Reklāma

Edit Your Comment

Reasons why you should NOT trade cryptocurrencies

Biedrs kopš

16 ieraksti

Feb 21, 2018 at 12:36

Biedrs kopš

16 ieraksti

There is money to be mad in cryto but it is all very speculative. I would never dream of putting any serious funds into it

Biedrs kopš

875 ieraksti

Feb 21, 2018 at 14:33

Biedrs kopš

875 ieraksti

CleanTrader posted:

There is money to be mad in cryto but it is all very speculative. I would never dream of putting any serious funds into it

So true, but I think it’s a good option as a long time investment!

keeping patience.......

Biedrs kopš

268 ieraksti

Feb 22, 2018 at 05:52

Biedrs kopš

268 ieraksti

crypto is to risky for training !!!! i use crypto is my long investment/retirement

Biedrs kopš

268 ieraksti

Biedrs kopš

394 ieraksti

Feb 28, 2018 at 16:08

Biedrs kopš

394 ieraksti

Cryptos are risky - we all know this. But those symbols are still tradable and getting more popular each day. Cryptos are definitely something different on the market. Also you have a lot of options, entertainment with the price changing - something which is considered by the "rich" traders as interesting.

I consider the cryptos non-tradable for the average trader and very much tradable for the traders who like to risk a lot and that do not care about the account balance. It's up to you guys - trade what you like and don't take someone's opinion as a must :) GL

I consider the cryptos non-tradable for the average trader and very much tradable for the traders who like to risk a lot and that do not care about the account balance. It's up to you guys - trade what you like and don't take someone's opinion as a must :) GL

Accept the loss as experience

Biedrs kopš

659 ieraksti

Feb 28, 2018 at 16:39

Biedrs kopš

659 ieraksti

DrVodka posted:

crypto is to risky for training !!!! i use crypto is my long investment/retirement

It’s a good plan! For short-term trading cryto is too much risky; I have also a buy trade from 2K (BTC/USD)! I am holding this trade with a long time target.

Biedrs kopš

1 ieraksti

Mar 11, 2018 at 15:11

Biedrs kopš

1 ieraksti

Currently Bitcoin software is still in beta with many incomplete features in active development. New tools, features, and services are being developed to make Bitcoin more secure and accessible to the masses. Some of these are still not ready for everyone. Most Bitcoin businesses are new and still offer no insurance. Currently its bit risky to invest in bitcoins rather I would prefer to invest in Gold.

https://yourstory.com/mystory/06eb393550-rajesh-exports-md-a-b

https://innertowords.com/rajesh-exports-md-investing-gold-far-better-option-crypto-currencies/

https://yourstory.com/mystory/06eb393550-rajesh-exports-md-a-b

https://innertowords.com/rajesh-exports-md-investing-gold-far-better-option-crypto-currencies/

forex_trader_314834

Biedrs kopš

58 ieraksti

Mar 27, 2018 at 08:20

Biedrs kopš

58 ieraksti

Like I said

https://www.esma.europa.eu/press-news/esma-news/esma-agrees-prohibit-binary-options-and-restrict-cfds-protect-retail-investors

Forex is dead in the EU.

Now crypto will rise.

https://www.esma.europa.eu/press-news/esma-news/esma-agrees-prohibit-binary-options-and-restrict-cfds-protect-retail-investors

Forex is dead in the EU.

Now crypto will rise.

Biedrs kopš

507 ieraksti

Mar 27, 2018 at 13:33

(labots Mar 27, 2018 at 13:35)

Biedrs kopš

507 ieraksti

johndoe2016 posted:

Like I said

https://www.esma.europa.eu/press-news/esma-news/esma-agrees-prohibit-binary-options-and-restrict-cfds-protect-retail-investors

Forex is dead in the EU.

Now crypto will rise.

Not at all :)

Just the brokers will apply for licenses in exotic places in the world... and then will attract clients with high leverage but in different legal entity. To bring some more clearance, here is an example:

Company "A" is a solid EU regulated broker with many clients and the same broker establish company "AA" in Marshal Islands. Now when a client (new, but this is valid also for current clients as well) comes to them asking to open a trade account, the company representative will explain - if the client open account with company "A" then EU regulation should be applicable, but if he select company "AA" which is the same company, the client may use conditions offered by "AA". :)

This is just very basic example :)

Biedrs kopš

4573 ieraksti

Mar 27, 2018 at 13:33

Biedrs kopš

4573 ieraksti

Trading crypto is like driving F1 - lot of adrenalin, lot of profit.

Trading forex is calm and stable income, but boring.

Trading forex is calm and stable income, but boring.

Biedrs kopš

12 ieraksti

Mar 27, 2018 at 13:39

Biedrs kopš

12 ieraksti

That won't kill Forex. Forex trading is here to stay. There are restrictions like that in the US and there are still plenty of Forex traders. Just because there are leverage restrictions it won't stop people putting in money

Biedrs kopš

394 ieraksti

Mar 28, 2018 at 14:16

Biedrs kopš

394 ieraksti

togr posted:

Trading crypto is like driving F1 - lot of adrenalin, lot of profit.

Trading forex is calm and stable income, but boring.

