EBC Markets Briefing | China and Europe still investable under US tariffs

Traders are expecting China to relax tight grip on the yuan, if Donald Trump’s tariffs go into effect. A weaker yuan seems necessary to offset the impact of the negative impacts.

The offshore unit hit its lowest level since October 2022 on Monday, but it recouped the loss on Trump’s latest remark that the US will speak to China for a deal regarding tariffs.

While a 10% levy is better than the 60% threatened by Trump previously, the spectre of an escalating trade war dims China’s outlook, as exports have been a rare bright spot.

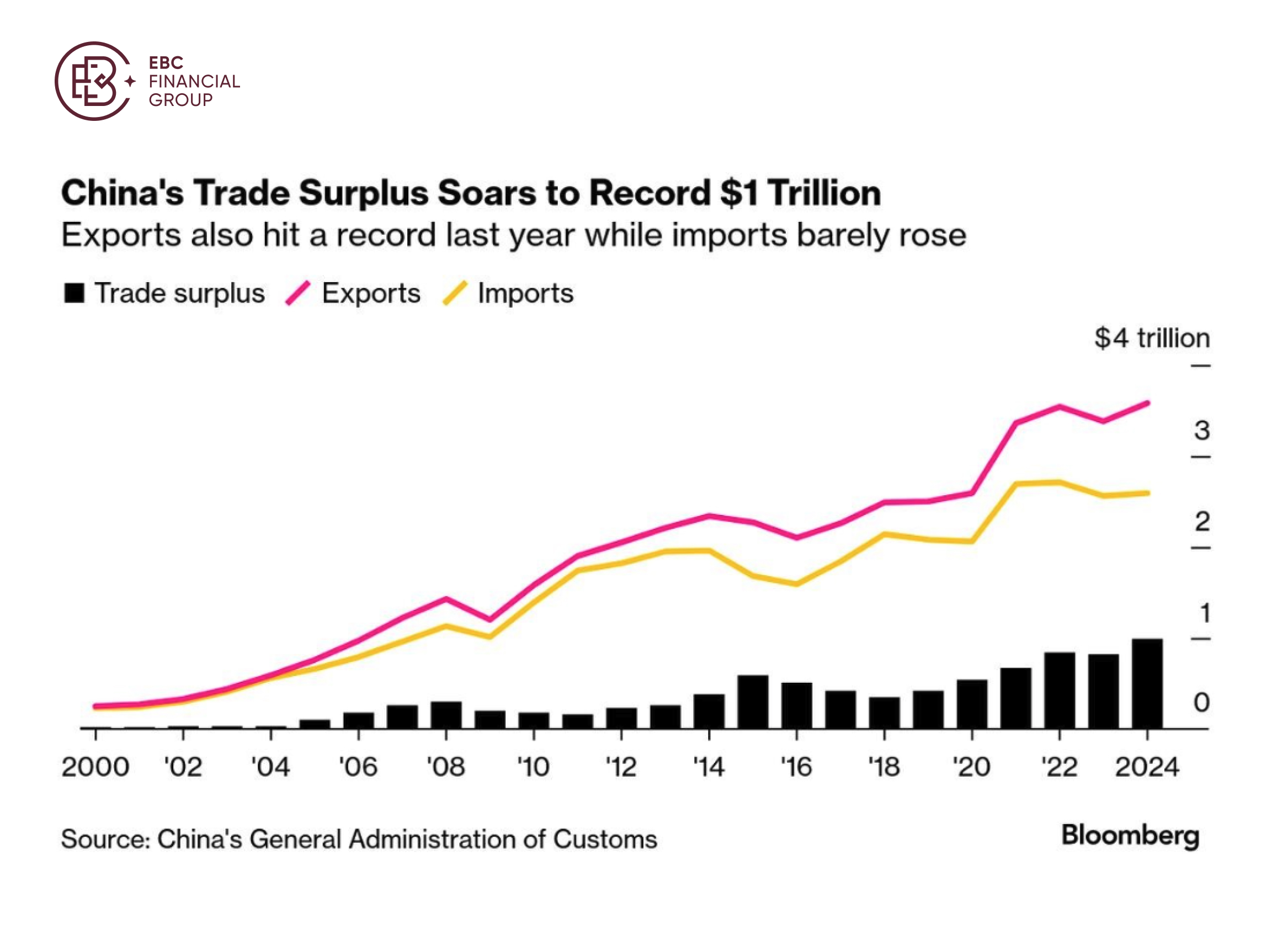

China’s trade surplus hit a record high of around $1 trillion in 2024, partly driven by its transition from importing cars to becoming the world’s largest car exporter.

Euro parity with the dollar also looks like an inevitability. Aggressive ECB rate cuts to spur economic recovery will further widen the gap to US borrowing costs to reduce the appeal of the single currency.

According to the DTCC, markets are positioning for a strong chance of a move to parity and below by mid-year. Wagers also went through for the move to unfold as soon as this quarter.

George Saravelos, head of FX research at Deutsche Bank, sees tariffs on Beijing adding to disinflationary pressure in the eurozone as cheap Chinese goods are rerouted to the European market.

Chinese stocks

China is expected to show tepid earnings growth for 2024 in the last quarter, according to data compiled by Bloomberg. Further earnings downgrades may be on the horizon after 10% additional tariffs.

Finance Ministry said on Tuesday it would impose levies of 15% for US coal and LNG and 10% for crude oil, farm equipment and some vehicles, renewing a trade war that began in 2018.

Trump warned he might increase tariffs on China further unless Beijing satisfies his need. The worst-case scenario of 60% tariffs cannot be ruled out if neither makes compromises.

