Fed minutes may provide clues on US rate outlook

OVERNIGHT

Asia-Pacific stock markets are lower this morning with the biggest falls being seen in Chinese indices. In the latest indication that the post-restriction rebound in China’s economy is fading, the Caixin services PMI fell by more than expected in June as it slipped to a five-month low. Ahead of US Treasury Secretary Yellen’s visit, China President Xi called for a halt in the trend toward economic decoupling and the cutting of supply chains.

THE DAY AHEAD

With US markets now back from holiday, attention will be on whether the Federal Reserve is likely to hike interest rates at its next monetary policy update. Some clues on this may be provided by the minutes of the Fed’s June meeting when it decided to leave interest rates unchanged. Fed Chair Powell has said that this should be seen as a ‘pause’ rather than an end to the current rate hiking cycle and that a majority of Fed policymakers think that two more rate hikes may be needed this year. In the light of those comments markets are now attaching an 85% probability on another rate hike on the 26th of July but they are more sceptical about whether the Fed will hike again after that.

Given the comments from Powell and other Fed policymakers since the June rate pause was announced, it seems unlikely that much new will be learned from the minutes. However, it remains unclear why the Fed did pause and so the detail of the discussion may be informative on this. Markets will also be watching for any indication of what precisely policymakers will be looking for when deciding on whether a July rate hike is indeed necessary.

The data calendar includes June PMI services outturns for the UK and the Eurozone. Aside from new detail for some of the individual Eurozone economies these are second readings that are not expected to be revised from the original estimates. Those showed services activity in both economies losing some momentum although it was still seen as solid. Evidence on inflationary pressures was mixed but most notably in the UK, labour market pressures were still intense.

In the US, May factory orders data will provide insights into trends in manufacturing. Orders have been trending down over the last twelve months, suggesting that the sector is under similar pressure in the US as it is elsewhere. More positively, already published durable goods orders point to a bounce in May. Much of that seems due to the volatile transport sector but there are also tentative signs in capital goods orders that President Biden’s ‘green’ incentives are having an impact.

MARKETS

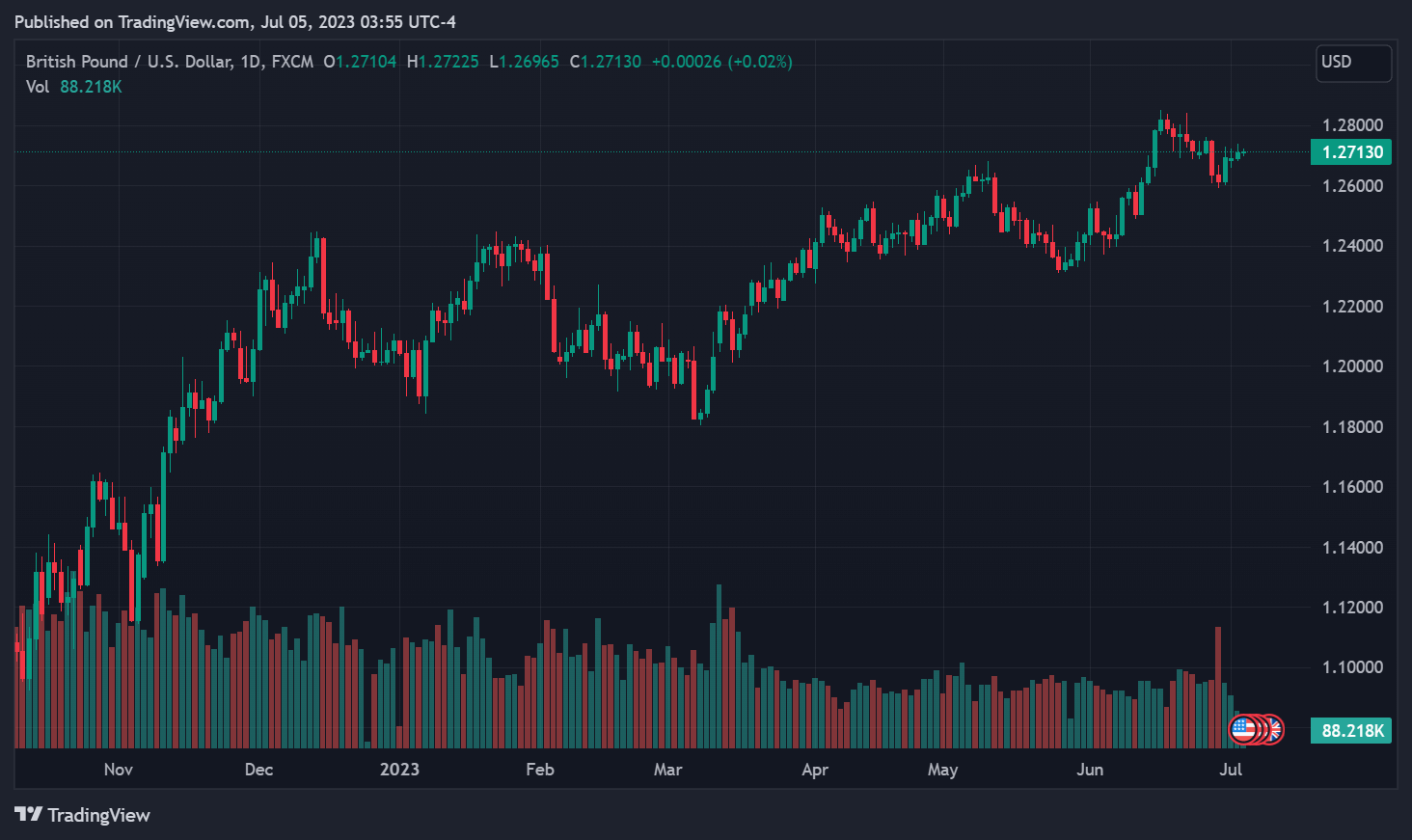

The US Treasury market was closed yesterday but yields have risen overnight in Asian trading reflecting the uncertain interest rate outlook. Meanwhile, German bond yields rose yesterday but UK gilt yields declined modestly. In currency markets sterling is a touch lower overnight both against the euro and a generally stronger US dollar.