Gold flips backwards but still shines above 2,000

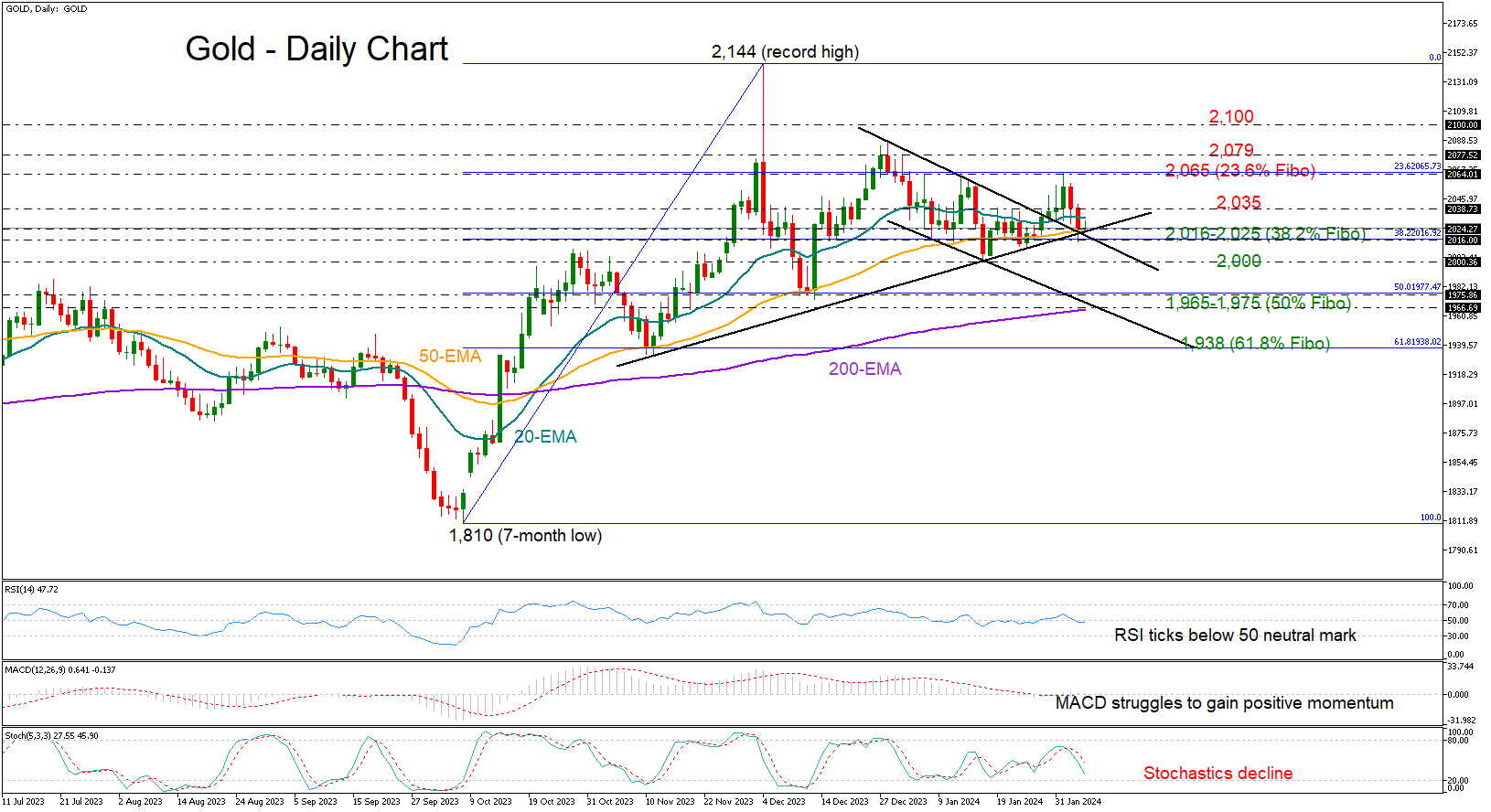

Gold could not mark a new higher high above January’s tough resistance of 2,065, correcting lower to close around its 50-day exponential moving average (EMA) and the support trendline from November at 2,025.

The latest downturn in the technical indicators has increased downside risks, but the series of higher lows that started in October keeps feeding hopes for a bullish continuation as long as the price holds above the 2,000 round level.

Should the bears breach the 2,000 floor, the price could dive into the 1,965-1,975 zone formed by the 50% Fibonacci retracement of the previous upleg and the 200-day EMA. The lower boundary of the bearish channel is also in the neighborhood. Therefore, a step lower could raise fresh selling interest, pressing the price towards the 61.8% Fibonacci of 1,938.

If the bullish scenario unfolds, with the precious metal bouncing back above the 2,035 constraining zone, traders will look for an extension above the critical 2,065-2,079 resistance territory before they target the 2,100 psychological number. Beyond the latter, the recovery could stretch towards the record high of 2,144.

All in all, gold is maintaining a neutral profile in the short-term picture. A decisive rally above 2,065-2,079 or a plunge below 1,965-1,975 would change the outlook accordingly.

.jpg)