Asia slows more than expected

Asia slows more than expected

The statistics packages from China and Japan - the largest economies in the Asian region - came out below expectations, highlighting weak domestic demand and production.

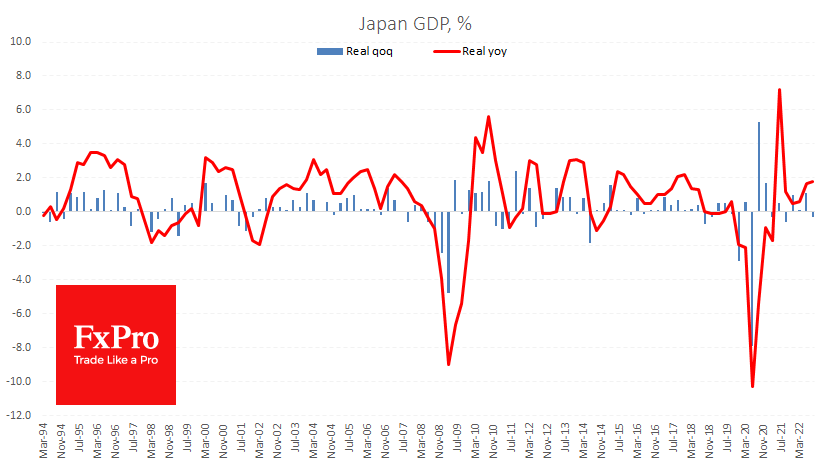

Japan's economy lost 0.3% in the third quarter while it was expected to grow by the same amount. Meanwhile, real GDP added 1.8% y/y. A jump in imports was responsible for the decrease while private consumption showed a relatively moderate positive contribution.

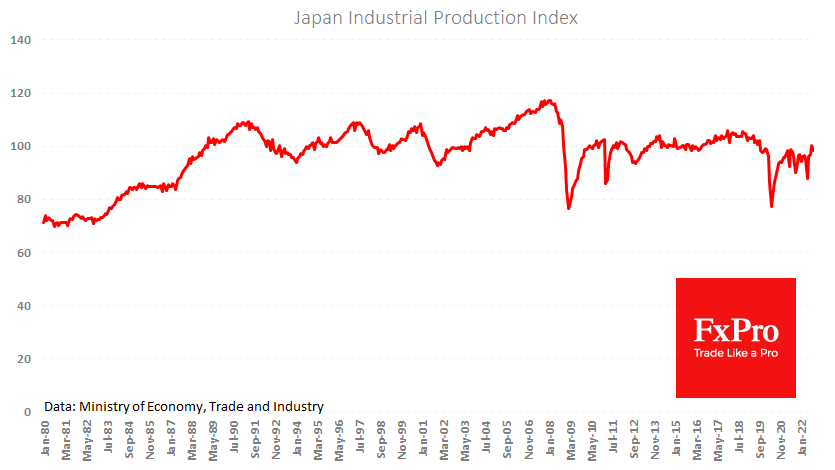

Industrial production lost 1.9% in September, reversing a sharp turnaround after three months of growth, during which the index increased by 13.4%. A jump in energy prices prevents production from taking full advantage of the weaker yen. China's slowdown will likely constrain Japan's industry by not giving it enough orders.

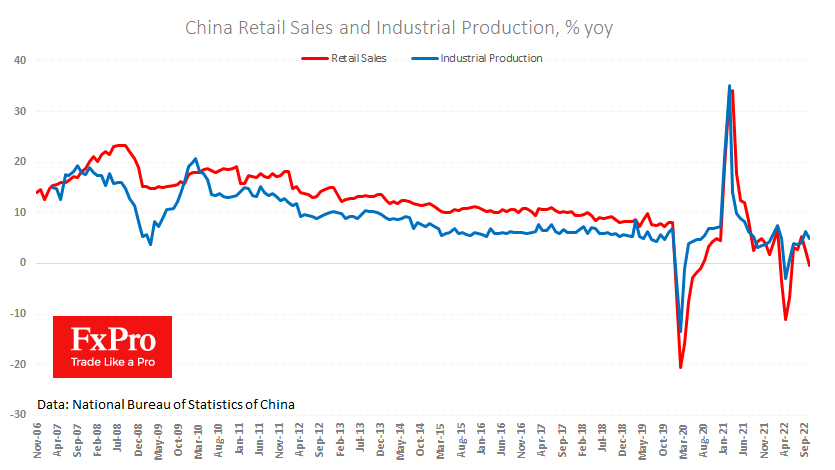

China noted a 0.5% y/y fall in retail sales thanks to 0-covid restrictions. These are gradually easing but remain much more restrained than in other major economies worldwide. Industrial Production growth slowed to 5% y/y last month versus 6.3% in September.

Weighing retail sales and manufacturing numbers would be enough of a signal for the government to step up support to the economy.

Considering the weak data from Japan and China, their currencies have particularly strengthened this month by 6.5% and 4%, respectively. Currency volatility risks hurting exporters for whom exchange rate stability might be a better option after a slump since the start of the year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)