The dollar index clings to the uptrend

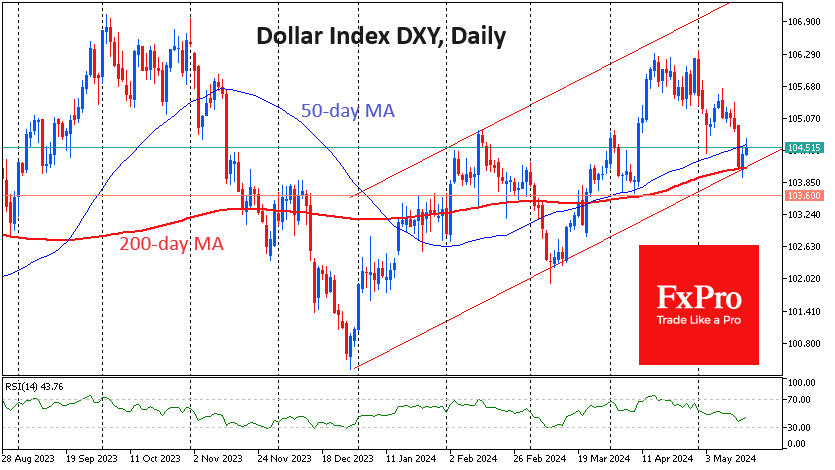

The US dollar is not giving up without a fight, gaining for the second day in a row against a basket of major currencies. Buyers seized the initiative after the Dollar touched the lower bound of its uptrend, which coincided with the 200-day moving average.

From the current level of 104.6, the DXY needs to consolidate below 103.6 to confirm the fall down from its uptrend. At that level, the dollar will drop below the previous local bottom and consolidate below the 200-day moving average.

Earlier in the week, the American currency's sharp decline followed weak CPI, causing markets to return to pricing 100% probability of two rate cuts for this year. However, the dollar has already been adding to its gains on Thursday and since the start of the day on Friday. Traders are probably taking note that leading indicators of inflation exceeded expectations.

The producer price index increased 0.5% in April—impressively higher than the expected 0.3%. The annual rate of increase was 2.2%, the highest in 12 months, reversing a rise since last November.

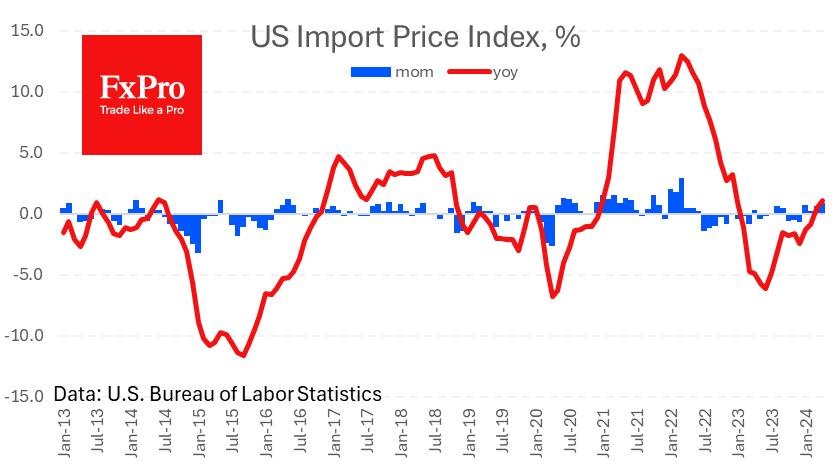

The import price index, released on Thursday, is also not expected to ease inflationary pressures. It added 0.9% last month and 2.8% for the 4-month cumulative, although the annual inflation rate is still not frightening at 1.1%.

Both figures are shaping upward inflation risks for the coming months as sellers pass on increased production and import costs to consumers. The latest round of tariff hikes on several imported goods from China also raises inflation risks.

On balance, the dollar has not gone into a tailspin but got its buy-the-dip pattern on pro-inflation risks, which prevent markets from reverting to expectations of aggressive rate cuts.

On the other hand, the dollar's position looks more vulnerable against the euro and the pound. EURUSD and GBPUSD have already broken above their 50- and 200-day moving averages and briefly exceeded previous highs, breaking the downward trend. This comparative divergence in dynamics between the DXY and the dollar's relationship to the euro and pound makes it worth watching developments with interest.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)