Crude Oil Slips as Supply Fears Ease | 16th July, 2025

Oil Retreats Below $66

On July 16, 2025, crude oil (WTI) drifts below the $66.00 mark as global supply concerns ease following a tempered stance from the White House regarding its 50-day deadline for Russia. The pullback comes after a period of elevated prices driven by geopolitical risk, but fading urgency is softening the outlook. Meanwhile, silver (XAG/USD) pushes toward $38.00, supported by safe-haven flows. NZD/USD trades higher above 0.5950 as sentiment improves in Asia-Pacific markets, with the PBOC maintaining currency stability at 7.1526. Investors are also focused on the UK’s CPI data and the upcoming US PPI report for further macro direction.

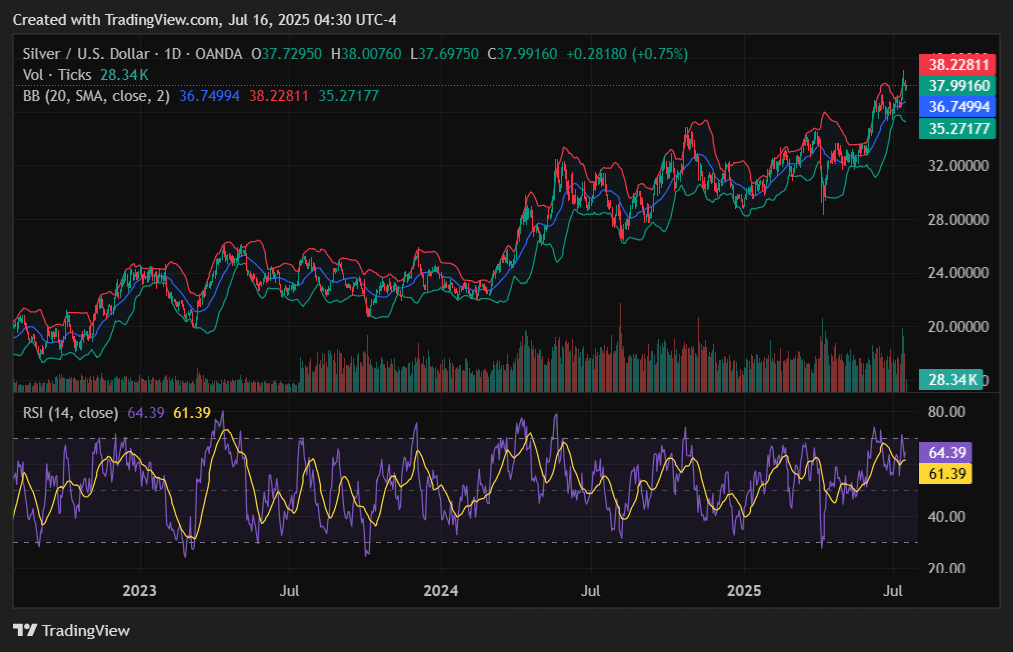

Silver Price Forecast (XAG/USD)

Current Price and Context

Silver (XAG/USD) is climbing toward $38.00, building on recent gains as global investors seek safe-haven assets amid ongoing geopolitical uncertainties and cautious sentiment ahead of key inflation data. The metal continues to benefit from macro instability, with the US Dollar showing mixed performance and real yields remaining subdued.

Key Drivers

Geopolitical Risks: Global tensions persist despite the easing of some immediate trade concerns. Safe-haven demand remains elevated, fueling silver’s rally.

US Economic Data: Market participants await the US Producer Price Index (PPI) report, which could influence real yield expectations and impact precious metals.

FOMC Outcome: Recent Fed minutes indicate cautious optimism but no rush to cut rates aggressively. Uncertainty keeps support intact for non-yielding assets like silver.

Trade Policy: Lingering uncertainty surrounding global tariffs and cross-border frictions keeps risk aversion elevated, indirectly boosting silver’s appeal.

Monetary Policy: While expectations for Fed rate cuts have moderated, dovish undertones continue to support metals amid inflation and policy uncertainty.

Technical Outlook

Trend: Bullish continuation; silver extends rebound from $36.00 breakout zone.

Resistance: $37.60, then $38.00 and $38.35.

Support: $37.00, followed by $36.50 and $36.00.

Forecast: Silver may test $38.00 in the near term if US inflation data comes in softer; downside risk limited above $36.50.

Sentiment and Catalysts

Market Sentiment: Bullish bias remains intact, driven by ongoing macro uncertainty and technical strength.

Catalysts: US PPI release, Fed commentary, global risk tone, and bond market movements.

Crude Oil Price Forecast (WTI/USD)

Current Price and Context

West Texas Intermediate (WTI) crude oil is trading below $66.00, retreating from recent highs as geopolitical supply risks begin to subside. Market reaction to Trump’s softened 50-day ultimatum to Russia has eased immediate fears of supply disruption, prompting traders to take profit after last week’s surge.

Key Drivers

Geopolitical Risks: The tone around Trump’s Russia deadline has moderated, reducing the likelihood of near-term supply shocks and calming oil markets.

US Economic Data: Attention shifts to US PPI data for signs of inflationary trends, which could influence energy demand expectations and interest rate outlooks.

FOMC Outcome: Fed’s cautious stance and delayed rate cuts could weigh on growth outlook, subtly dampening oil demand expectations.

Trade Policy: Uncertainty remains around broader trade tensions, particularly between the US and China, though direct oil trade implications are limited for now.

Monetary Policy: Stable Fed positioning and relatively strong USD have limited the upside for crude, especially as risk appetite fluctuates.

Technical Outlook

Trend: Short-term bearish; retreat from $67.30 confirms corrective pressure.

