Increased Gold and Crude Oil Swings

Increased Gold and Crude Oil Swings

Gold

The growth trajectory of gold has become less straightforward. After briefly surpassing $2,940 at the start of the week, gold experienced a sharp pullback of nearly $80. However, by the week's end, the price rebounded, signalling that while buyers remain cautious, they continue to apply upward pressure.

On daily timeframes, gold has entered the overbought territory on the RSI index. Historically, this has led to a temporary pause rather than a reversal.

On weekly timeframes, the market still favours bulls, as the pullback over the last two months has created space for further acceleration, easing the overbought condition.

Oil

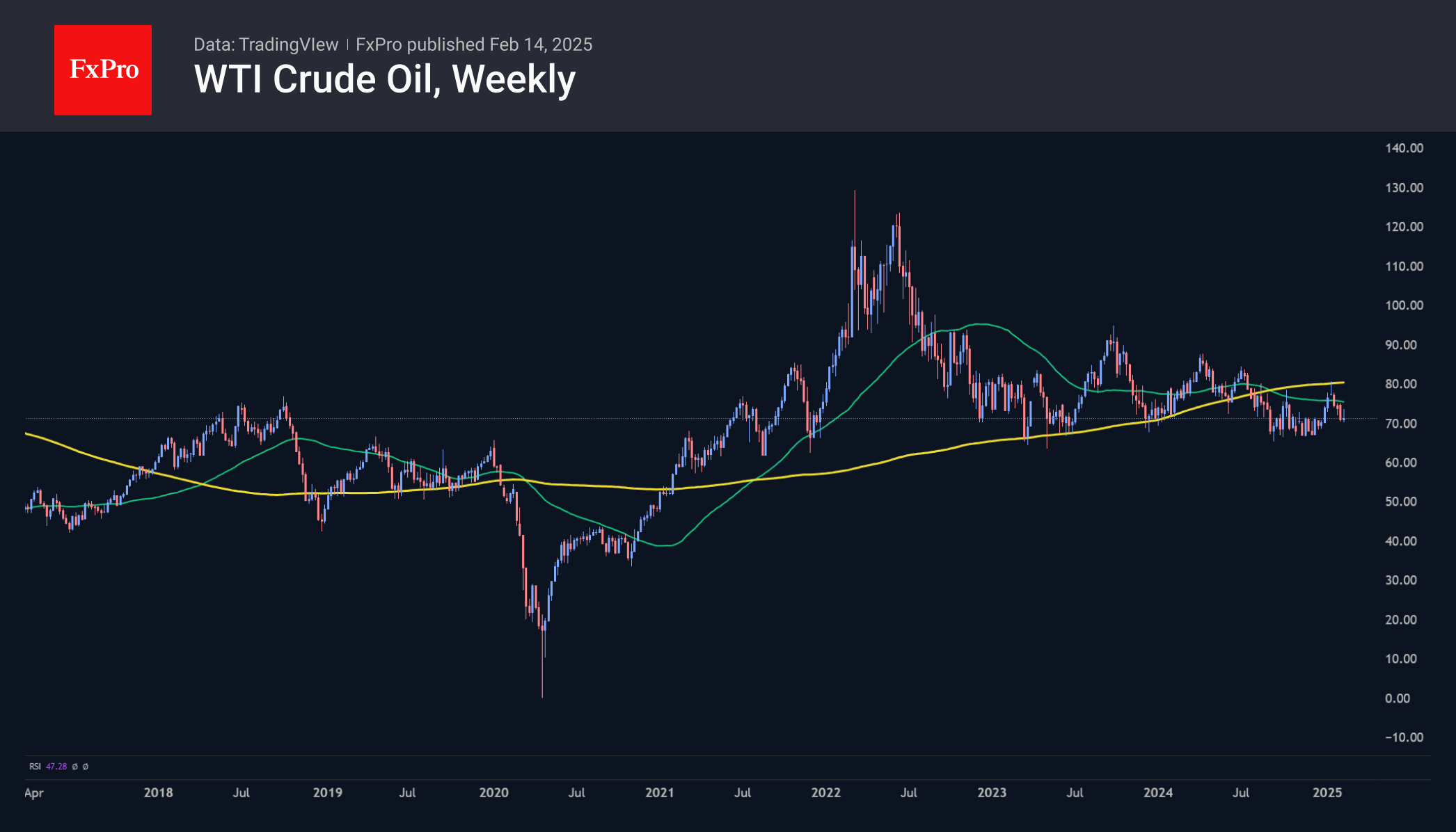

Oil prices rose by 4% during the week and then fully erased the increase, falling to six-week lows following calls between President Trump and the leaders of Russia and Ukraine, which hinted at potential geopolitical détente.

