- Sākumlapa

- Kopiena

- Tirdzniecības sistēmas

- ZantaraFX

ZantaraFX (By Zantara )

Diskusija

In the near future, by the end of the week, I see the following developments in the gold market.

Trump's criticism of the Fed and demands for aggressive policy easing enhance the attractiveness of the precious metal as a defensive asset. Gold is in a strong uptrend, supported by structural factors such as political uncertainty, trade risks, and a weakening dollar.

The US and EU are close to agreeing on 15% tariffs

Against this backdrop, the US dollar strengthened today, while gold fell in price. Geopolitical positivity began to correct itself in the markets.

Excellent movement of gold according to yesterday's markings. It's a pity I didn't hold my position. Now we can expect a local upward rebound and a further decline. The target is the lower boundary of the ascending channel.

Tomorrow is Friday. We are waiting for the end of the week and a possible decline in the US dollar.

Gold continues to move according to plan towards the lower boundary of the upward channel.

Gold fell to $3,368 after peaking at $3,439. The rise in real yields to 2.046% is having a negative impact on the precious metal.

Gold is under pressure due to high real yields and the recovery of the dollar. However, political risks surrounding the Fed could be a catalyst for a return to growth. Trump's visit to the Fed and threats to the central bank's independence traditionally support interest in defensive assets. A false breakout was recorded on the daily chart, but the pattern remains bullish.

The stabilisation of the dollar reflects conflicting factors — on the one hand, strong economic data, and on the other, political pressure on the Fed. The pullback of AUD/USD from its highs shows technical resistance, but fundamental factors (strong Australian PMIs, hawkish RBA) remain supportive. EUR/USD is under pressure from the ECB's neutral stance. Trump's political pressure on the Fed is creating uncertainty about future monetary policy.

Ursula von der Leyen is meeting with Trump today to try to reach a trade deal before the deadline on Friday 1 August.

If there is no deal, the US will impose 30% duties on EU goods after 1 August. The EU has threatened to impose commensurate retaliatory measures.

Earlier it was reported that the US and EU were close to an agreement with 15% duties and that an agreement could be reached as early as today.

Trump claimed that if the agreement was reached, it would be the biggest trade deal for the US.

The European economy will suffer losses after the conclusion of a trade deal with the US, which involves reducing tariffs from 30% to 15% that threatened the EU.

Le Pen called the US trade deal a triple fiasco for the European Union.

We are waiting for good trading ideas on gold and the US dollar.

Donald Trump once again bombarded Russia and Iran with tough statements - these speeches became the main geopolitical event of the day.

During a speech in Scotland, Trump dramatically cut the deadline for Russia to end the war in Ukraine - from the previously stated 50 days to just 10-12 days. He threatened to immediately impose new sanctions, including ‘secondary’ sanctions, against both Russian assets and countries that maintain large-scale trade with Moscow. The president emphasised that he was losing patience with the lack of progress in resolving the conflict and demanded action ‘without delay’.

Amid these statements and rising geopolitical tensions, global markets reacted with panic. Risky assets, including equities and cryptocurrencies, came under pressure. Bitcoin, which was trading at around $120,000, corrected down to 118,000, breaking its uptrend and entering a consolidation phase. Trump, as before, showed: his words can instantly ‘cool’ global markets.

Gold is at a crossroads. It broke through the descending channel boundary, there is a risk to fall much lower

We are preparing for the Fed meeting. If Powell hints at a rate cut today, gold will fully recoup all losses. Market participants are currently in uncertainty, but technical factors indicate a possible continuation of the growth of the US dollar.

On Thursday, 31 July, the BTC/USDT pair is trading at $118,500. Buyers have fully recovered yesterday's losses. The price has remained in a sideways trend since 14 July. Today, there are prerequisites for a breakout of $118,900 (trend line from ATH $123,218). As long as interest rates remain high and the Fed takes a cautious stance, a sharp rally in crypto is not to be expected. To update the historical maximum, it is necessary to consolidate above $120,400.

Silver, platinum and palladium prices continued to decline on Thursday. Gold temporarily stopped falling.

European indices declined by an average of 1%. Chinese indices are down 2%.

Crypto is also under pressure.

Sentiment in global markets continues to deteriorate.

The correction itself in the bitcoin market has been prolonged. The balance of power is gradually shifting towards the sellers. The nearest target for them is the level of $112,000. However, a sharp reversal cannot be ruled out. If the data on the labour market turns out to be weaker than expected, the dollar may weaken, and then bitcoin may quickly return to the level of $118,800. For now, I remain cautious - the situation is too dynamic to make unambiguous decisions.

Berkshire Hathaway's operating profit fell 4% year-on-year in Q2 2025.

The company once again issued a stern warning about Trump's tariffs and their potential impact on various areas of the company's business.

The amount of cash on the company's balance sheet remains at a record high: Buffett still believes that now is not the best time to buy.

In Q2 2025, Berkshire was again a net seller of shares and did not buy back its own shares.

Berkshire has been a net seller of shares for 11 consecutive quarters!

Citi raised its gold forecast for the next three months to $3,500 from $3,300 amid deteriorating US economic indicators.

‘U.S. growth and tariff-related inflation concerns are set to remain elevated during 2H'25, which alongside a weaker dollar, are set to drive gold moderately higher, to new all-time highs.’

Trump claimed that last week's employment report was rigged, just like the data before the presidential election, and said that massive revisions to the figures, unprecedented in scale, were made in favour of ‘radical left-wing Democrats’ to conceal the real economic successes of his administration.

Morgan Stanley notes that, according to the risk appetite indicator, the level of ‘greed’ in US stocks has risen to historically high extremes.—————————-More and more Wall Street investment houses are warning clients to prepare for a correction in US stocks.

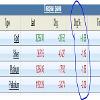

There were some excellent trades on gold today. We are currently in a sideways trend, and I believe there will be another update to the maximum, and we can try a local short again.