AUD Sinks on Soft Jobs Data, RBA Cut Bets Climb

Jobs Data Hurts AUD

The Australian Dollar slid sharply on Thursday as dismal labor market data reinforced expectations of a rate cut by the Reserve Bank of Australia. Risk sentiment remained subdued across Asia-Pacific markets, while traders digested cautious commentary from Japan’s top FX officials and a stronger-than-expected PBOC yuan fix. Meanwhile, the euro drifted lower ahead of key inflation data from the Eurozone, and the New Zealand dollar weakened as market tone turned risk-off. Traders are bracing for upcoming catalysts that could dictate FX direction heading into the weekend.

AUD/USD Forecast

Current Price and Context

AUD/USD slips to around 0.6620 following weaker-than-expected Australian labor data. The jobless rate ticked up to 4.2% in June while full-time employment fell sharply, reinforcing market expectations that the Reserve Bank of Australia (RBA) may shift toward monetary easing in the coming months. This data-led pullback comes amid broad US Dollar strength and cautious market sentiment.

Key Drivers

Geopolitical Risks: Minimal direct influence on AUD today; focus remains on macro data.

US Economic Data: USD remains bid on upbeat US retail sales and industrial production data earlier in the week.

FOMC Outcome: Fed policymakers remain cautious; no immediate signs of dovish pivot, supporting the USD.

Trade Policy: Trade tensions remain subdued; no fresh headlines impacting AUD directly.

Monetary Policy: RBA rate cut bets rise sharply after weak employment report. Money markets now price in a 25 bps cut by November, a shift from prior neutral expectations.

Technical Outlook

Trend: Bearish short-term trend intact; breakdown from 0.6700.

Resistance: 0.6700, then 0.6755 and 0.6800.

Support: 0.6620, then 0.6580 and 0.6550.

Forecast: AUD/USD may drift toward 0.6620, with a downside extension to 0.6580 if RBA rate-cut expectations intensify.

Sentiment and Catalysts

Market Sentiment: Bearish bias dominates after the weak Australian labor market report increased expectations for RBA easing.

Catalysts: Rising market speculation about an RBA rate cut later this year is weighing on the AUD.Any surprise improvement or deterioration in upcoming US data could amplify AUD/USD volatility.Commentary from RBA officials or changes in global risk sentiment may also influence the pair’s direction.

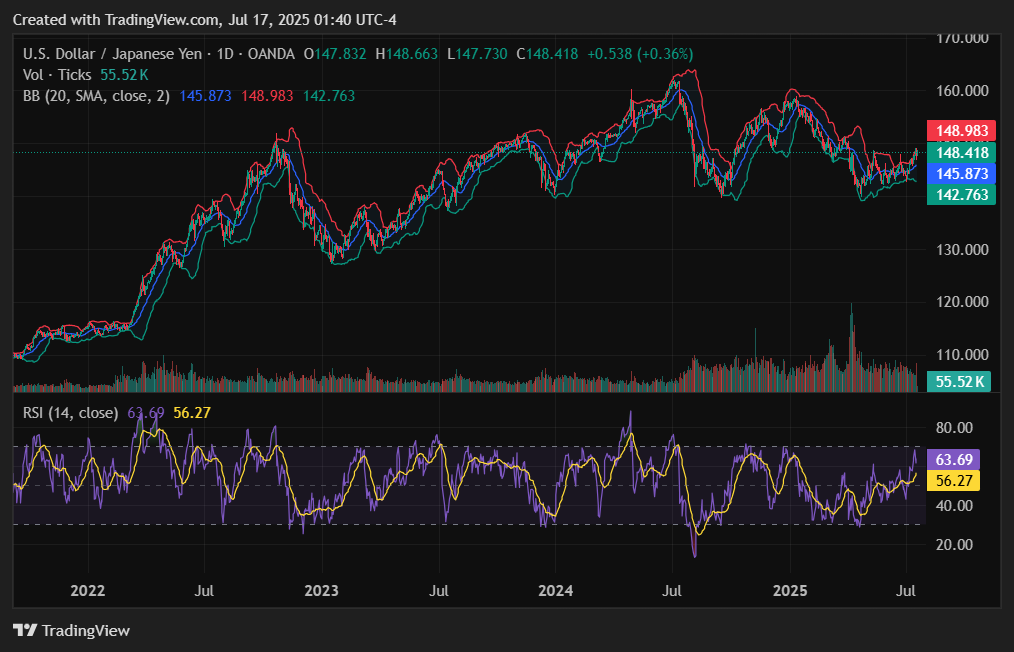

USD/JPY Forecast

Current Price and Context

USD/JPY trades at 147.88, near one-month highs, as Japanese authorities express concern over currency volatility. However, yield differentials continue to favor the USD.

