time of writing it is at 100.90 and next support observe at 100.50 ahead of 98.78. Resistance is unchanged at 103.50 /60. Kuroda will speak tomorrow.

They have tried the verbal way since the pair was around 105. And while they may not rush to act, they surely have to make good on something to save the export. Export feel -11.3% in May, and -10.1%. And the May low was 105.52. We expect more fall as it hit a new low levels in June and July. Nikkei have fallen over 20% YTD. We could certainly see some desperation to save the economy.

Sep 28, 2015からメンバー

34 投稿

Jul 06, 2016 at 11:07

Sep 28, 2015からメンバー

34 投稿

stian posted:Way2Riches posted:

What do you at these levels of USD/JPY ??? Is intervention sure not a verbal that has counter productive so far. At the time of writing it is at 100.90 and next support observe at 100.50 ahead of 98.78. Resistance is unchanged at 103.50 /60. Kuroda will speak tomorrow.

They have tried the verbal way since the pair was around 105. And while they may not rush to act, they surely have to make good on something to save the export. Export feel -11.3% in May, and -10.1%. And the May low was 105.52. We expect more fall as it hit a new low levels in June and July. Nikkei have fallen over 20% YTD. We could certainly see some desperation to save the economy.

If USD/JPY set on a natural course then below 100 is inevitable to reach post brexit low at 98.78 and further. However there might something to do by Kuroda when it pass 100. We know market is tired of verbal threats. Yes Japan desperately needs to boost economy by weak Yen and investors demands safe haven.

Jul 06, 2016 at 13:25

(編集済みのJul 06, 2016 at 13:27)

Nov 14, 2015からメンバー

315 投稿

Way2Riches posted:Obviously we can't be sure how they will act, but timing wise it is the perfect time if they ever want to expand as many central banks are considering to expand their stimulus programs or cut their rates because Brexit.stian posted:Way2Riches posted:

What do you at these levels of USD/JPY ??? Is intervention sure not a verbal that has counter productive so far. At the time of writing it is at 100.90 and next support observe at 100.50 ahead of 98.78. Resistance is unchanged at 103.50 /60. Kuroda will speak tomorrow.

They have tried the verbal way since the pair was around 105. And while they may not rush to act, they surely have to make good on something to save the export. Export feel -11.3% in May, and -10.1%. And the May low was 105.52. We expect more fall as it hit a new low levels in June and July. Nikkei have fallen over 20% YTD. We could certainly see some desperation to save the economy.

If USD/JPY set on a natural course then below 100 is inevitable to reach post brexit low at 98.78 and further. However there might something to do by Kuroda when it pass 100. We know market is tired of verbal threats. Yes Japan desperately needs to boost economy by weak Yen and investors demands safe haven.

Jul 07, 2016 at 01:10

(編集済みのJul 07, 2016 at 01:11)

Nov 14, 2015からメンバー

315 投稿

Not as agreesive as I would've hoped, but: "Bank of Japan Governor Haruhiko Kuroda said on Thursday the central bank is ready to take additional monetary easing steps if needed" (Reuters). So certainly still on the cards for next BoJ meeting.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。