USDJPY holds above 150 but with caution

USDJPY escaped the FX intervention risk on Thursday despite closing marginally above the 150 round level for the second consecutive day and charting a new one-year high of 150.76.

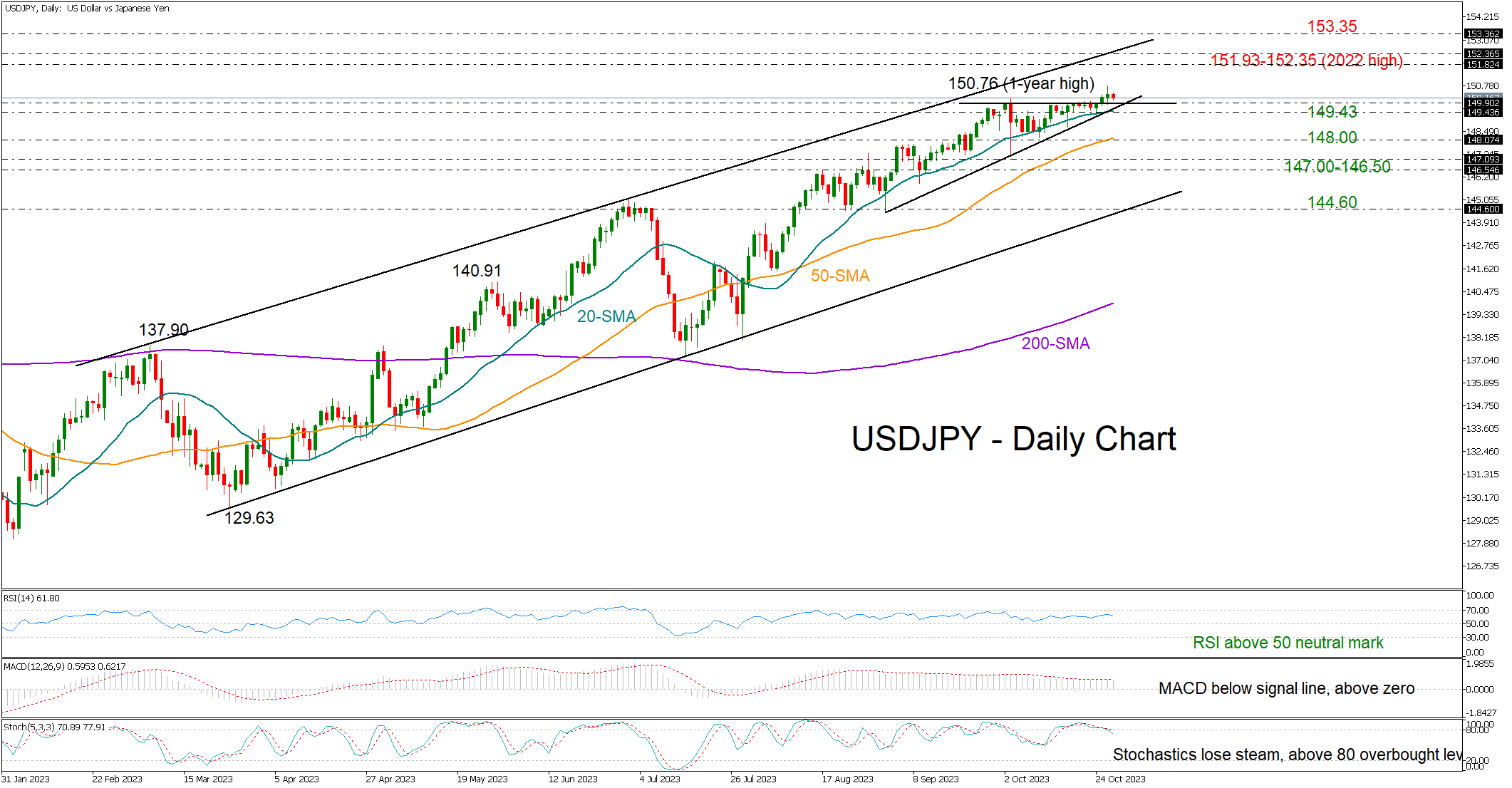

The pair seems to have pierced an ascending triangle on the upside, increasing optimism for a bullish continuation ahead of the US core PCE inflation release. Yet, Thursday’s tiny candlestick at the top of the uptrend and the mixed technical signals are currently reflecting some skepticism in the market.

Should the bulls resume their positive momentum, they may immediately hit the 151.93-152.35 area formed by the 2022 top and the upper band of the broad bullish channel. Beyond that, the 153.35 area had been somewhat restrictive during 1990, while the 155.35-156.60 had been another key obstacle in the same year and therefore could be the next target.

In the event the price tumbles below the triangle and the 20-day simple moving average (SMA) at 149.43, the 50-day SMA could come first to the rescue at 148.00. A break below the latter could take a breather within the 146.50-147.00 territory. If not, the sell-off could intensify towards the channel’s lower band at 144.60.

Summing up, USDJPY has stretched its 2023 uptrend to new highs this week, but with a lack of strong momentum, there are concerns that buying appetite is fading. Still, the focus is expected to remain on the upside unless the price slides below 149.43.