EBC Markets Briefing | Chinese stocks see large inflow on AI hopes

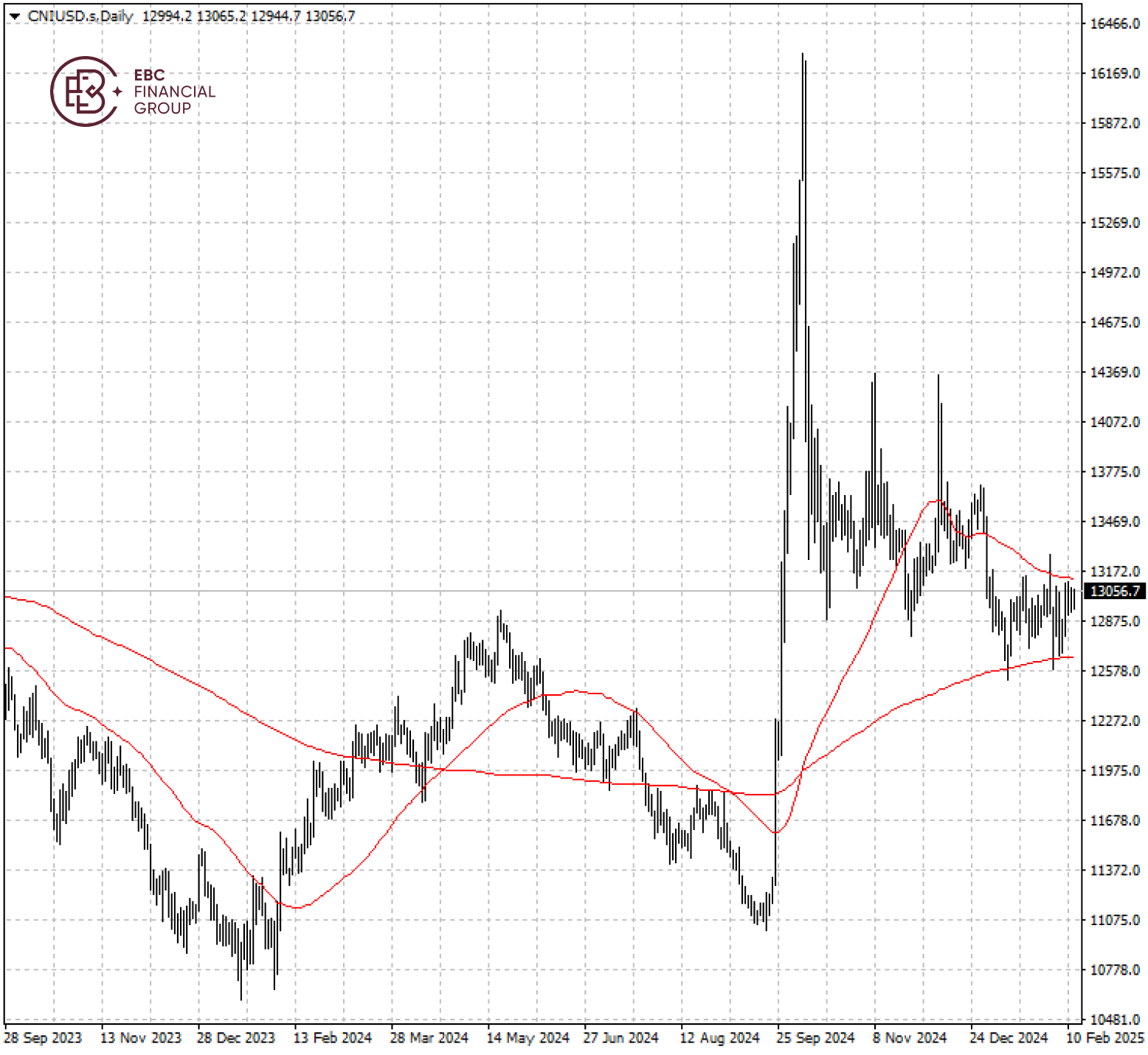

The A50 index steadied on Wednesday with a yearly loss around 3%. MSCI further trimmed Chinese stocks from its global benchmarks, while the market gives way to India in portfolios.

Global hedge funds have been snapping up Chinese stocks for much of this year, with their buying rising to the highest in over 4 months in the past week, driven by DeepSeek frenzy, Goldman Sachs said in a note.

The company's breakthrough low-cost AI model has become a catalyst for the revaluation of Chinese assets among investors that are already worried about the peaking valuation of US stocks.

Sentiment was also supported by Beijing's stimulus and less-than-expected additional tariffs Trump imposed on Chinese goods, analysts said.

Chinese investors are helping to drive a bull run in Hong Kong shares, ploughing almost HK$150 billion into the market this year, more than seven times the amount they added during the same period in 2024.

But jitters are lingering as Trump has been ramping up his efforts to reduce trade deficit. China is at the heart of the new tariffs on steel and aluminium given its large indirect exports of the products to the US.

The A50 has been largely stuck in a tight range between 50 SMA and 200 SMA. A breakout is needed for more clues to its further direction.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.