Fed’s hawkish tone risks sinking S&P500 to 4700

Bears showed strength ahead of the FOMC decision.

U.S. indices sagged on Tuesday as investors opted to risk off. They are awaiting a tighter Fed tone following Wednesday’s meeting.

The S&P500 suffered a sell-off as it attempted to climb above its 50-day moving average. It was a real show of strength, with the index falling more than 1.7% for the day - its biggest one-day drop since August 2023.

In mid-April, the S&P500 fell below its 50-day moving average, which acts as an informal indicator of the medium-term trend, and a stepped-up sell-off followed. On Tuesday, that curve worked out as resistance, a new sign of a reversal to a correction or bear market.

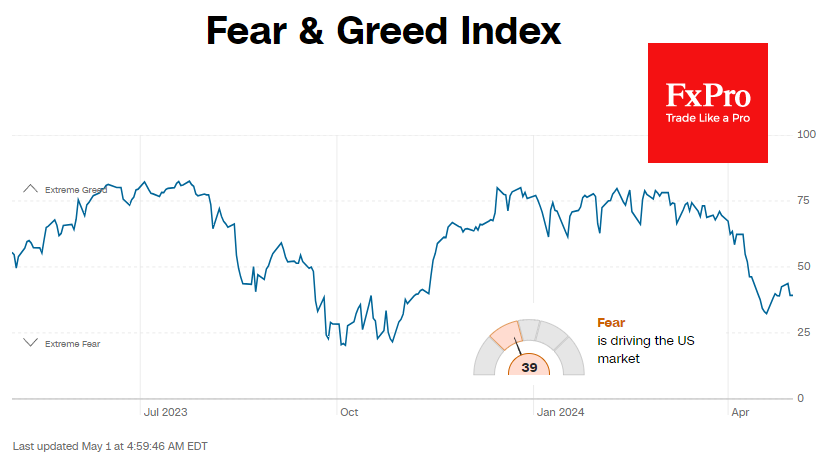

The Fear and Greed Index pulled back to the 39 (fear) level, not far from the low of 32 set on 19 April. The sentiment index showed very similar dynamics in the middle of last year when the correction took more than three months. Then, buyers actively returned only after a 10% correction from the peak.

Now, a similar pullback will send the S&P500 to the 4750 area, which is the middle of the December-January consolidation area. The 4700-4800 area is now also centred around the 161.8% target of the April decline amplitude and the 200-day moving average. This combination of important levels clearly whets the bears’ appetite.

The fundamental driver of the decline in risk appetite is the change in expectations for the Fed’s key rate. Since the beginning of the year, it has become routine to push back the rate cut forecast and reduce the number of rate cuts from three to 1-2. At Wednesday’s meeting, market watchers expect Powell to formally confirm this shift from the FOMC, which had previously forecast three rate cuts this year.

And that’s where the real intrigue kicks in. In his comments, Powell may recognise the need to keep rates higher for longer but reiterate his intentions to cut them soon. This could be a moment of profit-taking for the bears and a resumption of the upward trend, at least in the coming days.

The opposite and slightly more likely scenario suggests a reaction mirroring that of exactly six months earlier. Now, formalising the sell-off in equities may be the recognition that inflation is on a higher trajectory, and it may take more time to curb it and possibly a new key rate hike.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)