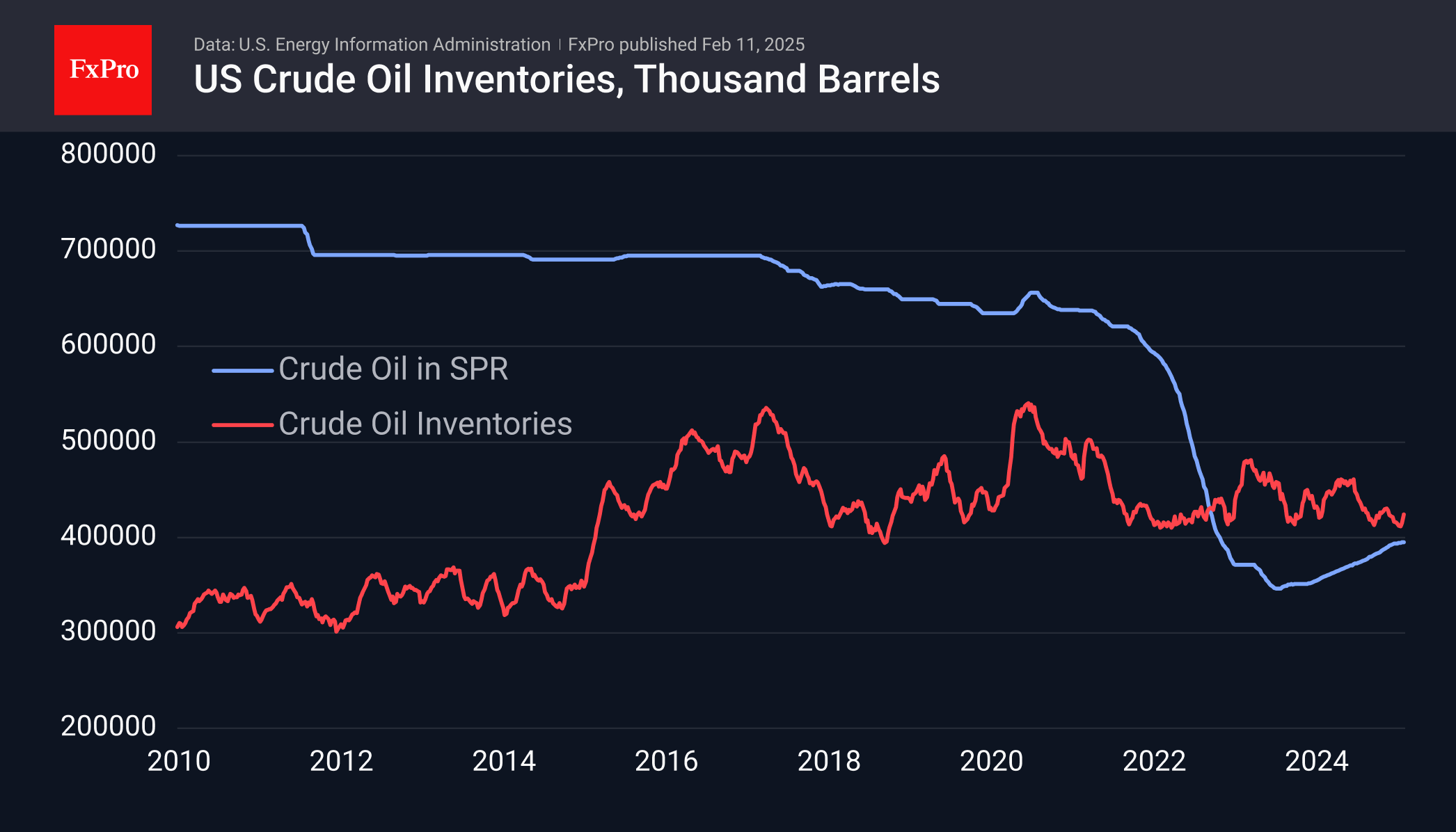

However, the decline was largely driven by a third consecutive week of growth in US commercial oil inventories, which increased by a total of 16.2 million barrels. At the same time, production remains near historical highs of approximately 13.5 million barrels per day.

The long-term technical outlook favours bears, as oil is trading below both its 50- and 200-week moving averages. Notably, selling pressure intensified after touching these levels, reinforcing the notion that sellers continue to dominate the market.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)