Resistance: $66.75, then $67.30 and $68.50.

Support: $65.00, then $64.20 and $63.00.

Forecast: WTI may range between $64.20–$66.75. A dovish inflation surprise or renewed geopolitical flare-up could spark another upside test.

Sentiment and Catalysts

Market Sentiment: Neutral to mildly bearish as supply worries ease and traders await further macro cues.

Catalysts: Trump’s future Russia stance, US inflation data (PPI), OPEC+ commentary, and weekly inventory reports.

NZD/USD Price Forecast

Current Price and Context

NZD/USD is trading above 0.5950, maintaining bullish traction as investors digest positive risk sentiment ahead of the US PPI release. The pair benefits from a softer USD and improved risk appetite, supported in part by China’s stable GDP performance and ongoing expectations for a patient Fed.

Key Drivers

Geopolitical Risks: Geopolitical risks remain in the background, but easing trade and supply fears support broader market stability.

US Economic Data: Investors are focused on the upcoming US Producer Price Index report, which could influence Fed rate expectations and USD performance.

FOMC Outcome:

The Fed remains cautious; the absence of hawkish surprises keeps pressure on the dollar and supports risk-linked currencies like the Kiwi.

Trade Policy: Global trade tensions are easing for now, aiding risk sentiment and demand for commodity-linked currencies such as NZD.

Monetary Policy: RBNZ’s firm stance combined with the Fed’s patience contributes to moderate upside pressure on NZD/USD.

Technical Outlook

Trend: Mild bullish recovery, with higher lows forming since 0.5900.

Resistance: 0.5975, then 0.6000 and 0.6030.

Support: 0.5925, then 0.5900 and 0.5860.

Forecast: NZD/USD could challenge 0.6000 if the US PPI print comes in soft. Downside risks limited above 0.5900.

Sentiment and Catalysts

Market Sentiment: Bullish tilt as risk sentiment improves and USD weakens modestly.

Catalysts: US PPI, Chinese trade balance follow-up, and Fed commentary.

USD/CNY Reference Rate Update

Current Price and Context

The People’s Bank of China (PBOC) set the USD/CNY reference rate at 7.1526 on July 16, 2025, slightly higher than the previous fix of 7.1498. The move signals the central bank’s cautious stance amid global uncertainty and domestic growth challenges, as Beijing maintains tight control over the yuan’s daily midpoint to stabilize trade competitiveness.

Key Drivers

Geopolitical Risks: Renewed global uncertainties, including energy supply and trade issues, keep the yuan in focus. However, tensions remain manageable for now.

US Economic Data: A stronger US dollar ahead of the PPI release places mild pressure on the yuan, though the PBOC fix aims to counter excess volatility.

FOMC Outcome:The Fed’s cautious tone provides room for emerging market currencies to stabilize. China’s central bank remains committed to stability rather than easing aggressively.

Trade Policy: With Trump’s latest tariff headlines on pause, China focuses more on economic data and currency stability.

Monetary Policy: The PBOC’s steady reference rate indicates a neutral monetary stance. No rate cuts signal confidence in current liquidity levels.

Technical Outlook

Trend: Slight upward bias in USD/CNY due to cautious yuan guidance.

Resistance: 7.1650, then 7.1800 and 7.2000.

Support: 7.1450, then 7.1300 and 7.1200.

Forecast: USD/CNY may hold within a narrow band (7.1450–7.1650) as the PBOC balances economic stability and trade competitiveness.

Sentiment and Catalysts

Market Sentiment: Neutral to cautious; investors interpret the PBOC fix as a steady hand amid inflation and trade questions.

Catalysts: Chinese retail sales and industrial output data, US PPI, Fed commentary, and potential global trade rhetoric.

Pound Steady Ahead of UK CPI

Current Price and Context

GBP/USD is holding firm around 1.2950, trading in a tight range as investors await the UK CPI release due mid-week. The British Pound remains supported by cautious optimism that inflation will remain above the BoE’s 2% target, delaying potential rate cuts. Risk appetite and USD softness also help stabilize the pair.

Key Drivers

Geopolitical Risks: Limited direct impact on GBP, though global energy prices and trade headlines may indirectly influence inflation expectations.

US Economic Data: Traders await the US PPI print, which may move the dollar and shift GBP/USD dynamics.

FOMC Outcome: A less aggressive Fed tone supports GBP/USD; no rate hike surprises bolster broader FX stability.

Trade Policy: No major UK-EU or UK-US trade headlines at the moment, allowing GBP to focus on domestic data.

Monetary Policy: Markets are watching if UK CPI supports or undermines the BoE’s cautious rate cut stance. Inflation above 2.0% could strengthen GBP short-term.

Technical Outlook

Trend: Neutral to mildly bullish consolidation.

Resistance: 1.2975, then 1.3000 and 1.3050.

Support: 1.2910, followed by 1.2860 and 1.2800.

Forecast: GBP/USD may trade between 1.2910–1.3000 until CPI release; a hotter-than-expected inflation print could lift the pair toward 1.3050.

Sentiment and Catalysts

Market Sentiment: Cautious optimism; GBP viewed as data-sensitive with limited downside unless CPI significantly disappoints.

Catalysts: UK CPI (YoY expected at 2.0%), US PPI, Fed commentary, and broader risk appetite.

Wrap-up

WTI’s decline signals a shift in energy market sentiment as traders weigh the real impact of political threats versus supply fundamentals. Silver’s rise and stable commodity-linked currencies reflect a cautiously optimistic tone. With inflation data due from both the US and UK, markets are likely to remain sensitive to macro headlines and central bank cues. The path ahead hinges on how policymakers respond to price pressures and geopolitical developments in the coming days.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!