Markets initially ignored the acceleration of the US Core CPI

Markets initially ignored the acceleration of the US Core CPI

The US consumer inflation report raised market confidence in a September Fed rate cut to 90%, boosting demand for equities and moderately weakening the dollar.

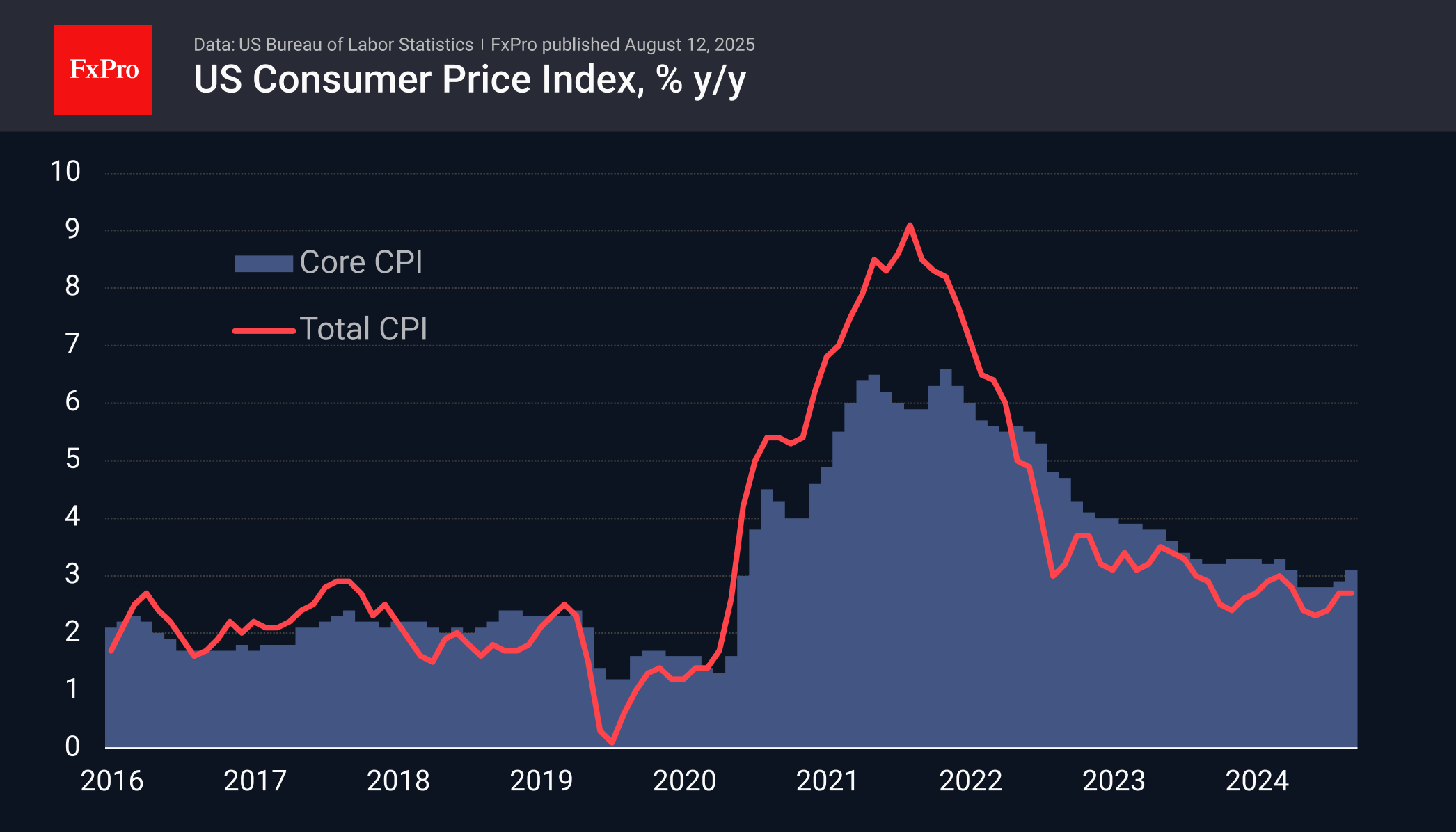

The overall consumer price index remained at 2.7% y/y in July, while an acceleration to 2.8% was expected, once again falling short of average forecasts. Market analysts have been systematically overestimating inflation since February, expecting a greater price response from the president's tariff policy.

It seems the market found what it was looking for in this data, strengthening expectations of a key rate cut in September to 90% from 86% a day earlier and 57% a month ago. However, it is still wise to be cautious with an unambiguous interpretation of the released figures.

The core price index, excluding food and energy, accelerated to 3.1% — the highest since February — and above the expected 3.0%. This is an important sign of increasing inflationary pressure, hidden in the overall indicator by the decline in oil prices.

The Fed targets core inflation, so the current report is unlikely to cause the central bank to change its cautious tone regarding the inflation outlook due to the impact of tariffs. It does not seem wise to lower rates on the confirmation of accelerating price growth and mounting pro-inflationary risks from tariffs.

The markets have also noted the impact of core inflation, as the initial 0.5% surge in EURUSD was down to less than 0.2% an hour later. The pair remains tied to the medium-term trend, touching its 50-day moving average daily since the beginning of August. From February to July, it acted as support, but now it seems ready to reclassify as resistance, not letting the pair's rate go.

Confirmation of the dollar's bullish reversal can be seen in the EURUSD's failure to break below the area of recent lows near 1.1400 against the current 1.1620. However, the dollar is only gathering strength for such a breakout, as there are no important fundamental factors for such a move.

An alternative scenario is for the pair to continue growing and break through the area of recent highs at 1.1800, formed last month.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)