The dollar gains from its peers’ problems

The dollar is gaining, rebounding from its low point set at the last Fed meeting on 17 September. It is quite common for the dollar to rise, being the lesser evil for investors, rather than due to its own strength.

The DXY gained 3% to 98.55 from its low of 95.83, set moments after the Fed cut rates and signalled further policy easing. The bearish event itself was a turning point, as we saw a whole series of factors undermining the value of other currencies to a greater extent.

The latest news was a rather unexpected quarter-point cut in the RBNZ's key rate, which took about 1% off the NZDUSD immediately after the decision was announced. Although the pair has now recovered about half of its initial losses, it has reached its six-month low, falling to 0.5730. A ‘death cross’ is forming in the pair, a bearish technical analysis signal, when the 50-day moving average falls below the 200-day moving average. This signal is reinforced by the fact that both curves are above the price. Such a signal is often followed by more intense selling. However, even without such a signal, the pair has been moving in a downward channel since the beginning of July, touching its lower boundary two weeks ago and today.

The change of leader of Japan's largest party triggered a sell-off of the yen. The USDJPY has already added 4.5% to its lows at the end of last week, reaching 152.8, its highest level since February. Sanae Takaichi promises to stimulate the economy through government spending and soft monetary policy. As a result, long-term government bond yields are hitting historic highs, as investors anticipate an increase in placements and fear problems with servicing the national debt. The currency, as a natural stabiliser of such imbalances, tends to decline. We saw a similar impulse in 2022, which caused the USDJPY to rise by about a third in seven months. While we do not expect such a surge this time, we still anticipate growth up to the area of recent highs at 159-162, and the continuation of a similar policy in the long term could take the pair to 200.

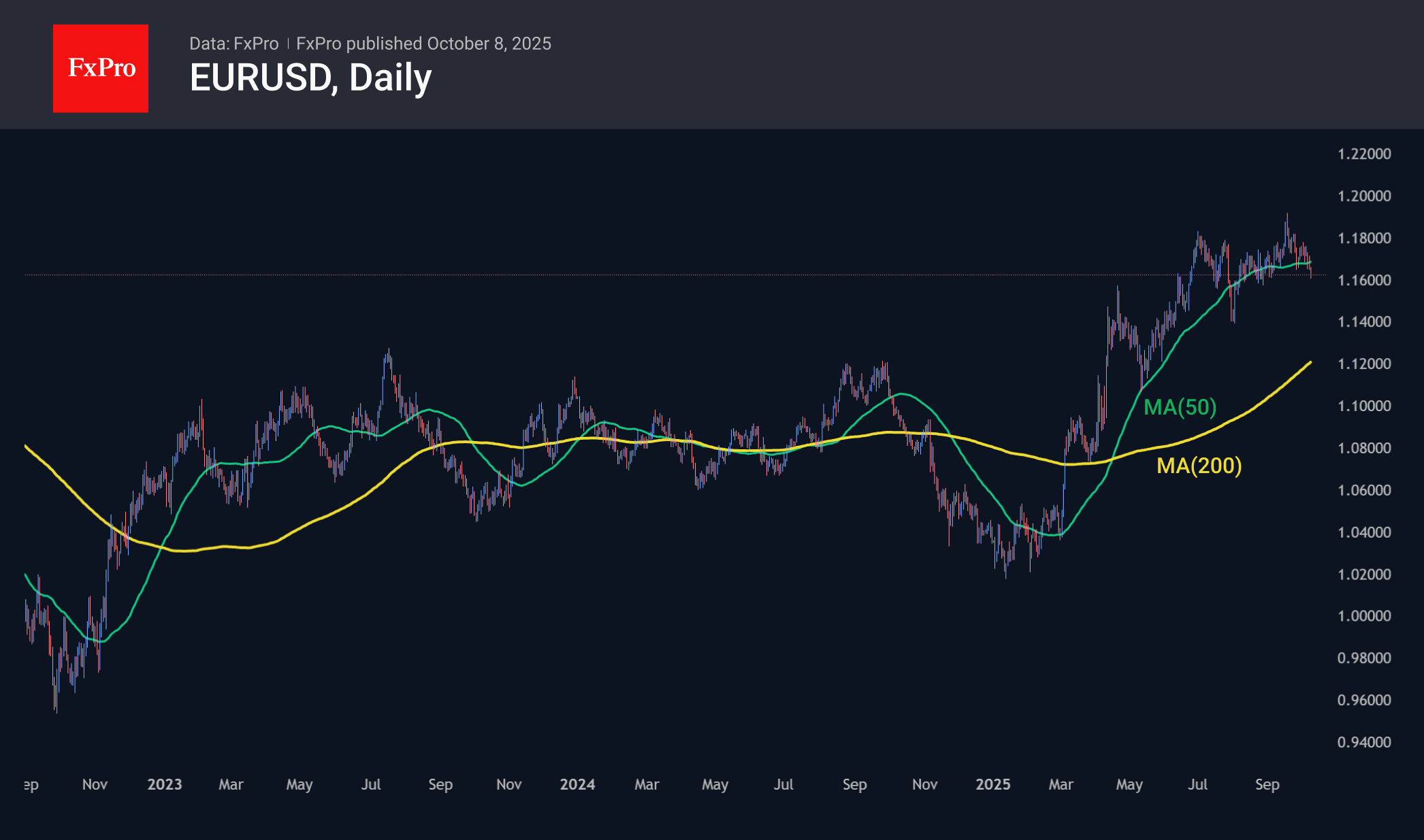

EURUSD has fallen 2.5% from its peak of 1.1919, testing support at 1.1600 in the middle of the week. The pair managed to do so in August, but the political crisis in France and growing difficulties in German industry are now working in favour of the bears. Although the ECB says it has ended its policy easing, the euro has a strong direct correlation with economic growth, forcing EURUSD to seek equilibrium at a lower level, possibly around 1.1000.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)