Key Drivers

Geopolitical Risks: Limited safe-haven flows into yen; geopolitical tension has shifted preference to USD.

US Economic Data: Solid recent US macro figures support Treasury yields and the dollar.

FOMC Outcome: Fed remains hawkish; two cuts still expected in 2025, but not imminent.

Trade Policy: No major trade headlines affecting USD/JPY directly, but global supply chain talk continues to favor dollar safety.

Monetary Policy: BoJ’s ultra-loose policy stance remains a drag on JPY, with Aoki’s verbal remarks doing little to shift outlook.

Technical Outlook

Trend: Bullish continuation after consolidating above 146.50.

Resistance: 148.00, then 148.75 and 149.10.

Support: 147.40, then 146.90 and 146.20.

Forecast: USD/JPY could test 148.75 if BoJ remains passive and US data stay strong.

Sentiment and Catalysts

Market Sentiment: Bullish; X posts emphasize yen weakness despite verbal concerns.

Catalysts: Japanese CPI due later this week, US Jobless Claims, and Fed speeches

EUR/USD Forecast

Current Price and Context

EUR/USD is trading near 1.1610, extending its decline as markets brace for the upcoming Eurozone Harmonized Index of Consumer Prices (HICP) release. The pair remains under pressure from a resilient USD and cautious euro sentiment amid monetary divergence.

Key Drivers

Geopolitical Risks: No immediate geopolitical tension in the Eurozone, but global unease supports USD safe-haven flows.

US Economic Data: Positive US indicators, including solid housing and labor data, underpin dollar strength ahead of Eurozone inflation prints.

FOMC Outcome: The Fed’s firm stance, with two projected rate cuts later in the year, contrasts the ECB’s pause, creating downside pressure on EUR.

Trade Policy: No fresh headlines, but concerns over transatlantic trade conditions remain in the background.

Monetary Policy: The ECB is expected to hold policy steady, while the Fed’s hawkish bias keeps yield spreads wide, hurting EUR/USD.

Technical Outlook

Trend: Bearish continuation from last week’s breakdown below 1.1700.

Resistance: 1.1660, then 1.1725 and 1.1800.

Support: 1.1600, followed by 1.1575 and 1.1500.

Forecast: EUR/USD could test the psychological 1.1600 support zone. A weak HICP print may trigger a further drop toward 1.1575.

Sentiment and Catalysts

Market Sentiment: Bearish bias continues across major FX desks; social media notes stress around inflation impact on ECB credibility.

Catalysts: Eurozone HICP data, US housing starts, and ECB commentary through the week.

