Soft risk sentiment weighs on equities

OVERNIGHT

Most major stock indices across the Asia Pacific area were trading lower on the day, while US equity futures also fell as risk sentiment took a knock at the start of the new week. Uncertainty around the future path of interest rates across major economies continues to weigh on sentiment, ahead of a busy week of US data releases. Meanwhile, in Japan, the ruling LDP party won 4 out of 5 seats in Sunday’s by-elections. Speculation has risen of late that a snap general election may be called later this year, albeit PM Kishida has continued to deny that this was the case.

THE DAY AHEAD

The past week’s UK inflation data surprised on the upside, increasing conviction levels in financial markets that Bank of England rate-setters may have more policy tightening to do. Amid the flurry of labour market indicators, unexpectedly strong annual earnings growth stood out. Underlying regular pay growth excluding bonuses stayed near recent highs at 6.6% for the three months to February compared with the consensus and our forecast for 6.2%. Annual CPI inflation, meanwhile, remained in double digits as it fell by less than predicted to 10.1% in March from 10.4% in February. While wage growth remains below CPI inflation and is therefore falling in real terms, from the perspective of policymakers it remains above levels consistent with the BoE’s 2% CPI inflation target. Expectations for another increase in Bank Rate next month have risen, with a 25bp increase to 4.5% on 11 May fully discounted by interest rate markets, while also pricing in more tightening through the summer months. Over the weekend, BoE Deputy Governor Ramsden said that officials must not get “knocked off course” in their bid to rein in inflation.

Similarly, prospects of further ECB hikes have also strengthened after the April Composite PMI beat expectations. That follows the improvement in the composite PMI during Q1, which suggested that the Q1 GDP due later this week will show moderate growth over the quarter. Ahead of that, further insight into economic momentum within the bloc in Q2 will come from today’s German IFO business survey for April. Across the day, a number of ECB members – Vujcic, Villeroy and Panetta – are due to speak at various events, which will give markets further opportunity to reassess their expectations of how much further the ECB will raise interest rates.

Elsewhere, it is a relatively quiet day for key economic data releases and central bank speakers. In the US, Fed surveys from the Chicago Fed (March) and Dallas Fed (April) will provide some colour on regional trends across the US. For the UK, there are no key events due today. However, early tomorrow the ONS will release its latest update on the UK public finances. The data, which is for March, will complete the picture for the fiscal year 2022/23. In its recent update following the Budget, the Office for Budget Responsibility (OBR) forecast a full-year borrowing forecast of £152.4bn. To achieve those figures, public sector net borrowing (PSNBx) would need to be around £20bn in March. Any undershoot would leave the Treasury with an overfund which would be offset against the current fiscal year’s (2023/24) borrowing requirements.

MARKETS

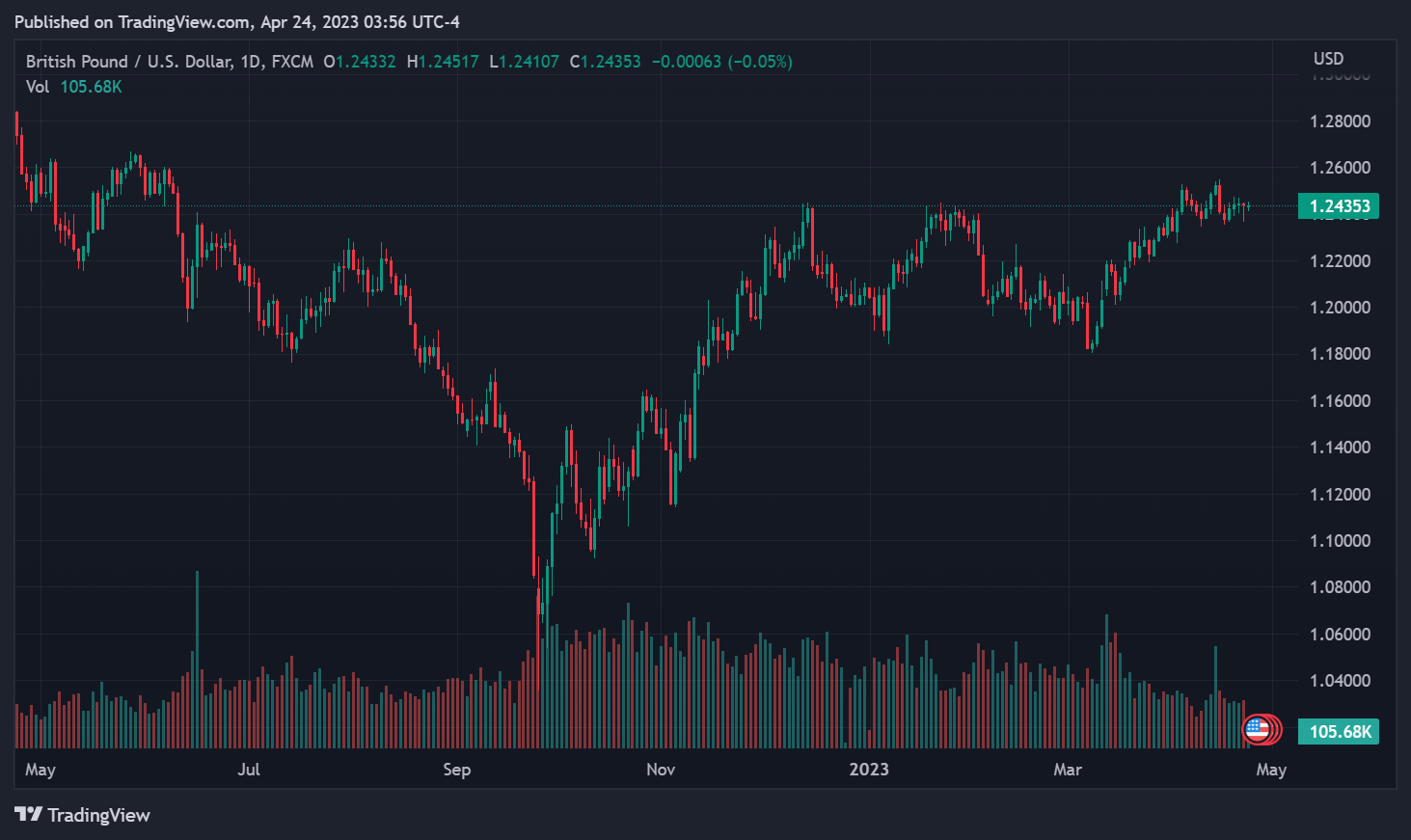

The US dollar is modestly firmer relative to Friday’s close, which has pushed GBP/USD to just above the 1.24 mark and kept EUR/USD below 1.10.