I absolutely agree with this.... :)

Accept the loss as experience

Biedrs kopš

1288 ieraksti

Mar 28, 2018 at 14:45

(labots Mar 28, 2018 at 15:12)

Biedrs kopš

1288 ieraksti

johndoe2016 posted:

Like I said

https://www.esma.europa.eu/press-news/esma-news/esma-agrees-prohibit-binary-options-and-restrict-cfds-protect-retail-investors

Forex is dead in the EU.

Now crypto will rise.

The link you provided is NOT referring to Spot Forex.

The link you provided refers to DERIVATIVES of Spot Forex, namely CFDs (Contract For Difference) and Binary Options.

An explanation of the difference between Spot Forex and Forex CFDs:

https://money.stackexchange.com/questions/45576/what-is-the-difference-between-spot-forex-trading-and-cfd-forex-trading?utm_medium=organic&utm_source=google_rich_qa&utm_campaign=google_rich_qa

Derivatives are being regulated, and the same approach needs to be taken with cryptocurrency - the sooner the better. Cryptocurrency is currently where Binary Options were five or ten years ago...

(Spot) Forex is not "dead". Get your facts straight.

This thread is a collection of cryptocurrency-related articles that illustrate reasons why the "crypto" market is a pure speculation play, and highlight the risks involved with cryptocurrency. Please contribute articles relevant to this thread's topic.

Biedrs kopš

1288 ieraksti

Mar 28, 2018 at 15:27

Biedrs kopš

1288 ieraksti

Crypto market-cap dips below $300 billion as doom and gloom continues (27 Mar 2018)

https://www.marketwatch.com/story/crypto-market-cap-dips-below-300-billion-as-bitcoin-nears-long-term-support-2018-03-27

Biedrs kopš

12 ieraksti

Mar 29, 2018 at 11:12

Biedrs kopš

12 ieraksti

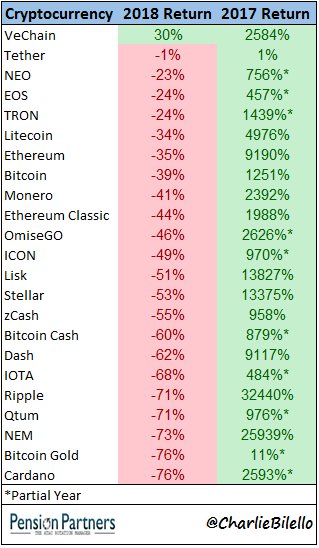

Interesting chart but I would take a 26000% gain one year and a -76% fall the next any day of the week

Biedrs kopš

4573 ieraksti

Mar 29, 2018 at 11:53

Biedrs kopš

4573 ieraksti

BluePanther posted:Crypto market-cap dips below $300 billion as doom and gloom continues (27 Mar 2018)

https://www.marketwatch.com/story/crypto-market-cap-dips-below-300-billion-as-bitcoin-nears-long-term-support-2018-03-27

You are comparing the whole year of 2017 with couple of months of 2018. At the end of 2018 these number will look completely different. Hopefully better :)

Biedrs kopš

1288 ieraksti

Apr 01, 2018 at 04:04

Biedrs kopš

1288 ieraksti

Bitcoin woes (1 Apr 2018)

https://www.marketpulse.com/20180331/bitcoin-woes/

Deleveraging Bitcoin (1 Apr 2018)

https://www.marketpulse.com/20180331/deleveraging-bitcoin/

Biedrs kopš

1288 ieraksti

Apr 01, 2018 at 04:06

(labots Apr 01, 2018 at 04:07)

Biedrs kopš

1288 ieraksti

togr posted:

You are comparing the whole year of 2017 with couple of months of 2018. At the end of 2018 these number will look completely different. Hopefully better :)

True, the comparison chart only displays partial results for 2018 compared to whole year results for 2017. Early days yet for this year (things may only get worse).

Keep in mind: a loss of 50% requires a gain of 100% to recover.

Biedrs kopš

659 ieraksti

Apr 11, 2018 at 06:50

Biedrs kopš

659 ieraksti

togr posted:BluePanther posted:Crypto market-cap dips below $300 billion as doom and gloom continues (27 Mar 2018)

https://www.marketwatch.com/story/crypto-market-cap-dips-below-300-billion-as-bitcoin-nears-long-term-support-2018-03-27

You are comparing the whole year of 2017 with couple of months of 2018. At the end of 2018 these number will look completely different. Hopefully better :)

Maybe, it will! But, right now it’s under 7000 USD. Really frustrating.

Biedrs kopš

4573 ieraksti

Apr 11, 2018 at 13:43

Biedrs kopš

4573 ieraksti

AmDiab posted:togr posted:BluePanther posted:Crypto market-cap dips below $300 billion as doom and gloom continues (27 Mar 2018)

https://www.marketwatch.com/story/crypto-market-cap-dips-below-300-billion-as-bitcoin-nears-long-term-support-2018-03-27

You are comparing the whole year of 2017 with couple of months of 2018. At the end of 2018 these number will look completely different. Hopefully better :)

Maybe, it will! But, right now it’s under 7000 USD. Really frustrating.

Do you know in JAN 17 it was under 1,000 :)

at $880

*Spams netiks pieļauts, un tā rezultātā var slēgt kontu.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.