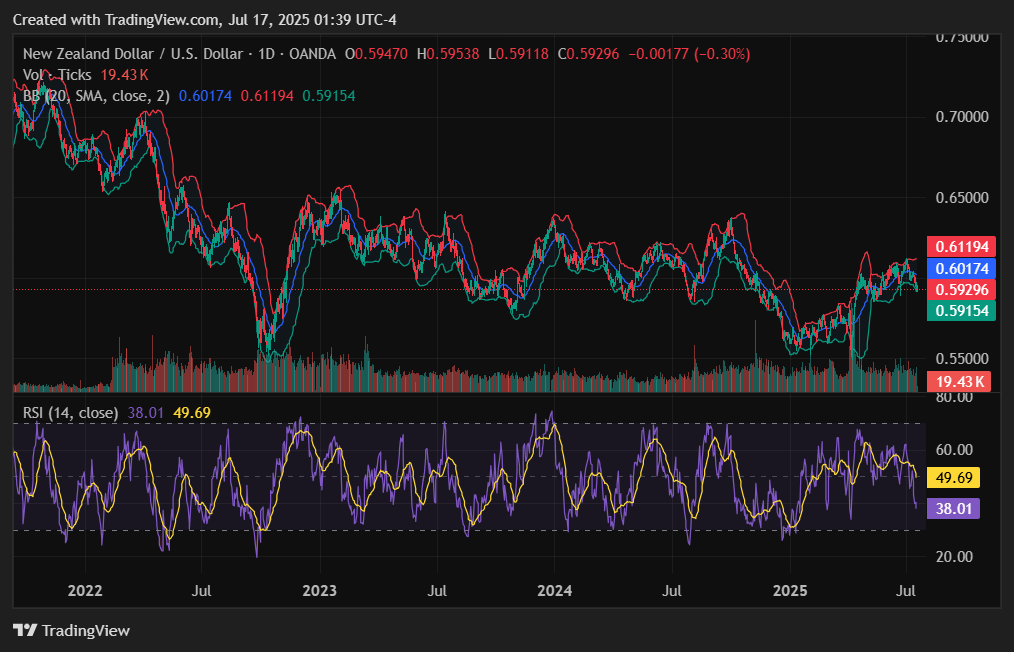

NZD/USD Forecast

Current Price and Context

NZD/USD trades at 0.5938, slipping below the 0.5950 threshold as risk sentiment fades and the greenback remains broadly supported. The pair continues to reflect investor caution amid mixed global data and a soft commodity outlook.

Key Drivers

Geopolitical Risks: No direct impact on NZD, but risk-off flows due to broader geopolitical unease support USD demand.

US Economic Data: Robust US retail and housing data bolster the dollar, contributing to Kiwi weakness.

FOMC Outcome: Hawkish Fed guidance, with delayed rate cuts, keeps USD buoyant and pressures NZD.

Trade Policy: China-related trade concerns indirectly impact NZD due to its strong trade ties with Beijing.

Monetary Policy: The Reserve Bank of New Zealand (RBNZ) maintains a neutral stance; markets are pricing in a possible rate cut if economic data weakens further.

Technical Outlook

Trend: Bearish breakdown below 0.5950 confirms downside pressure.

Resistance: 0.5955, followed by 0.6000 and 0.6040.

Support: 0.5920, then 0.5880 and 0.5850.

Forecast: A sustained drop below 0.5920 could trigger a retest of 0.5880. Upside recovery remains limited unless risk sentiment improves.

Sentiment and Catalysts

Market Sentiment: Bearish tone dominates Kiwi sentiment; social platforms note growing speculation around RBNZ easing.

Catalysts: China economic data, New Zealand services PMI, and upcoming US macro releases.

USD/CNY Forecast

Current Price and Context

USD/CNY hovers around 7.1480 in offshore trade after the People’s Bank of China (PBOC) set the daily reference rate at 7.1461 — a stronger-than-expected fix versus the previous 7.1526. The move reflects ongoing official efforts to stabilize the yuan amid capital outflow risks and uneven economic momentum.

Key Drivers

Geopolitical Risks: Limited immediate impact; investors are focused on domestic Chinese fundamentals and capital flow controls.

US Economic Data: Strong USD performance continues to influence USD/CNY direction, despite PBOC’s managed fix.

FOMC Outcome: The Fed’s hawkish outlook underpins USD strength, challenging China’s efforts to cap yuan weakness.

Trade Policy: No new tariff headlines, but US-China trade sentiment remains fragile and sensitive to political developments.

Monetary Policy: PBOC’s steady LPR and tighter fix signal intent to curb depreciation, while US-China policy divergence sustains wide interest rate gaps.

Technical Outlook

Trend: Rangebound with upside bias, capped by PBOC fix levels.

Resistance: 7.1520, then 7.1600 and 7.1800.

Support: 7.1380, then 7.1285 and 7.1150.

Forecast: PBOC’s stronger fix may contain upside in the short term, but any resurgence in USD strength could push USD/CNY above 7.1520 again.

Sentiment and Catalysts

Market Sentiment: Mixed; traders are cautious about betting against PBOC, but offshore markets remain biased toward a weaker yuan.

Catalysts: US data surprises, China’s next LPR announcement, potential policy easing signals from Beijing.

Wrap-up

In summary, today’s session was marked by a decisive shift in sentiment against the Aussie as weak employment data heightened RBA rate cut bets. Japanese authorities voiced concerns over speculative FX movements, which added to the cautious tone in yen trading. Meanwhile, the euro and kiwi softened amid broader risk aversion and anticipation of upcoming economic data. The PBOC’s stronger yuan fixing signaled some intent to stabilize the currency, yet markets remained wary. As key data looms, traders remain alert to central bank cues and macroeconomic signals to guide the next move.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!