EBC Markets Briefing | Euro slumps on Trump’s new tariff idea

The dollar firmed on Monday after Trump’s fresh tariff threats put pressure on the euro and the Australian dollar. The single currency traded close to its two-year low touched last week.

Trump said he will announce reciprocal tariffs this week, matching the tariff rates levied by each country. He acknowledged Americans could “feel some pains” from tariffs though earlier this month.

US job growth slowed more than expected in January, but a 4.0% unemployment rate probably gives the Fed cover to hold off cutting interest rates at least until June for more clarity on the global trade landscape.

ECB board member Piero Cipollone said European firms could absorb some of the higher costs by sacrificing profit margin while the euro's inevitable weakening against the dollar would also buffer the bloc.

Trade strife could drag economic growth down but not enough to induce a recession, especially since other parts of the economy are showing resilience, he added.

Euro zone business activity returned to growth at the start of the year after two months of contraction. The expansion in the services industry helped offset an ongoing downturn in the beleaguered manufacturing sector.

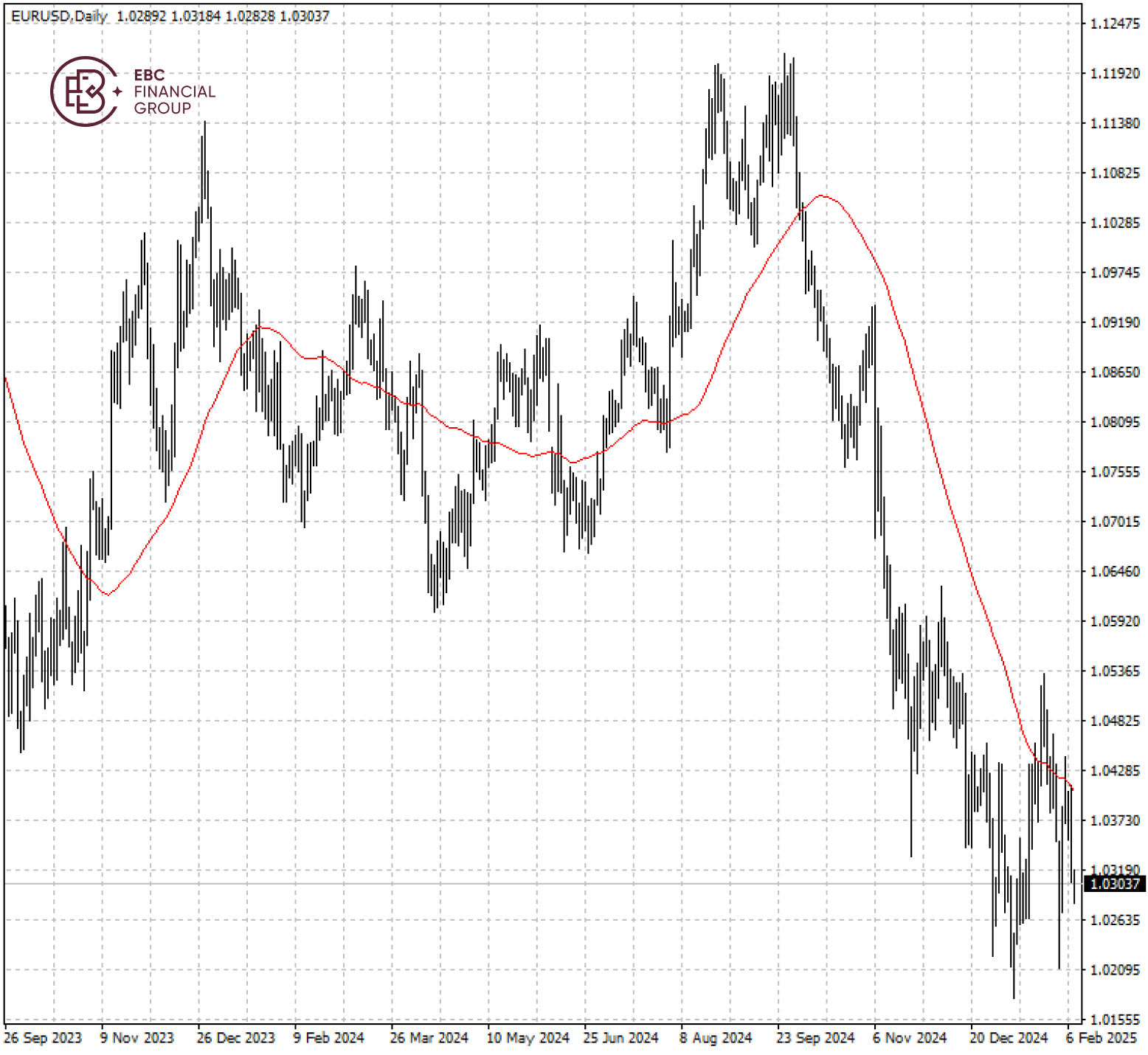

The euro has dipped below 50 SMA – a bearish sign indicative of further losses ahead. The initial support is seen at 1.2600.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.