EBC Markets Briefing | Pound shrugs off BOE rate cut

Sterling steadied on Friday after Bloomberg News reported Fed Governor Christopher Waller is emerging as a top candidate to serve as the central bank's chair among Trump's team.

Traders boosted bets that the central bank would cut rates in September after July's jobs report on Friday showed fewer jobs gains than expected and sharp downward revisions to previous months.

The BOE has warned that rising food prices could drive inflation to 4% as it voted for a fifth cut in interest rates in a year, amid mounting concerns about the strength of the UK economy.

The MPC was initially split on reducing or holding interest rates with four members wanting to hold rates, four others voting to cut and one policymaker voting for a larger 50-bp cut.

They said Rachel Reeves' £25 billion national insurance raid has contributed to sluggish growth and pushed up food prices. Firms indicated investment was being withheld or delayed because of Labour's policy uncertainty.

Economists expect the downward trajectory for interest rates to continue into next year though there was no "smoking gun" or conclusive evidence of a solid downturn in employment figures.

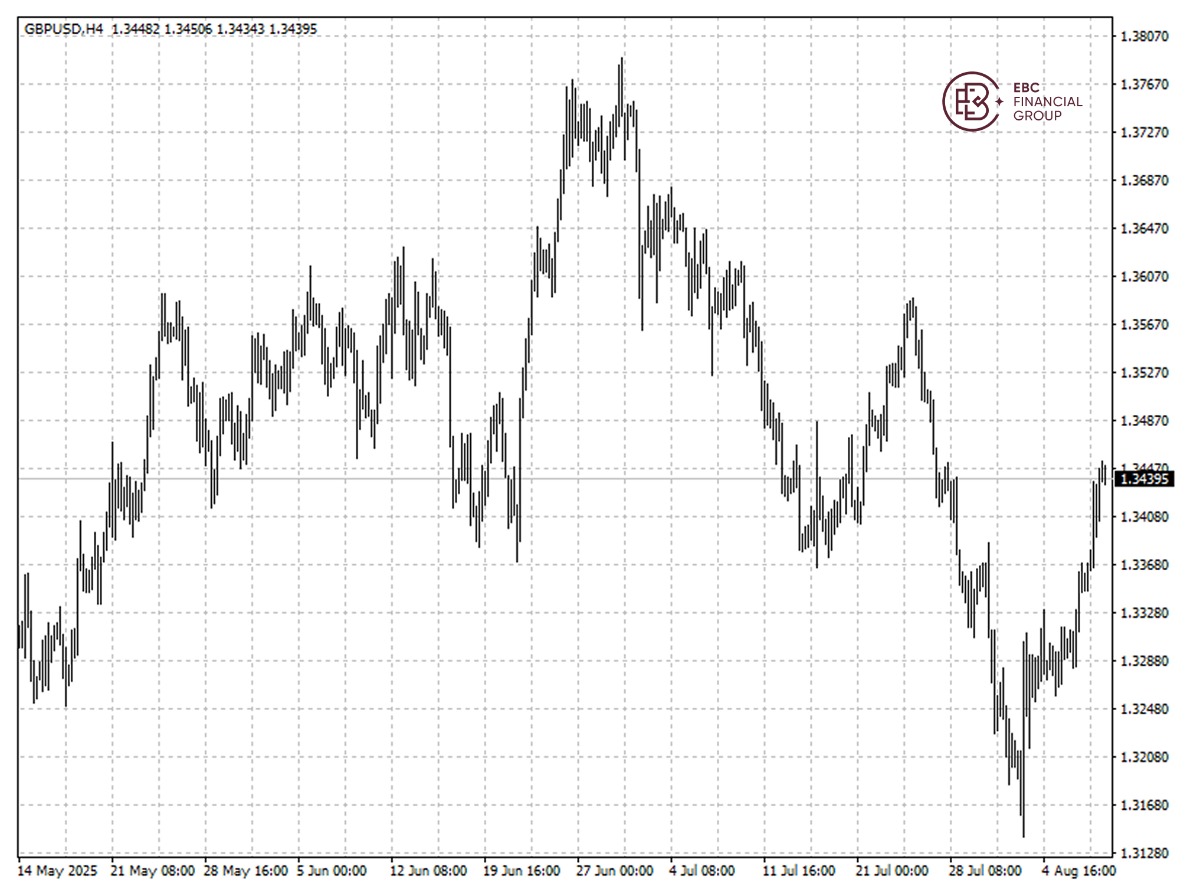

The pound hovered around 1.3453 it hit in late July. It is key whether the resistance could be breached. A push lower to 1.3350 is likely if the momentum eases.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.