The UK labour market remains strong

Unemployment claims in the UK fell by 11.2k in February, against analysts' average forecast of a rise of 12.5k. Jobless claims have fallen by nearly 50,000 over the past three months after a sustained period of stabilisation, a sure sign that the economy is firmer than previously thought.

Unemployment remained at 3.7% in the three months to January, close to a nearly 50-year low. Demand in the labour market continues to push up wages. In the three months to January, total wages and salaries, including bonuses, were 5.7% higher than a year earlier - below last year's peak but well above the inflation target.

A very high earnings growth reinforces the expectation of further policy tightening by the Bank of England. Short-term market liquidity concerns drove yesterday's repricing of market expectations for the rate. A surge in demand for short-term gilts indicates that markets are waiting for a significant tone softening.

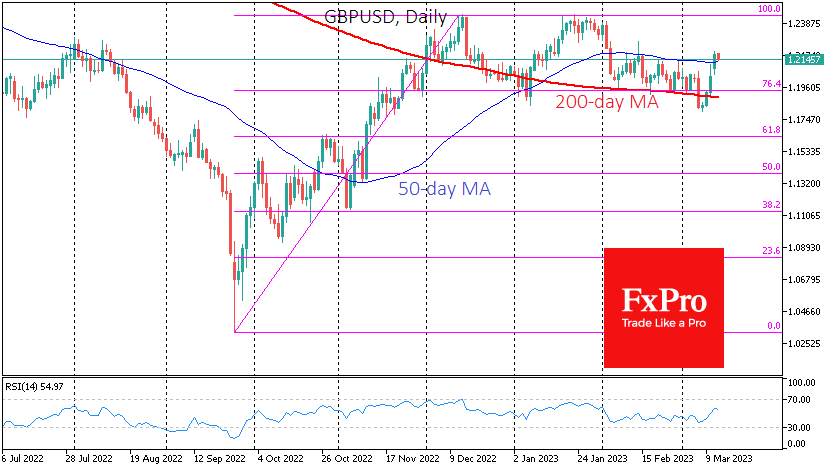

Robust employment data provides local support for the Pound, fueling the rally. The technical picture for the GBPUSD remains bullish. Late last week, the pair was bought on a break below the 200-day moving average, potentially ending a shallow correction and consolidation in the pair since the beginning of the year.

The pair closed above its 50-day average on Monday, confirming a bullish medium-term sentiment. The Pound may now have an open path to 1.2400, repeating the December and February highs. However, a solid move higher will likely require a divergence in monetary policy between the Bank of England and the Fed. We may get that divergence in the next few weeks if the UK continues struggling with inflation and the Fed suddenly shifts to banking sector problems.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)