Bitcoin confidently updates highs

Bitcoin confidently updates highs

Market Picture

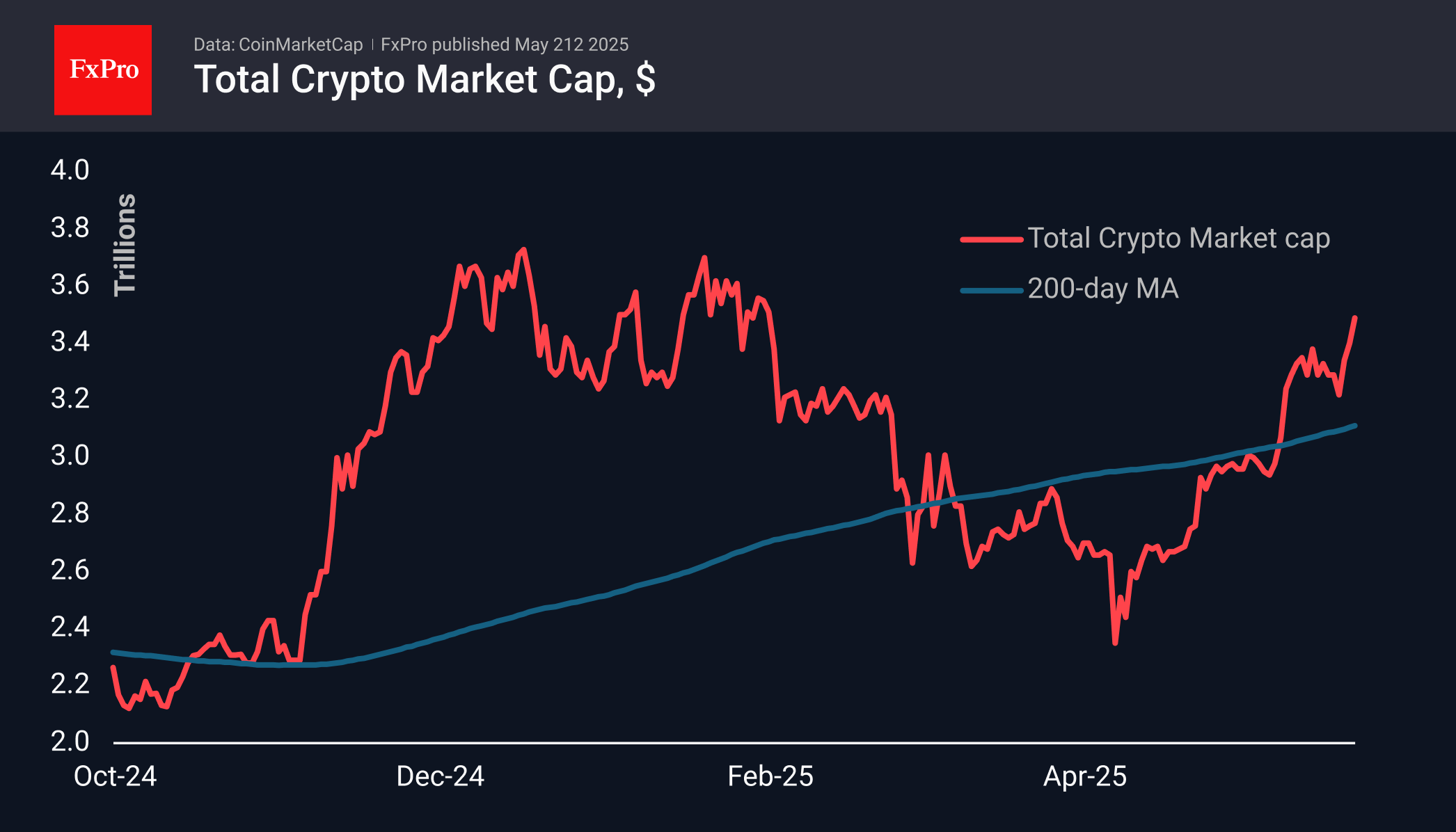

Market capitalisation topped $3.5 trillion on Thursday morning, later retreating slightly below that round level. Interestingly, Bitcoin's all-time highs have yet to spark FOMO. The historical highs of the first cryptocurrency keep the market positive, but the growth rate of altcoins is still commensurate with the dynamics of BTC.

The sentiment index at 72 remains on the cusp of entering the area of extreme greed, which often corresponds to periods of robust market growth when FOMO has yet to turn on, making growth vulnerable to corrective pullbacks.

Bitcoin was climbing to $111.8K on Thursday morning, recording a new all-time high, before slipping back somewhat, as early buyers began cautiously locking in profits. Working against Bitcoin right now is the exit from risk assets in financial markets due to the sell-off in US government bonds. In such an environment, institutional clients could be net sellers, although at first glance, cryptocurrencies may appear to be a safe haven.

News Background

Bitcoin's $3 billion rise in realised bitcoin capitalisation overnight to new records reflects the continuation of the accumulation phase ahead of another momentum over the coming week, CryptoQuant noted.

States are investing in the first cryptocurrency through shares of Strategy, the largest public holder of BTC, according to Standard Chartered. Government entities increased their investment in Strategy stock in the first quarter.

The Texas House of Representatives approved a bill to create a strategic bitcoin reserve. The document has been sent to the governor for his signature. Texas is likely to become the third US state after New Hampshire and Arizona with such an initiative.

Strive Asset Management, a company linked to Vivek Ramaswamy, intends to acquire 75,000 BTC at a discount from the bankrupt Mt. Gox exchange to create a bitcoin reserve.

River said the US could be a major beneficiary of bitcoin's growth due to its regulatory advantages, advanced mining infrastructure, and state-level support. The country already controls 79.2% of global assets in spot bitcoin ETFs and more than 38% of the BTC network hash rate. Nearly 50 million Americans own bitcoins.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)