Could EURGBP bulls keep the rebound alive?

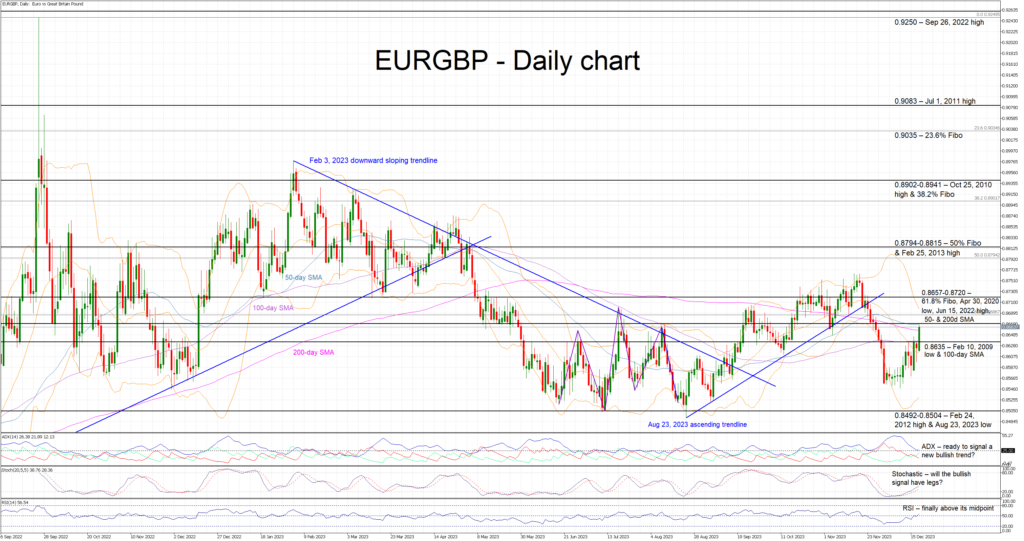

EURGBP is trading higher today after the downside surprise registered by the UK inflation report. The 0.8635 level was easily surpassed with the EURGBP bulls now preparing to test the resistance set by the 0.8657-0.8720 area. They are just halfway to recovering the losses incurred during the November 20-December 1 correction.

In the meantime, the momentum indicators appear supportive of the current upleg. The Average Directional Movement Index (ADX) remains a tad above its 25-threshold, confirming the increasing bullish pressure in the market. Similarly, the RSI has finally managed to return back above its 50-midpoint. More importantly, the stochastic oscillator is edging higher, above its oversold territory, and building a good gap from its moving average.

Should the bulls feel confident, they could first try to push EURGBP above the very busy 0.8657-0.8720 area. This is populated by the 61.8% Fibonacci retracement of the August 4, 2022 – September 26, 2022 uptrend, the June 15, 2022 high and the 50- and 200-day simple moving averages (SMAs). If successful in overcoming this key region, the bulls could have the chance to stage a move above the recent peak of 0.8765 and record a new 7-month high.

On the flip side, the bears appear determined to defend the busy 0.8657-0.8720 area and protect their recent hard-earned gains. They could then try to push EURGBP back below the 0.8635 level defined by the February 10, 2009 low and the 100-day SMA. Even lower, the path appears to be unhindered until the 0.8492-0.8504 area.

To sum up, with some support from the momentum indicators, EURGBP bulls are trying to keep the current upleg intact. However, their true drive could be tested at the busy 0.8657-0.8720 area.

.jpg)