Crypto market buzzing in anticipation of regulatory change

Market Picture

Crypto market capitalisation surpassed $3.3 trillion, up 3.8% in the last 24 hours. Ethereum (+7.4%), Solana (+7.5%), XRP (+24%), and Cardano (+9.6%) provided traction.

The price of Bitcoin broke through $99K on Friday morning, continuing its steady assault on all-time highs. A strong inflow of capital into spot BTC ETFs is fuelling the systematic uptrend, largely due to institutional clients and speculators. However, since the beginning of November, there have also been several news-driven rallies. The most recent was the resignation of SEC chief Henry Gensler. He had been actively trying to curb the spread of cryptocurrencies throughout the financial industry. Now, traders are betting on a U-turn in crypto policy, not just a more dovish regulation.

Bitcoin is rapidly approaching $100K, at which point we should expect a major shakeout at a major milestone, but we still see the end of this momentum around $110K.

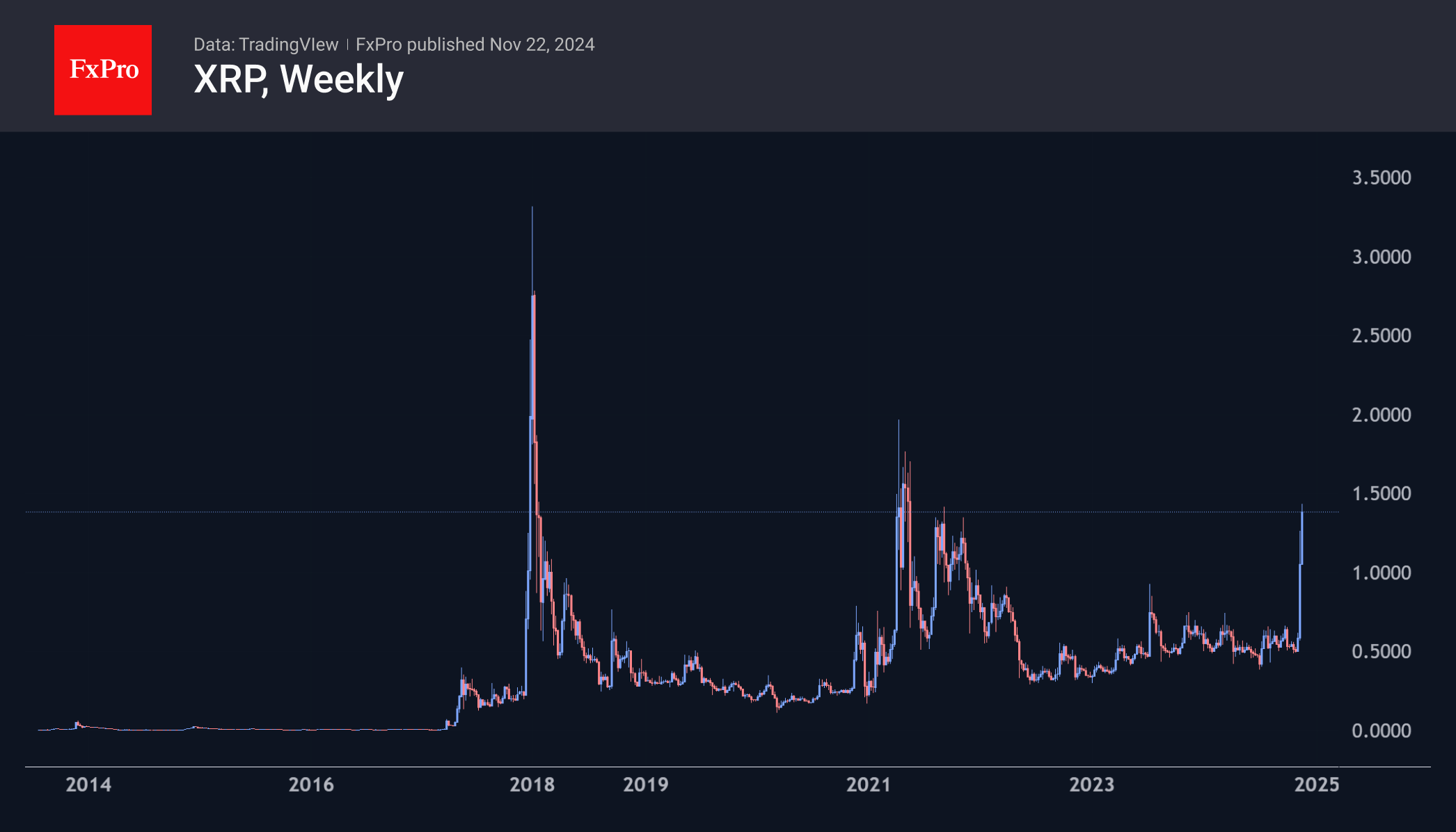

XRP rose by almost a quarter in less than 24 hours on the news of the SEC chief's departure. The price peaked at $1.43 early on Friday before pulling back to $1.37. This was the area of the 2021 highs when there was also a spike in hopes of a court victory against the SEC. The all-time high of 3.84 was set in early 2018, during the first altcoin mania.

News Background

According to Bloomberg, Trump and his transition team are discussing the possibility of creating a White House staff position focused on cryptocurrencies with industry leaders. The official is expected to play a liaison role between Congress, the White House, as well as the SEC and CFTC.

The Foundation for Research on Equal Opportunity questioned the possibility of solving the US national debt problem with a Bitcoin reserve. The initiative, which has been submitted to Congress for consideration, involves purchasing 1 million BTCs for five years at the expense of the Fed's gold reserves.

Since the beginning of the year, MicroStrategy's shares have risen 650%, outperforming bitcoin's growth by a factor of five. The company's market capitalisation has exceeded $96 billion. Previously, the company's founder, Michael Saylor, announced his intention to turn MicroStrategy into a bitcoin bank with a capitalisation of $1 trillion.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)