EBC Markets Briefing | Oil up as Ukraine ramps up attacks

Oil prices edged higher on Thursday due to supply concerns after Ukraine fired a volley of British Storm Shadow cruise missiles into Russia. Moscow’s threat to use nuclear power was shrugged off.

Kyiv says it needs the capability to defend itself by hitting Russian rear bases. Secret documents revealed that Berlin has begun making plans for how it could help deploy as many as 800,000 NATO troops into Ukraine.

US crude stocks rose by 545,000 barrels last week, the EIA said, compared with analysts' expectations for a rise of 138,000 barrels. Gasoline inventories also rose more than forecast.

Trump made it clear that they intend to return to his hardline policy of enforcing sanctions against Iran because of Tehran's nuclear programme and its support of militants groups fighting Israel.

China's crude imports are on track to rebound in November to the highest in three months, but the increasing appetite of the world's largest oil importer is more about price than rising demand.

Arrivals declined by 420,000 bpd in the first 10 months of the year, with much of the weakness coming after crude prices rallied strongly in Q2, as local refinery throughput remains weak.

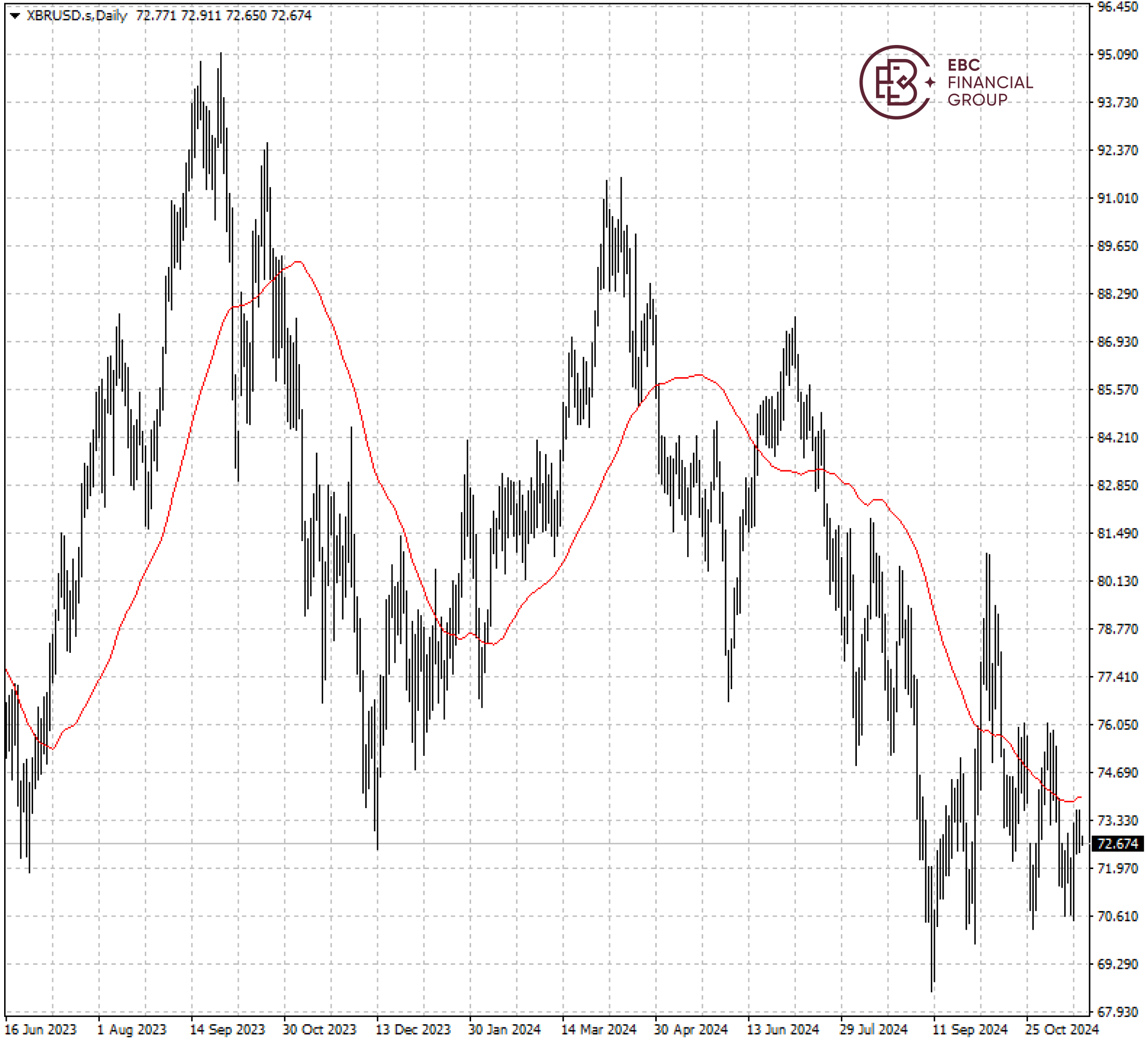

Brent crude fluctuated around $73 with 50 SMA capping its rally. If the resistance holds, the price will likely return to $70.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.