- Главная

- Сообщество

- Торговые системы

- Shmendridge-C7 plus 2222Scalpers (6xRisk)

Advertisement

Shmendridge-C7 plus 2222Scalpers (6xRisk)

Пользователь удалил эту систему.

Edit Your Comment

Shmendridge-C7 plus 2222Scalpers (6xRisk) Обсуждение

Участник с Apr 05, 2014

33 комментариев

Feb 07, 2015 at 10:14

Участник с Apr 05, 2014

33 комментариев

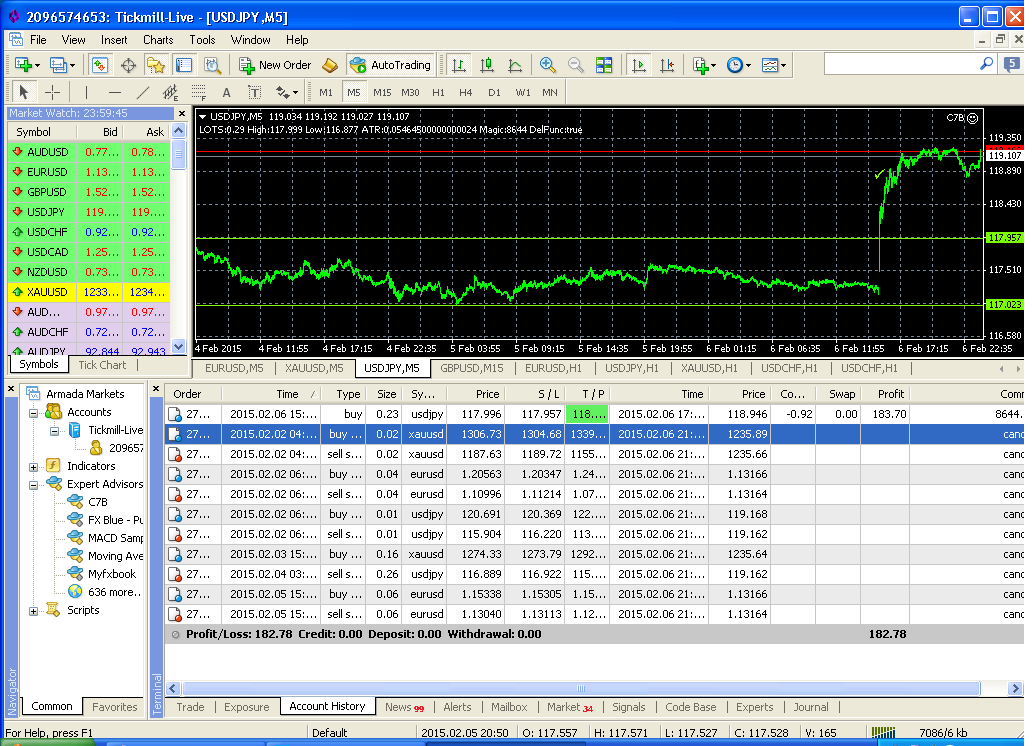

This bot uses advanced channel detection capabilities to determine and adapt. It will determine the probability and extent of the breakout and will adapt to it. This bot operates on only stop order entries and is not a scalper so delays won't matter at all. This bot can use strategically trailed stop-losses as many successful traders do. This bot is currently set to trade risking up to about 6% of equity on each position and up to 4 positions on a single pair (quite rare and with diversified stops and tp)

C7 bot is available in the market:

https://www.mql5.com/en/market/product/2733 -mt5

https://www.mql5.com/en/market/product/2753 -mt4

C7 bot is available in the market:

https://www.mql5.com/en/market/product/2733 -mt5

https://www.mql5.com/en/market/product/2753 -mt4

Участник с Apr 05, 2014

33 комментариев

Feb 07, 2015 at 10:25

Участник с Apr 05, 2014

33 комментариев

Участник с Apr 05, 2014

33 комментариев

Feb 07, 2015 at 10:25

Участник с Apr 05, 2014

33 комментариев

Oops of course I meant to say bringing the total gain of the account to 100%. The gain from the single trade was 20% Obv.

