German consumer climate continues to recover

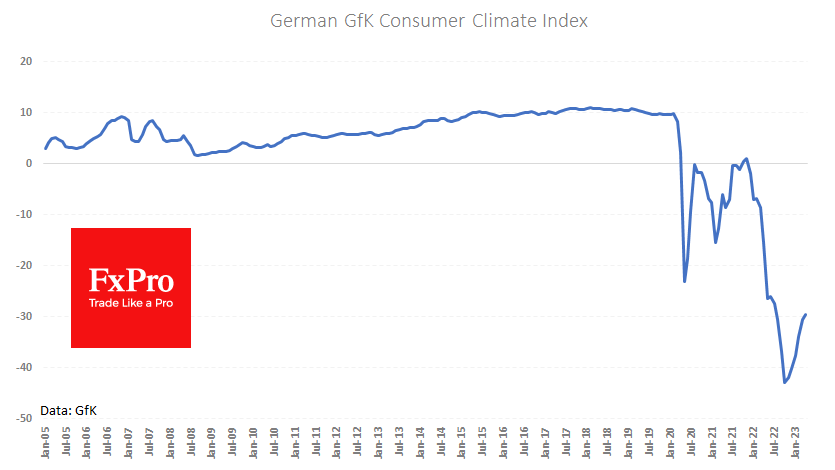

The GfK consumer climate index for Germany rose by 1.1 points to -29.5 in April, a very low level by historical standards and still below the lows of the pandemic in the year 2020. Sentiment has been improving since October, allowing talk of a recovery from the inflation and energy shock in Europe's largest economy, although the pace of recovery has slowed.

Interestingly, the turnaround in consumer sentiment coincided with a "bottom" in EURUSD. The single currency rallied strongly in the final quarter of last year, briefly topping 1.10 in early February before a technical correction. In the second half of March, the single currency recovered against the dollar, despite selling pressure from Credit Suisse and Deutsche Bank.

We believe this interest in the single currency correlates with rising business and consumer sentiment indices. The economic recovery will allow the ECB to maintain a tighter monetary policy.

Assuming a positive correlation between consumer sentiment and the EURUSD exchange rate, we expect the #1 currency pair to continue its upward trend but with a much more subdued amplitude than at the end of last year. As early as April, the euro could fully emerge from its correction and rise above 1.10, but it is unlikely to exceed 1.12 in the year's first half.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)