USDJPY remains exposed to bearish trend

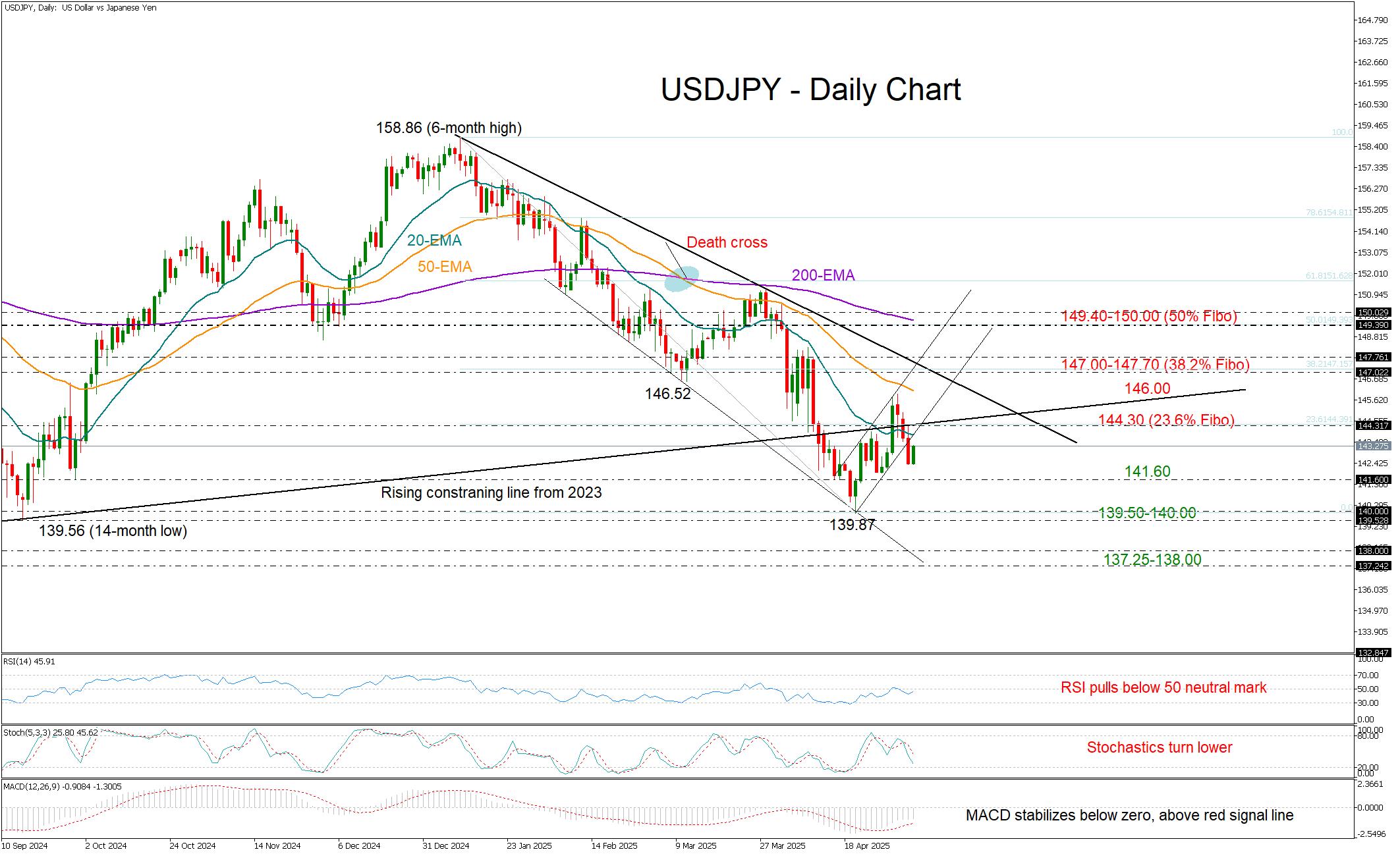

USDJPY has broken out of a brief bullish channel after failing to push past the constraining zone at 145.35, raising concerns that the bearish trend may still have room to extend.

With the RSI failing to cross above its neutral 50 mark and the stochastic oscillator resuming its downward slope, the likelihood of a meaningful rebound remains low. Adding to the bearish sentiment are the declining exponential moving averages (EMAs), which continue to support the downward trajectory in price. Perhaps any signals that rate cuts are still on the table during today’s FOMC policy announcement, which is expected to keep borrowing costs unchanged, could further weight on the greenback.

The next support may emerge near the key level of 141.65, which has occasionally shielded the market from selling pressure in the second half of 2024. Notably, this area also aligns with the 61.8% Fibonacci retracement of the 2023–2024 uptrend. Therefore, if the bears breach this level as well, attention will likely shift to the critical support zone of 139.50–140.00. A deeper decline could extend toward the 137.25–138.00 area, which served as support from November 2022 to July 2023.

On the upside, bulls must overcome resistance at 144.30 to reach the 146.00 region, where the 50-day EMA is currently situated. A further rise above the 38.2% Fibonacci retracement level at 147.00, along with the tentative resistance trendline from the 2025 peak, may be required to trigger a rally toward the 50% Fibonacci level at 149.40 and the 200-day EMA.

Overall, USDJPY has failed to enter bullish territory despite its recent recovery attempt. The bearish trajectory is likely to continue unless the 141.60 support level holds firm.

.jpg)