EBC Markets Briefing | Yen frets over latest opinion poll

The yen fell Thursday though Trump seems posed to sack Fed Chair Powell. Opinion surveys suggest PM Shigeru Ishiba's coalition may lose its majority in the upper house of parliament.

The Liberal Democratic Party is already a minority in the more powerful lower house, so a stalemate in both chambers could give opposition parties outsized influence in policy decisions.

They want the BOJ to avoid rate hikes and the government to cut the sales tax amid slowing growth, that could boost bond yields and complicate the efforts to normalise monetary policy.

The central bank will consider revising up this month its inflation forecast for the current fiscal year, reflecting persistent rises in rice and broader food costs, said three sources familiar with its thinking.

Data released since then has shown stubbornly high food inflation, as companies continued to pass on rising raw material costs. But trade talk, which has stalled, is regarded as more critical now.

Japan's exports in June contracted 0.5% year over year as deliveries continued to decline for the second straight month. Carmakers are doubling down on price cuts to retain market share.

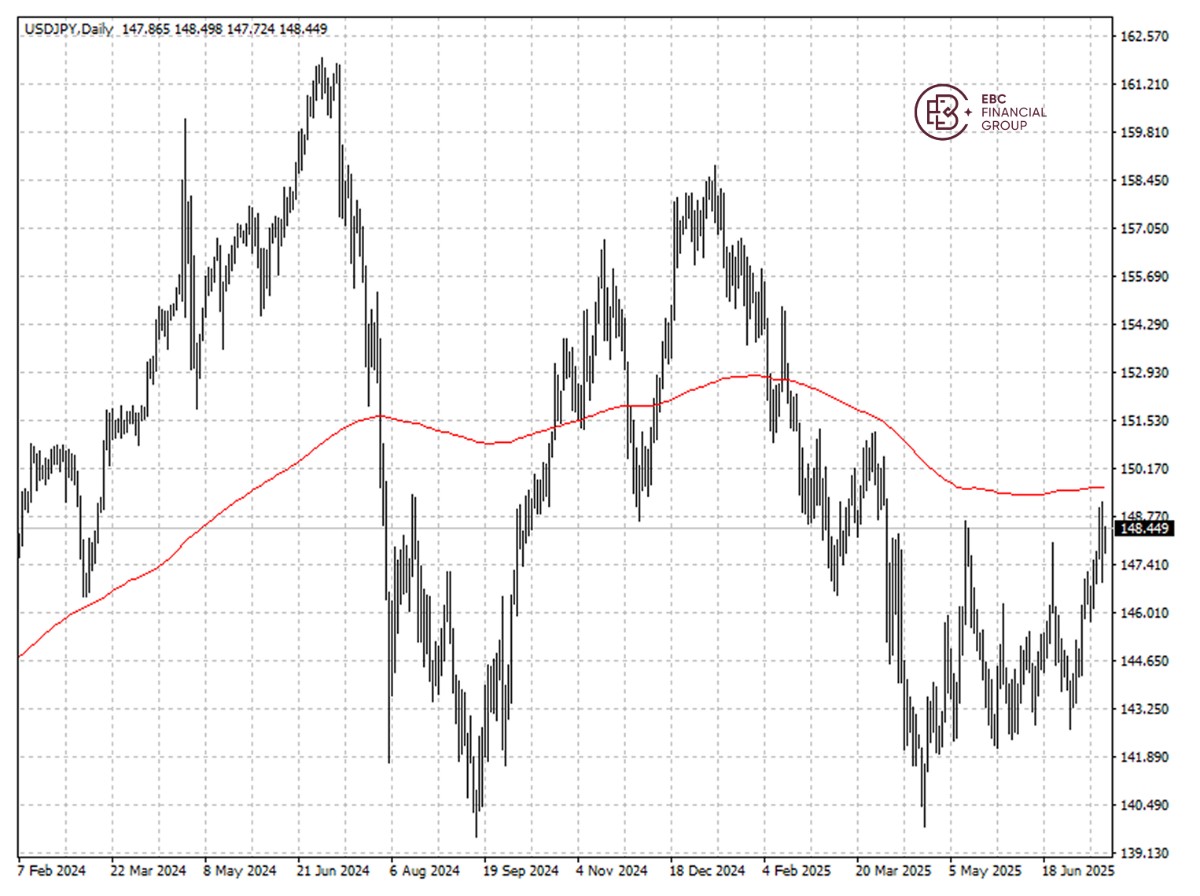

The yen still looks weak, weighed down by heightened political and economic uncertainties. We see it keep falling to the 200 SMA at least.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.