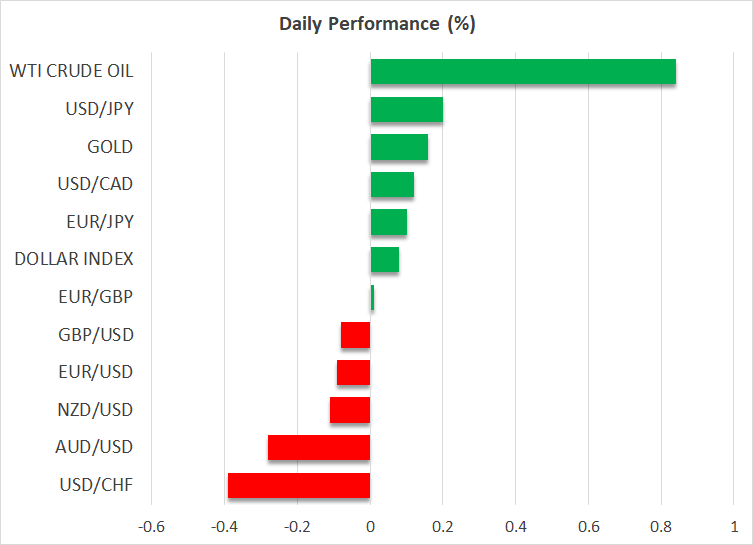

Dollar stops bleeding, oil slides as 2023 concludes

Dollar shows signs of life

The US dollar is set to close the year with losses of around 3% against a basket of major currencies, as market participants continue to wager that the Federal Reserve will slash interest rates with a heavy hand in 2024.

Markets are pricing in six rate cuts by the Fed next year, under the rationale that monetary policy has become too restrictive now that inflation has slowed so substantially. With energy prices grinding lower and favorable base effects set to mechanically push inflation even lower in the coming months, investors think the Fed has accomplished its goal.

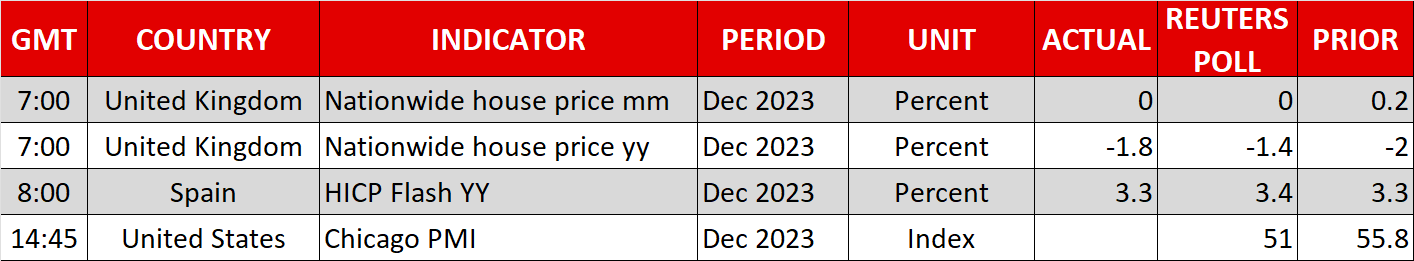

This narrative will be put to the test next week, with the release of the latest US employment report. The Fed needs a softer labor market to gain confidence that it has won the war against inflation, but this doesn’t seem to be playing out. Applications for unemployment benefits remained extremely low throughout December, so there were no signs of any mass layoffs in the US economy.

Speculation for another solid employment report next week helped breathe life back into the dollar yesterday following the jobless claims numbers, as a resilient labor market could delay the Fed rate cuts that the markets have penciled in.

Oil prices edge lower

In the commodity complex, oil prices resumed their downtrend yesterday and are on track to end the year about 10% lower. It appears that production cuts by OPEC+ and the geopolitical instability in the Red Sea were not enough to prop up oil prices for long.

Instead, investors have started to focus on the risk that there may be excessive supply in oil markets next year, and insufficient demand. Even though OPEC+ has taken repeated steps to rein in production and support prices, it is unlikely to pursue the same strategy for much longer, as it would forfeit more market share to US producers who have dialed up their own production to record levels.

Therefore, the days of OPEC+ being a stabilizing force in energy markets might be numbered and the threat of another price war similar to early 2020 cannot be ruled out. A period of oversupply could be devastating for oil prices, particularly if a weaker macroeconomic environment restrains demand next year.

Mind the liquidity gap

Elsewhere, the main theme during the holiday period has been the scarcity of liquidity in the markets. With many traders away from their desks and several money managers having closed their books for the year, liquidity has been thin.

When liquidity is in short supply, financial markets can move sharply without any real news. And if there are news headlines, their market impact can be greater than usual. Hence, thin liquidity conditions can amplify market volatility, especially if there is a news catalyst.

This phenomenon suggests that traders should attach less importance to moves that happen around the turn of the year, as they might not be sustained once liquidity is fully back online.

Looking ahead, China will release its latest business surveys over the weekend, and if there are any surprises, China-sensitive currencies such as the Australian and New Zealand dollars could open with price gaps on Monday.

Happy New Year!

.jpg)