Business activity in the UK is under pressure, as is the pound

Business activity in the UK is under pressure, as is the pound

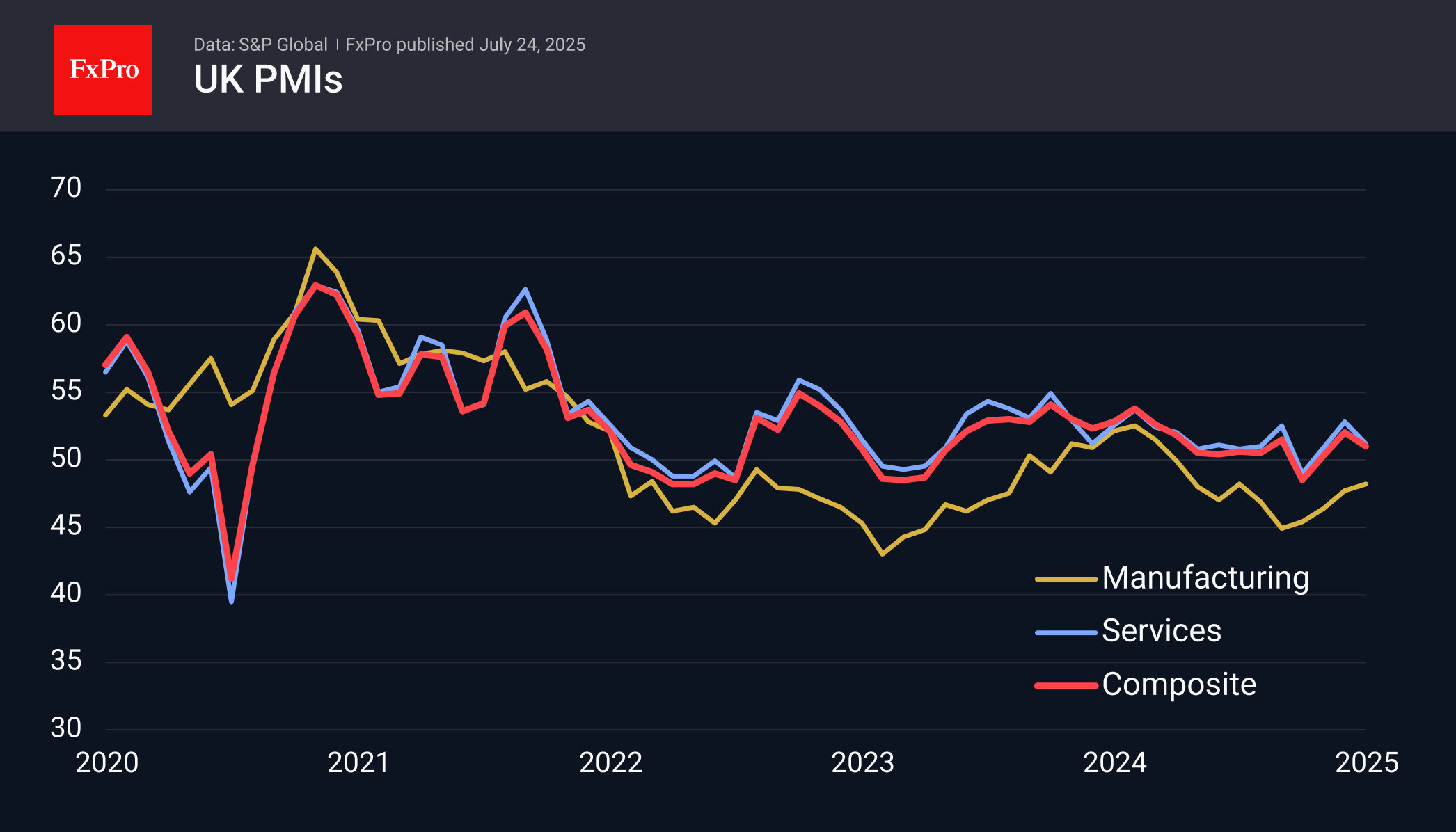

Preliminary estimates of PMI business activity indices showed a slowdown in the growth rate of the services sector, while manufacturing activity slowed slightly.

The manufacturing PMI for July, at 48.2, was better than the average forecast of 47.9 and the previous value of 47.7. However, the indicator has remained in decline (<50) for the last 10 months.

The services PMI fell to 51.2, showing a slowdown after June's reading of 52.8.

Another report, from the CBI, showed continued pessimism regarding industrial orders. The corresponding index stood at -30, remaining in contraction territory for the last three years.

All this indicates subdued economic activity in the UK. Although the Central Bank has been easing policy for a year now, this could potentially pave the way for further cuts in the key rate.

GBPUSD continued to decline against the background of this news, retesting the 50-day moving average. EURGBP has been trading near 0.8670, at the upper end of the range, since the end of 2023, and it looks like part of an upward drift within the 9-year range of 0.82-0.92.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)