Crypto rally stalls as market awaits key US inflation data

Crypto rally stalls as market awaits key US inflation data

Market Picture

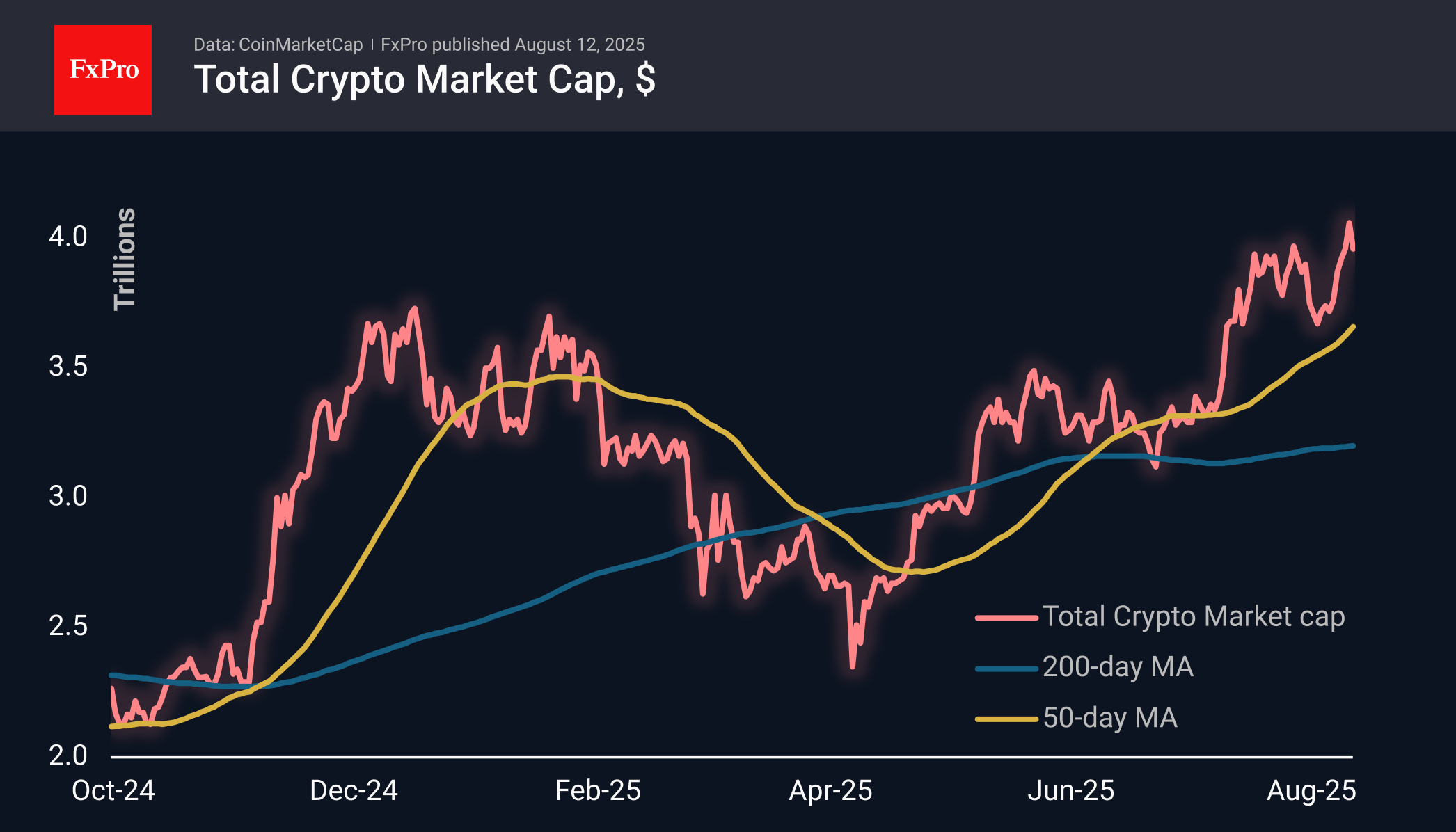

The crypto market capitalisation fell below the $4 trillion mark, down 1.8% over the last day. Bitcoin failed to stay above $120K, Ethereum's growth stalled at $4300, and many major altcoins have seen declines in the last couple of days.

Bitcoin closed Monday near its opening levels, losing nearly 3% of its 3.5% jump at the start of the day to $119K. There are fears of a repeat of the situation we saw in July, when a promising breakthrough turned into an exhausting sideways movement and rattled nerves with a decline in the first days of August. We attribute the BTC pullback to the cautious mood of major players ahead of US inflation data released later on Tuesday.

Ethereum is holding steady at the top at nearly $4300, indicating an optimistic mood among bulls: they are taking a wait-and-see approach rather than rushing to lock in profits after the rally. It seems the market is seriously set on moving towards historic highs at $4800, and is looking for a suitable reason to do so.

News Background

According to CoinShares, global investment in crypto funds rose by $578 million last week, more than doubling the outflow a week earlier. Investments in Bitcoin increased by $265 million, Ethereum by $270 million, Solana by $22 million, XRP by $18 million, and Near by $10 million. Investments in Sui decreased by $3 million.

Strategy additionally purchased 155 BTC last week at an average price of $116,401 per coin, according to company founder Michael Saylor. The company now owns 628,946 BTC, purchased at an average price of $73,288. The total investment is estimated at $46.09 billion.

According to Lookonchain, an unknown crypto whale has purchased 221,166 ETH worth about $1 billion over the past seven days. Market participants are optimistic about the coin's prospects.

Sky Protocol, formerly known as Maker, received a B- credit rating from S&P Global Ratings. This is the first rating of a DeFi platform by a traditional rating agency. Sky Protocol is a decentralised lending platform that allows users to take out loans secured by cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)