- Strona główna

- Społeczność

- Systemy handlowe

- Shmendridge-C7 plus 2222Scalpers (6xRisk)

Advertisement

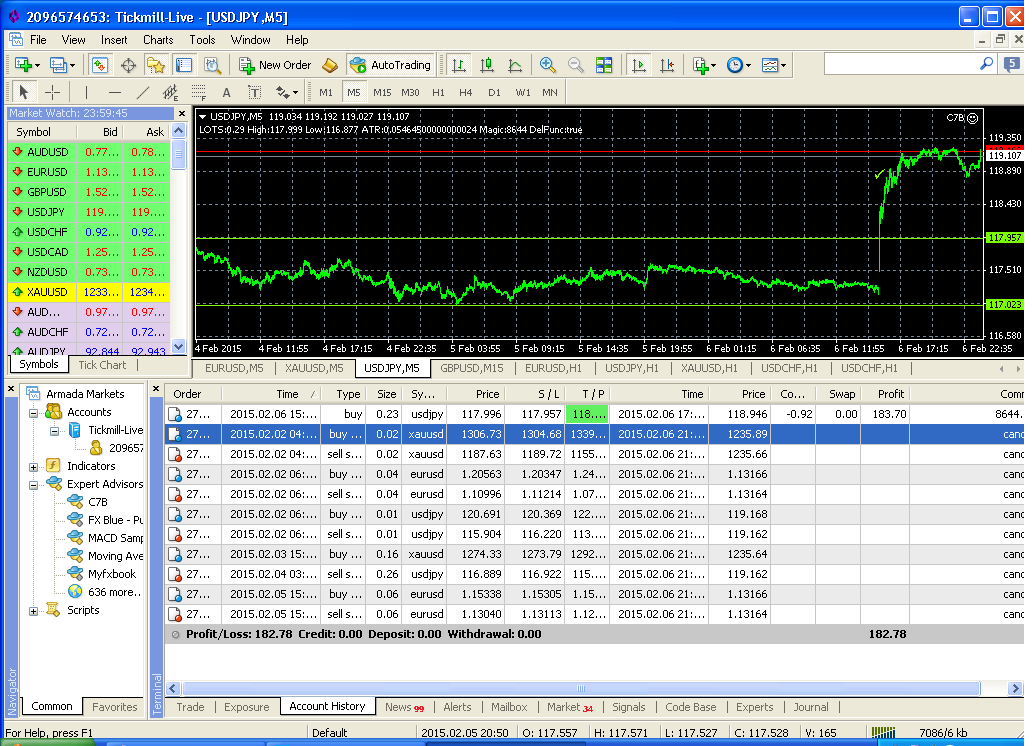

Shmendridge-C7 plus 2222Scalpers (6xRisk)

Użytkownik usunął ten system.

Edit Your Comment

Shmendridge-C7 plus 2222Scalpers (6xRisk) Omówić

Feb 07, 2015 at 10:14

Uczestnik z Apr 05, 2014

33 postów

This bot uses advanced channel detection capabilities to determine and adapt. It will determine the probability and extent of the breakout and will adapt to it. This bot operates on only stop order entries and is not a scalper so delays won't matter at all. This bot can use strategically trailed stop-losses as many successful traders do. This bot is currently set to trade risking up to about 6% of equity on each position and up to 4 positions on a single pair (quite rare and with diversified stops and tp)

C7 bot is available in the market:

https://www.mql5.com/en/market/product/2733 -mt5

https://www.mql5.com/en/market/product/2753 -mt4

C7 bot is available in the market:

https://www.mql5.com/en/market/product/2733 -mt5

https://www.mql5.com/en/market/product/2753 -mt4

Feb 07, 2015 at 10:25

Uczestnik z Apr 05, 2014

33 postów

Uczestnik z Oct 16, 2014

119 postów

Feb 07, 2015 at 12:13

Uczestnik z Oct 16, 2014

119 postów

Hey, I have just bought your EA on MQL5.

I don't understand why I am able optimize it, but backtest are always loosers?

What I am doing wrong?

I don't understand why I am able optimize it, but backtest are always loosers?

What I am doing wrong?

Apr 04, 2015 at 19:40

Uczestnik z Apr 05, 2014

33 postów

29298735 - Massive Slippage during low liquidity period. The spread widened to 9 pips, but not quite enough to trigger the low liquidity safety off (10 pips). The setting of this safety measure has been adjusted to 5 pips as well as a secondary measure coded in to the C7 engine which will react swiftly against any spread volatility regardless of whether its a new bar or not. Most C7 owners did not get hit by this trade as the spread of other brokers widened more which triggered their safety.

I will not open a new account for the C7 system as I feel that would be dishonest.

I will not open a new account for the C7 system as I feel that would be dishonest.

Apr 06, 2015 at 18:57

Uczestnik z Apr 05, 2014

33 postów

Well, some of the slippage was refunded by Tickmill. Too bad the correction must appear as a deposit in to the account instead of correcting the equity gains/losses of the account.

"We totally understand your concern regarding USD/JPY slippage. Being an STP broker we just clear our client's trades and re-translate quotes we get from Citi and other liquidity providers. Orders on the real market are always executed by current market prices, that's why slippage may occur during sharp movements.

Friday 03.04.15 was a holiday, the liquidity on that day was on the extremely low level and due to that fact the spreads were extremely wide as same as the volatility. The widest spreads were right before and some time after the news release.

We have investigated your order 29298735, due to the high volatility it was closed with negative slippage at 119,759 at actual market price.

We also have investigated your second order 29427758, it was opened with negative slippage, but was closed with positive slippage for T/P.

For this second order we decided to compensate You the negative slippage during the opening of the trade in amount 90,08 USD You will see that on your balance account with the comment Corr: Refund AM"

"We totally understand your concern regarding USD/JPY slippage. Being an STP broker we just clear our client's trades and re-translate quotes we get from Citi and other liquidity providers. Orders on the real market are always executed by current market prices, that's why slippage may occur during sharp movements.

Friday 03.04.15 was a holiday, the liquidity on that day was on the extremely low level and due to that fact the spreads were extremely wide as same as the volatility. The widest spreads were right before and some time after the news release.

We have investigated your order 29298735, due to the high volatility it was closed with negative slippage at 119,759 at actual market price.

We also have investigated your second order 29427758, it was opened with negative slippage, but was closed with positive slippage for T/P.

For this second order we decided to compensate You the negative slippage during the opening of the trade in amount 90,08 USD You will see that on your balance account with the comment Corr: Refund AM"

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.