ADP jobs report: broad-based and strong growth

ADP jobs report: broad-based and strong growth

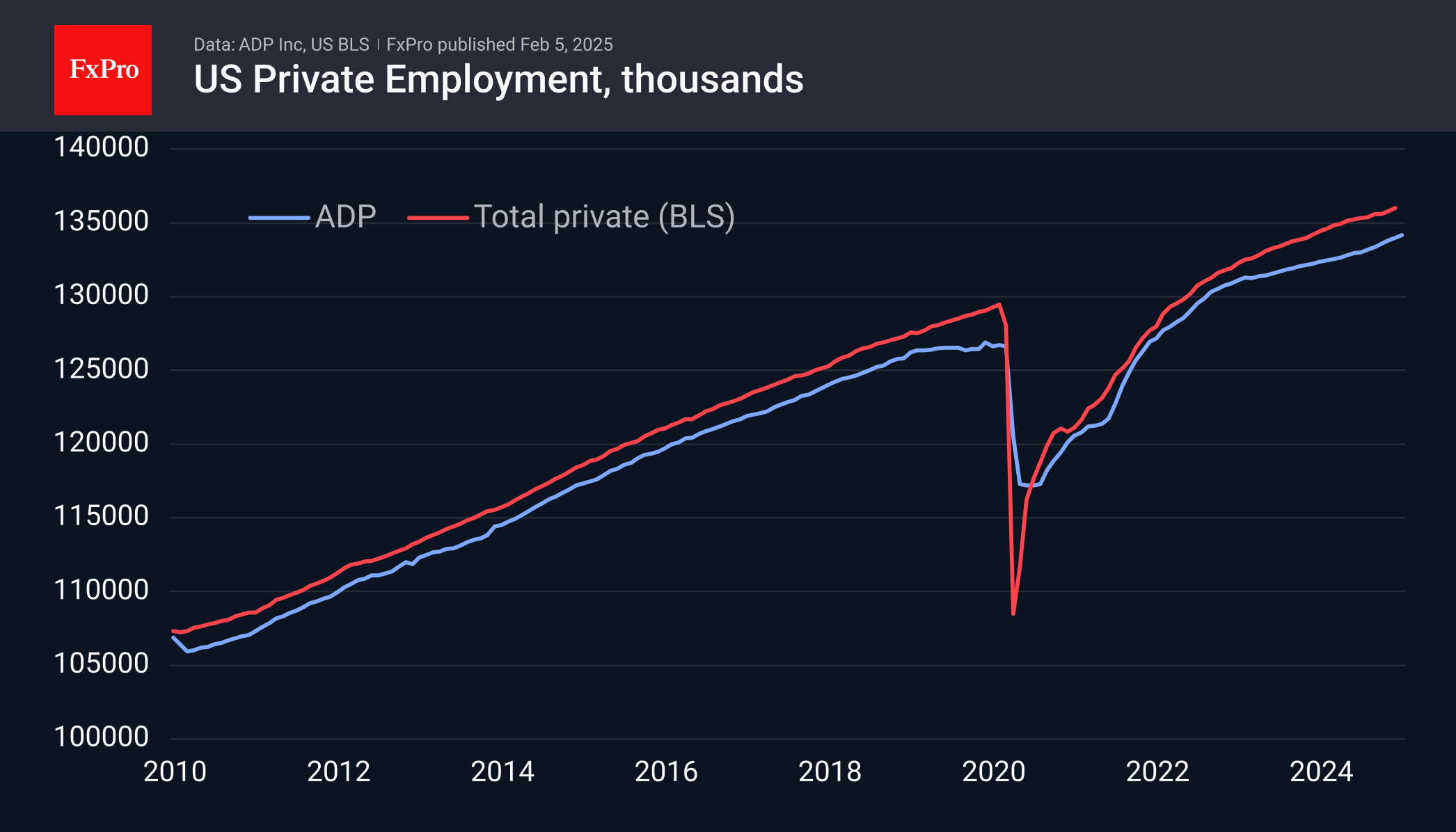

A new report from ADP suggests that the strong growth trend in the US labour market is continuing. According to the data released on Wednesday, the private sector added 183 thousand jobs. Last month's data was revised up by 54k to 176k. Job gains have accelerated since last August, roughly coinciding with the start of the Fed's rate-cutting cycle.

The breadth of growth was another encouraging economic signal, with firms of all sizes showing a net increase in employment. Among industries, manufacturing continued to suffer, shedding 13,000 jobs in January. Manufacturing has shed jobs in 21 of the past 24 months.

Despite the manufacturing sector, the economy as a whole is showing resilience, reducing the urgency for further rate cuts. The strong ADP data increases the odds that Friday's NFP data will easily beat the consensus expectation of 154k growth in total employment.

In theory, this strengthens the dollar and risks triggering a decline in equities on speculation that the Fed will tighten monetary policy in the coming months. In practice, however, financial markets are currently preoccupied with trade tariffs and corporate reports.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)