China's factory activity grew at a slower pace in January, while staffing levels fell at the quickest pace in nearly five years as trade uncertainties increased, a Caixin business survey showed.

We will likely see more fiscal stimulus as pledged in December. Moreover, a cultural shift in the equity market helps soothe local investors who harbour discontent with the gloomy performance.

Chinese firms distributed dividends totalling a record ¥2.4 trillion yuan in 2024, while share buybacks rose to a record high ¥147.6 billion last year, data from regulators showed.

Rising dividends may prevent mainland investors from rushing into bonds, as they have done for months. Benchmark government bond yield is around its record low around 1.65%.

European stocks

After a solid January, major stock indices in Europe all tumbled over 1% on Monday. Trump threatened to target the EU next, while warning the UK is “out of line.”

But European companies are set to deliver a third straight quarter of profit growth, according to data from LSEG I/B/E/S. That may help to maintain enthusiasm despite of political turmoil.

Investor cash has poured into the European market at the second-fastest pace in 25 years in January, according to BofA. Local shares are trading near the largest discount on record to their US peers.

A weak euro is seen as one of the tailwinds against the backdrop of struggling economies. Goldman Sachs strategists estimate that 60% of European company revenues come from outside Europe.

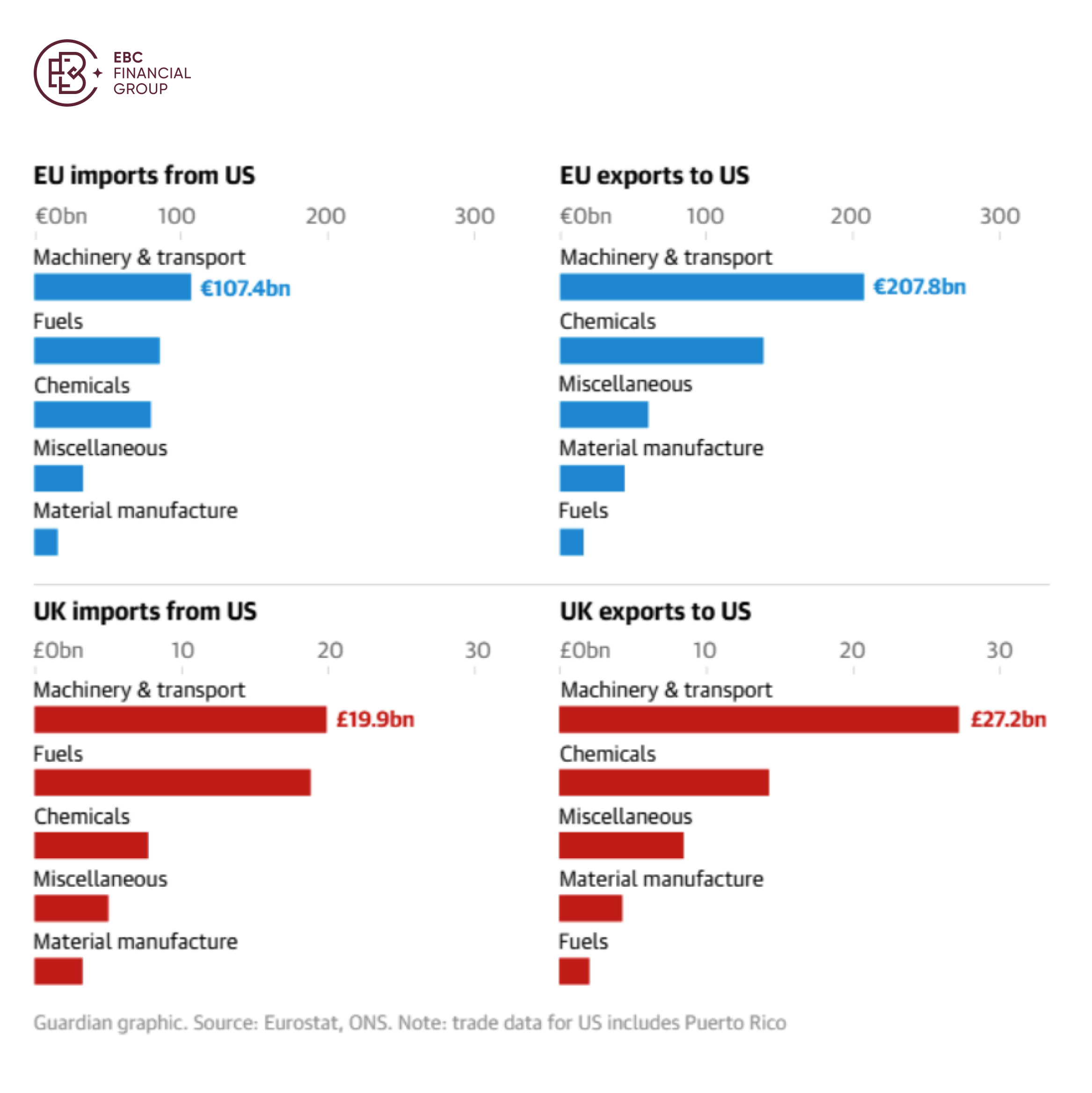

The EU said it would respond firmly if a threat to expand the trade measures to Europe were fulfilled. The bloc began drawing up contingency plans for a Trump trade war last summer.

The initial approach was to negotiate areas where the EU could buy more US products. Should all those efforts fail, some US imports could be hit with duties of 50% or more.

Some economists are more optimistic about the UK’s prospect considering a more balanced relationship with the US. PM Starmer is seeking to build ties with both the EU and the US.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.