Участник с Feb 06, 2015

2 комментариев

Feb 07, 2015 at 10:26

Участник с Feb 06, 2015

2 комментариев

N1, I caught todays USDJPY winner on my broker too.

Участник с Oct 16, 2014

119 комментариев

Feb 07, 2015 at 12:13

Участник с Oct 16, 2014

119 комментариев

Hey, I have just bought your EA on MQL5.

I don't understand why I am able optimize it, but backtest are always loosers?

What I am doing wrong?

I don't understand why I am able optimize it, but backtest are always loosers?

What I am doing wrong?

Участник с Apr 05, 2014

33 комментариев

Feb 08, 2015 at 07:41

Участник с Apr 05, 2014

33 комментариев

The .set files should start you in the right direction, I'm sending them now.

Участник с Apr 05, 2014

33 комментариев

Mar 25, 2015 at 00:01

Участник с Apr 05, 2014

33 комментариев

So, this week my VPS froze up and left the orders unmanaged and escentialy we took some random trades this week hurray! I have a ticket open with support, in the meantime I have moved my ea back to my local computer.

Участник с Apr 05, 2014

33 комментариев

Apr 04, 2015 at 19:40

Участник с Apr 05, 2014

33 комментариев

29298735 - Massive Slippage during low liquidity period. The spread widened to 9 pips, but not quite enough to trigger the low liquidity safety off (10 pips). The setting of this safety measure has been adjusted to 5 pips as well as a secondary measure coded in to the C7 engine which will react swiftly against any spread volatility regardless of whether its a new bar or not. Most C7 owners did not get hit by this trade as the spread of other brokers widened more which triggered their safety.

I will not open a new account for the C7 system as I feel that would be dishonest.

I will not open a new account for the C7 system as I feel that would be dishonest.

Участник с Apr 05, 2014

33 комментариев

Apr 06, 2015 at 18:57

Участник с Apr 05, 2014

33 комментариев

Well, some of the slippage was refunded by Tickmill. Too bad the correction must appear as a deposit in to the account instead of correcting the equity gains/losses of the account.

"We totally understand your concern regarding USD/JPY slippage. Being an STP broker we just clear our client's trades and re-translate quotes we get from Citi and other liquidity providers. Orders on the real market are always executed by current market prices, that's why slippage may occur during sharp movements.

Friday 03.04.15 was a holiday, the liquidity on that day was on the extremely low level and due to that fact the spreads were extremely wide as same as the volatility. The widest spreads were right before and some time after the news release.

We have investigated your order 29298735, due to the high volatility it was closed with negative slippage at 119,759 at actual market price.

We also have investigated your second order 29427758, it was opened with negative slippage, but was closed with positive slippage for T/P.

For this second order we decided to compensate You the negative slippage during the opening of the trade in amount 90,08 USD You will see that on your balance account with the comment Corr: Refund AM"

"We totally understand your concern regarding USD/JPY slippage. Being an STP broker we just clear our client's trades and re-translate quotes we get from Citi and other liquidity providers. Orders on the real market are always executed by current market prices, that's why slippage may occur during sharp movements.

Friday 03.04.15 was a holiday, the liquidity on that day was on the extremely low level and due to that fact the spreads were extremely wide as same as the volatility. The widest spreads were right before and some time after the news release.

We have investigated your order 29298735, due to the high volatility it was closed with negative slippage at 119,759 at actual market price.

We also have investigated your second order 29427758, it was opened with negative slippage, but was closed with positive slippage for T/P.

For this second order we decided to compensate You the negative slippage during the opening of the trade in amount 90,08 USD You will see that on your balance account with the comment Corr: Refund AM"

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.