EURUSD targets 1.11; 1.12 won't be easy to overcome

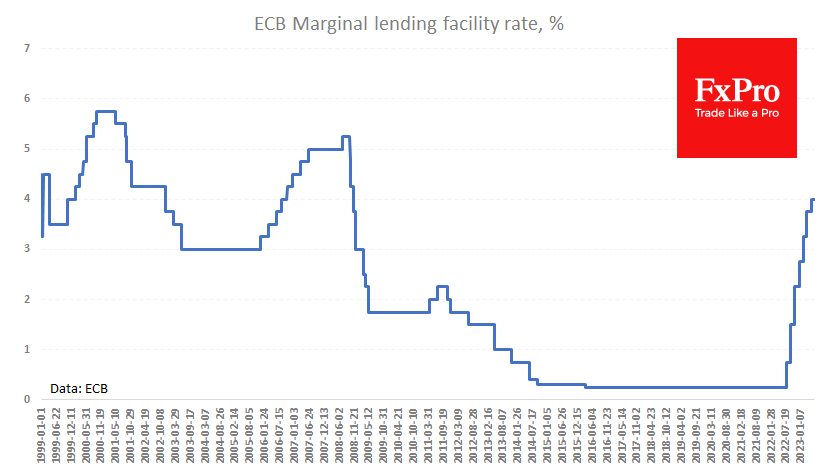

On Thursday, the ECB raised three key interest rates by 25 basis points, taking the benchmark lending rate to 4%, the highest since 2008. It also confirmed its intention to refuse to refinance coupons and maturing bonds, accelerating quantitative easing - another parameter of policy tightening.

Markets had anticipated this move, so the attention of traders and journalists was, as usual, focused on the comments that would determine the trajectory of future actions.

In contrast to Fed Chairman Powell, ECB President Lagarde was much more reassuring about future moves. She confidently stated that a few more hikes would be needed, leaving little doubt about a hike at the next meeting. This sharply contrasted with Powell, who highlighted a July hike as the more likely scenario but did not rule out the possibility of no hike.

Lagarde pointed to the strength of the labour market and rising core inflation as factors in domestic price pressures. Despite the reversal to a lower inflation trend, she maintained that the ECB still has ground to cover to contain inflation.

It took some time for the markets to appreciate the seriousness of the ECB's stance. An initial 0.5% rise in EURUSD on the release of the commentary, which did not soften the tone significantly from May, picked up after the press conference and continued for the rest of the day, giving EURUSD a 1.1% gain, with the pair stabilising around 1.0950.

The pair's technical disposition should also be considered, as it adds to the amplitude. After rising above 1.0880, the EURUSD crossed the 50-day moving average, and a decisive take of this level further supports the buyers' resolve.

The EURUSD has been trading in a broad bullish corridor since the beginning of the year after bouncing off its lower boundary earlier this month and confirming the seriousness of the short-term uptrend with yesterday's strong move. The bulls are now focusing on the 1.1050 area, the April high.

However, given the upward bias of the move, the pair could be as high as 1.1100 by the end of the month. The 1.1200 area will be the next major milestone, through which the ultra-long 200-week moving average trend passes, and many pivot points are concentrated. The dollar will struggle there.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)